rewrite this content using a minimum of 1000 words and keep HTML tags

Ethereum continues to show remarkable resilience, with demand leaving its mark even as price action remains sideways. ETH has been consolidating in a narrow range, mirroring the broader market where Bitcoin trades cautiously and altcoins display selective strength. Yet behind the scenes, institutional interest in Ethereum is quietly building, setting the stage for what could be the next major move.

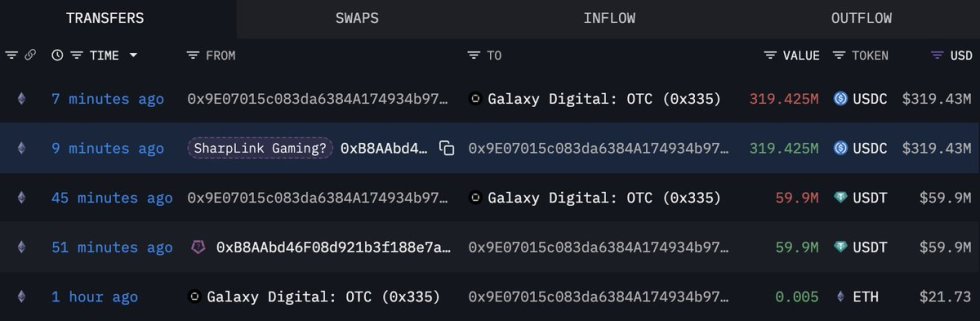

According to fresh data from Lookonchain, SharpLink recently transferred $379 million USDC to Galaxy Digital, capital that may be allocated toward purchasing more ETH. This transfer underscores a growing trend: institutional players are not shying away from Ethereum, even amid volatility and macroeconomic uncertainty. Instead, they are positioning themselves for what could be a decisive breakout once the current consolidation phase resolves.

SharpLink Gaming is among the first Nasdaq-listed companies to design a treasury strategy centered on ETH, marking a significant milestone in corporate adoption. By treating Ethereum as a strategic reserve asset, it reinforces the idea that ETH’s role extends well beyond speculative trading into long-term institutional portfolios.

Related Reading: Bitcoin Mining Difficulty Keeps Rising Despite Price Volatility – Details

With consolidation tightening and institutional inflows accelerating, the coming weeks may prove critical. Many investors expect a massive surge for Ethereum once the current sideways structure breaks, potentially marking the start of its next major rally.

SharpLink Expands Ethereum Treasury

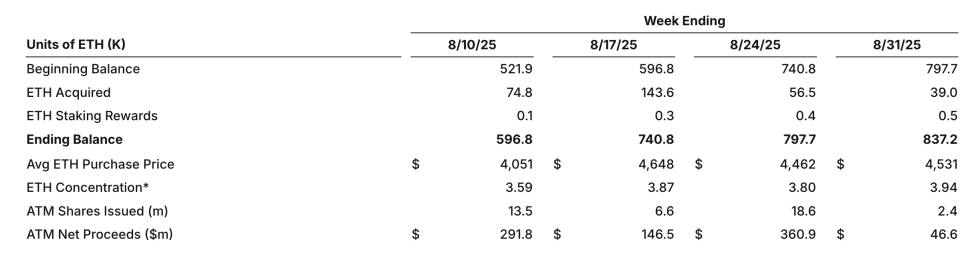

SharpLink has officially announced that its total Ethereum holdings climbed to 837,200 ETH as of August 31, 2025, solidifying its role as one of the largest corporate holders of the asset. The company continues to pursue its ETH-focused treasury strategy aggressively, with notable activity reported in the week ending August 31.

During that week, SharpLink purchased an additional 39,008 ETH, bringing its cumulative balance to new heights. These acquisitions were financed through $46.6 million in net proceeds raised via the company’s at-the-market (ATM) facility, demonstrating its ongoing ability to secure fresh capital for strategic allocations. Importantly, the average purchase price for the week’s ETH acquisitions stood at $4,531, reflecting the company’s confidence in buying at elevated levels as Ethereum consolidates near all-time highs.

This accumulation has elevated SharpLink to the position of the second-largest ETH treasury holding company, trailing only BitMine. BitMine currently holds more than 2 million ETH, valued at approximately $9.2 billion. Together, these treasury allocations highlight how major institutions are increasingly adopting Ethereum not only as a speculative asset but also as a long-term strategic reserve.

By expanding its ETH holdings so aggressively, SharpLink is sending a clear signal to the market: Ethereum’s role in corporate treasuries is no longer theoretical. As adoption grows, such moves could prove pivotal in reinforcing ETH’s status as a core asset in the global digital economy.

ETH Analysis: Trading Sideways

Ethereum is trading at $4,436, showing a 2% daily gain as the price begins to emerge from a prolonged consolidation phase. The 12-hour chart highlights that ETH has been moving sideways for much of September, holding firmly above $4,200 support. Now, momentum appears to be picking up as the price tests resistance around $4,450.

The 50 SMA at $4,407 is now acting as immediate support, while the 100 SMA at $4,182 provides a stronger cushion below. The 200 SMA, sitting at $3,460, remains well beneath the current range, confirming that ETH’s broader bullish structure is intact. As long as Ethereum maintains levels above $4,200, the technical setup favors continuation to the upside.

For bulls, the next critical test lies in reclaiming $4,600, a level that has repeatedly capped rallies in recent weeks. A decisive breakout above this resistance would set the stage for ETH to retest the $4,800–$5,000 zone, potentially marking the start of a stronger bullish leg.

Featured image from Dall-E, chart from TradingView

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

and include conclusion section that’s entertaining to read. do not include the title. Add a hyperlink to this website [http://defi-daily.com] and label it “DeFi Daily News” for more trending news articles like this

Source link