rewrite this content using a minimum of 1200 words and keep HTML tags

Looking for the best buy the dip crypto bots to capitalize on flash crashes and sudden price dips?

The crypto market is notorious for its wild volatility. Flash crashes can wipe out portfolios in minutes, but they also create incredible buying opportunities for those who are prepared.

The problem?

By the time you notice a flash crash manually, the opportunity is often gone. This is where automated crypto trading bots come to the rescue.

In this guide, I’ll walk you through the 5 best flash crash crypto trading bots specifically designed to help you buy the dip and profit from flash crashes automatically.

But before we dive into the tools, let me share something important:

These bots won’t make you rich overnight. However, if you have the patience to learn how they work and the discipline to test your strategies, they could help you turn market volatility into consistent profits.

What are Flash Crash and Buy the Dip Bots?

Flash crash and buy-the-dip bots are specialized automated trading tools that monitor the cryptocurrency market 24/7 and execute buy orders when specific conditions are met—usually when the price drops suddenly or reaches oversold levels.

Think of them as your personal trading assistant that never sleeps, never panics, and never misses an opportunity.

These bots use various strategies to identify dip-buying opportunities:

Dollar Cost Averaging (DCA): Automatically buying more as the price drops to average down your entry price.

Technical Indicators: Using RSI, Bollinger Bands, and other indicators to identify oversold conditions.

Multi-timeframe Analysis: Detecting flash crashes on shorter timeframes during broader uptrends.

Grid Trading: Placing multiple buy orders at predefined price levels below the current market price.

The beauty of these bots is that they remove emotional decision-making from the equation. No more panic selling or FOMO buying—just cold, calculated entries based on your predefined strategy.

Why You Need a Flash Crash Bot

Let me be honest with you:

The crypto market doesn’t care about your sleep schedule. Flash crashes can happen in the middle of the night when you’re sound asleep, and by the time you wake up, the market has already recovered.

Here’s why automated dip-buying bots are game-changers:

24/7 Market Monitoring: The bot watches the market round the clock so you don’t have to.

Lightning-Fast Execution: Bots can execute trades in milliseconds, catching the exact bottom of a dip.

Emotion-Free Trading: No panic, no greed—just systematic execution of your strategy.

Backtesting Capabilities: Test your dip-buying strategy on historical data before risking real money.

Risk Management: Set stop-losses and take-profit levels to automatically protect your capital.

Now, let’s look at the 5 best bots that can help you master the art of buying the dip.

5 Best Crypto Flash Crash and Buy the Dip Bots

1. Coinrule – Best for Pre-Built Flash Crash Strategies

Website: Coinrule

Coinrule is my top pick for traders who want ready-made flash crash strategies without spending hours building them from scratch.

What Makes Coinrule Stand Out

Coinrule offers a dedicated “Flash Crash Bot” that uses a multi-timeframe, buy-the-dip approach. The bot is designed to catch sudden price drops on a 1-hour timeframe, particularly during uptrends when profit-taking can lead to temporary price crashes.

The real magic of Coinrule is its library of over 300 pre-made trading strategies. You can browse through strategies specifically designed for dip buying, customize them to your risk tolerance, and deploy them in minutes.

Key Features:

Dedicated Flash Crash Bot with multi-timeframe analysis

300+ pre-built trading strategies (including multiple dip-buying strategies)

“Buy Dips in Bull Market” bot using RSI indicators

Backtesting on historical data

Military-grade security and encryption

Supports 10+ top exchanges (Binance, Coinbase Pro, OKX, Kraken, Bitpanda)

If-This-Then-That (IFTTT) rule builder for custom strategies

Mobile app for iOS and Android

When to Use Coinrule:

You’re a beginner who wants proven strategies without building from scratch

You prefer a visual rule builder over coding

You want to test multiple dip-buying strategies quickly

You trade on multiple exchanges and want a unified platform

Pricing:

Coinrule offers a 30-day free trial, allowing you to test all features risk-free. Paid plans start after the trial period, with different tiers based on the number of active bots and trading volume.

Bottom line: If you want to get started with flash crash trading quickly using proven strategies, Coinrule is your best bet.

2. Bitsgap – Best for Customizable Dip Buying with Pump Protection

Website: Bitsgap

Bitsgap is a powerful cloud-based crypto trading platform that offers one of the most sophisticated “Buy The Dip” (BTD) bots in the market.

What Makes Bitsgap Stand Out

Bitsgap’s BTD Bot is specifically engineered to monitor the market for sudden price drops and execute buy orders automatically. But here’s what sets it apart from the competition:

Pump Protection Feature: This is a game-changer. The bot includes a “Pump Protection” mechanism that prevents it from reacting to artificial price inflation or fake pumps. This means you won’t waste money buying during manipulated price movements—only genuine dips.

The bot is highly customizable, allowing you to set specific conditions for triggering buy orders, including:

Low/High Price settings

Trailing Down features to catch the absolute bottom

Stop Loss and Take Profit levels

Custom percentage drops to trigger buys

Key Features of Bitsgap:

Dedicated Buy The Dip (BTD) Bot

Pump Protection to avoid false signals

Demo Mode to test strategies without risk

Backtest capabilities with historical data

GRID Bot for range-bound markets

DCA Bot for dollar-cost averaging

COMBO Bot combining multiple strategies

Smart Trading Terminal

API keys safely encrypted with 2FA authentication

When to Use Bitsgap:

You want maximum control over your dip-buying parameters

You need protection against pump-and-dump schemes

You want to combine multiple bot strategies (DCA + Grid + BTD)

You’re serious about backtesting before going live

Pricing:

Bitsgap offers a 7-day PRO plan trial with no credit card required. After the trial, plans start at $23/month for the Basic plan, with Advanced and Pro plans available for higher trading volumes.

Reviews: 3.9/5 on Trustpilot (626 reviews), 4.6/5 on Capterra

Also, check out my detailed review of Bitsgap.

Bottom line: If you want a highly customizable BTD bot with advanced protection features, Bitsgap is worth every penny.

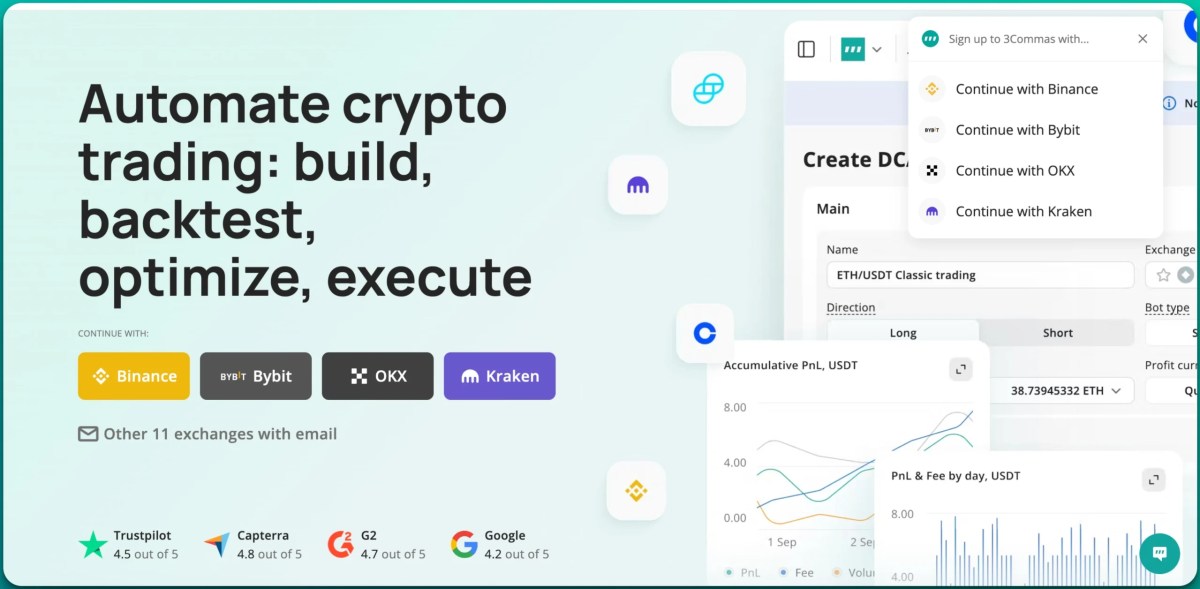

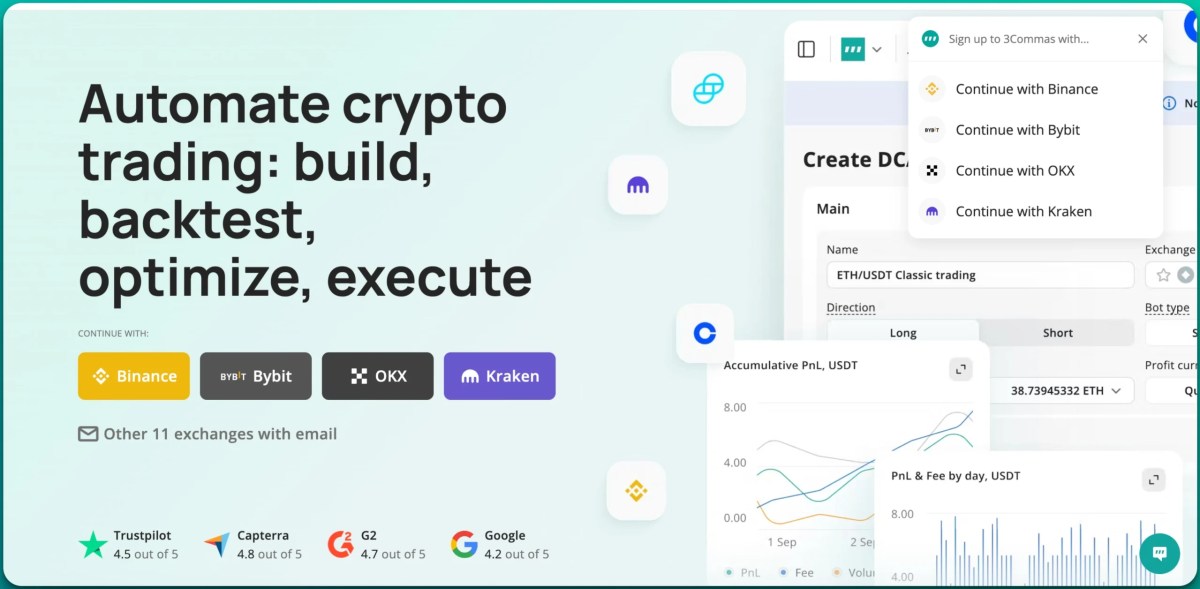

3. 3Commas – Best for Established Platform with DCA Mastery

Website: 3Commas

3Commas is one of the most established names in crypto trading automation, with over 2 million registered traders and a proven track record since 2017.

Note: DCA and ‘buy the dip’ are two different strategies, but they are commonly used together. In contrast, DCA is a strategy to accumulate.a project at a predefined pace. Buy the dip, take advantage of a sudden price dip to buy and sell it, and accumulate for profit.

What Makes 3Commas Stand Out

3Commas has perfected the art of Dollar Cost Averaging (DCA), which is essential for buying the dip effectively. Their DCA bot is incredibly flexible, allowing you to adjust your purchasing strategy based on price changes—buying more as the price drops to lower your average entry.

The platform also offers dedicated Buy The Dip (BTD) strategies and GRID bots that can re-enter the market after a big dip with buy-only grids.

Key Features:

Advanced DCA Bot (most flexible in the market)

Buy The Dip (BTD) strategy templates

GRID Bot with buy-only mode for dip buying

Signal Bot for automated signal trading

SmartTrade for manual entries with automated exits

Backtest on 1-minute historical data (up to one year)

Multi-pair bots can monitor 100+ pairs simultaneously

TradingView integration via webhooks

Bulk editing for managing multiple bots

Paper trading to test strategies risk-free

Mobile app for iOS and Android

When to Use 3Commas:

You want a proven platform with a large community

You prefer DCA strategies for buying dips

You want to monitor multiple pairs for dip opportunities

You use TradingView for analysis and want webhook integration

You’re managing multiple accounts or clients

Check out my detailed review of 3Commas.

Pricing:

3Commas offers a free trial to test the platform. Paid plans are tiered based on features and the number of active bots.

Reviews: 4.5/5 on Trustpilot, 4.8/5 on Capterra, 4.7/5 on G2

Bottom line: If you want a battle-tested platform with the most advanced DCA features, 3Commas is the industry standard.

4. Cryptohopper – Best for Customization and Strategy Marketplace

Website: Cryptohopper

Cryptohopper bills itself as “the world’s most customizable crypto trading bot,” and for good reason. With over 1 million users, it’s one of the most popular platforms for automated trading.

What Makes Cryptohopper Stand Out

Cryptohopper’s strength lies in its Strategy Marketplace, where you can purchase proven dip-buying strategies from professional traders. Some popular strategies include:

“Buy The Dip Strategy Premium” – Uses multiple indicators for strong entry points

“The Strategies of Kuresofa – Buying the Dip” – Generates buy signals when price drops excessively

The platform offers powerful Dollar Cost Averaging (DCA) features that let you “double or triple up on investments that went sour”—essentially buying more as the price drops to average down your entry.

Key Features:

Marketplace with hundreds of dip-buying strategies

Advanced DCA with customizable safety orders

Short selling to track currencies to the bottom

Triggers to respond to price rises and falls

Trailing stop-loss for risk management

Multiple indicators: EMA, Williams %R, RSI, Bollinger Bands

Strategy Designer with drag-and-drop interface

Backtesting with historical data

TradingView integration

Social trading to follow expert traders

Paper trading mode

Mobile app

When to Use Cryptohopper:

You want access to a marketplace of proven strategies

You prefer buying strategies rather than building them

You want maximum customization options

You’re interested in social trading and following expert signals

You trade on multiple timeframes and pairs

Pricing:

Cryptohopper offers a 3-day free trial. Paid plans start at competitive rates with different tiers based on features and the number of active positions.

Check out: Cryptohopper review

Bottom line: If you want the most customizable platform with access to professional strategies, Cryptohopper is your playground.

5. Pionex – Best for Free Built-In Bots and Low Fees

Website: Pionex

Pionex is unique because it’s both a cryptocurrency exchange AND a bot provider. This means you don’t need to connect external exchanges—everything happens in one place.

What Makes Pionex Stand Out

Here’s the kicker: Pionex offers 16 built-in trading bots completely FREE. You only pay the trading fee of 0.05%, which is one of the lowest in the industry.

The platform’s “Buy-the-Dip” tool is a dual-investment product that allows you to earn interest while waiting for your target buy price to be reached. This means your capital isn’t sitting idle—it’s earning yield until the dip happens.

Pionex also offers powerful Grid Bots and Futures Grid Bots that can automatically buy dips and sell rallies within a predefined price range.

Key Features:

16 FREE built-in trading bots

Buy-the-Dip tool with interest earnings

Grid Bot (Spot and Futures)

Martingale Bot for aggressive DCA

Smart Trade Bot for 24/7 intelligent trading

Arbitrage Bot

Rebalancing Bot

Only 0.05% trading fee (no monthly subscription)

Both exchange and bot provider in one

Mobile app

Low minimum investment

When to Use Pionex:

You want free bots without monthly subscriptions

You prefer an all-in-one exchange with built-in automation

You’re a high-volume trader who wants the lowest fees

You want to earn interest while waiting for dips

You’re a beginner who wants to test multiple bot types for free

Pricing:

Completely FREE bots with only a 0.05% trading fee per transaction. No monthly subscriptions, no hidden costs.

Check out Pionex review to learn about it various trading bots features.

Bottom line: If you want the most cost-effective solution with free bots and the lowest fees, Pionex is unbeatable.

Quick Comparison Table – Best Buy the dip bot

Platform

Best For

Flash Crash Feature

Free Trial

Pricing

Coinrule

Pre-built strategies

Dedicated Flash Crash Bot

30 days

Varies by plan

Bitsgap

Customization + Protection

BTD Bot with Pump Protection

7 days PRO

From $23/mo

3Commas

Advanced DCA

DCA + BTD strategies

Yes

Varies by plan

Cryptohopper

Strategy Marketplace

DCA + Marketplace strategies

3 days

Varies by plan

Pionex

Free bots + Low fees

Buy-the-Dip + Grid Bots

N/A (Free forever)

FREE (0.05% fee)

When to Use Which Bot?

Still confused about which bot to choose? Here’s my recommendation based on your situation:

Choose Coinrule if:

You’re a beginner who wants proven strategies ready to deploy

You want a dedicated Flash Crash Bot with multi-timeframe analysis

You prefer visual rule builders over coding

You want the longest free trial (30 days)

Choose Bitsgap if:

You want maximum customization of your dip-buying parameters

You need protection against pump-and-dump schemes

You’re serious about backtesting strategies before going live

You want to combine multiple bot types (DCA + Grid + BTD)

Choose 3Commas if:

You want the most established platform with proven reliability

You prefer advanced DCA strategies for buying dips

You want to monitor 100+ pairs simultaneously

You use TradingView and want webhook integration

You’re managing multiple accounts

Choose Cryptohopper if:

You want access to a marketplace of professional strategies

You prefer buying proven strategies rather than building from scratch

You want maximum customization options

You’re interested in social trading and expert signals

Choose Pionex if:

You want free bots without monthly subscriptions

You prefer an all-in-one exchange with built-in automation

You’re a high-volume trader focused on minimizing fees

You want to test multiple bot types without a financial commitment

My Personal Recommendation

If you’re starting out, I recommend beginning with Pionex, as it’s completely free and offers 16 different bots to experiment with. This will help you understand how automated dip buying works without any financial commitment.

Once you’re comfortable with the basics, upgrade to Coinrule or Bitsgap for more sophisticated flash crash strategies with better customization options.

For experienced traders, 3Commas or Cryptohopper offer the most advanced features and the largest communities for learning and sharing strategies.

Important Tips Before You Start

Before you deploy any of these bots with real money, keep these tips in mind:

Start with Paper Trading: Most of these platforms offer demo modes. Use them to test your strategies without risking real capital.

Backtest Your Strategies: Always backtest your dip-buying strategy on historical data before going live. This will give you confidence in your approach.

Start Small: Even after testing, start with a small amount of capital. Once you see consistent results, you can scale up.

Use Stop Losses: Always set stop-loss levels to protect your capital. Even the best dip-buying strategy can fail in extreme market conditions.

Join the Community: All these platforms have active Telegram or Discord communities. Join them to learn from experienced traders and get help when needed.

Don’t Expect Miracles: These bots are tools, not magic money-making machines. Your success depends on your strategy, risk management, and patience.

Monitor Market Conditions: While bots can run 24/7, you should still monitor overall market conditions and adjust your strategies accordingly.

Conclusion: Which is the Best Flash Crash Bot?

There’s no single “best” bot for everyone—it depends on your experience level, budget, and trading style.

However, if I had to pick one for each category:

Best for Beginners: Pionex (free, easy to use, all-in-one solution)

Best for Strategy Variety: Coinrule (300+ pre-built strategies)

Best for Customization: Bitsgap (highly customizable with pump protection)

Best for Advanced Traders: 3Commas (most established, advanced DCA)

Best for Social Trading: Cryptohopper (strategy marketplace, expert signals)

The crypto market will continue to experience flash crashes and sudden dips—that’s just the nature of this volatile asset class. The question is: Will you be ready to capitalize on these opportunities, or will you watch them pass by?

With the right bot and the right strategy, you can turn market volatility from your enemy into your greatest ally.

My advice? Take advantage of the free trials, test multiple platforms, and find the one that fits your trading style best. The best bot is the one you’ll actually use consistently.

Now it’s your turn. Which bot are you going to try first?

Disclaimer: Crypto trading involves significant risk. Only invest what you can afford to lose. Always use proper risk management, including stop-losses and position sizing. The bots mentioned in this article are tools to help automate your strategy—they don’t guarantee profits.

Help us improve. Was this helpful

Thanks for your feedback!

and include conclusion section that’s entertaining to read. do not include the title. Add a hyperlink to this website http://defi-daily.com and label it “DeFi Daily News” for more trending news articles like this

Source link