rewrite this content using a minimum of 1000 words and keep HTML tags

Stablecoin issuance is a lucrative business, and in 2025, Hyperliquid, a leading decentralized derivatives trading platform generating at least $400 billion in trading volume, is set to launch its platform-specific stablecoin. While Circle’s USDC holds a larger market share, powering popular trading pairs like HYPE USDC, Hyperliquid believes a native stablecoin could funnel profits to HYPE crypto holders.

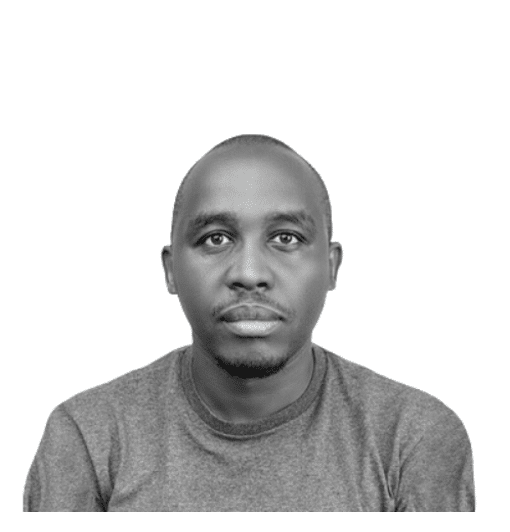

According to Coingecko, the total stablecoin market cap exceeds $290 billion. USDT leads, commanding nearly 50% of the market with over $169 billion in circulation, primarily on Tron and Ethereum. USDC, the second largest, has issued over $72 billion, with a major presence on Solana and Hyperliquid.

(Source: Coingecko)

Due to its ease of redemption back to USD, USDC is the go-to stablecoin, powering Hyperliquid’s community-driven liquidity provision, enabling the platform to process billions in monthly trading volume. Circle issues USDC in compliance with U.S. regulations, clarified further by the GENIUS Act, which outlines requirements for stablecoin issuers tracking the USD on major public chains.

DISCOVER: 9+ Best High-Risk, High-Reward Crypto to Buy in 2025

Hyperliquid Wants Its Stablecoin, Circle Has Other Plans

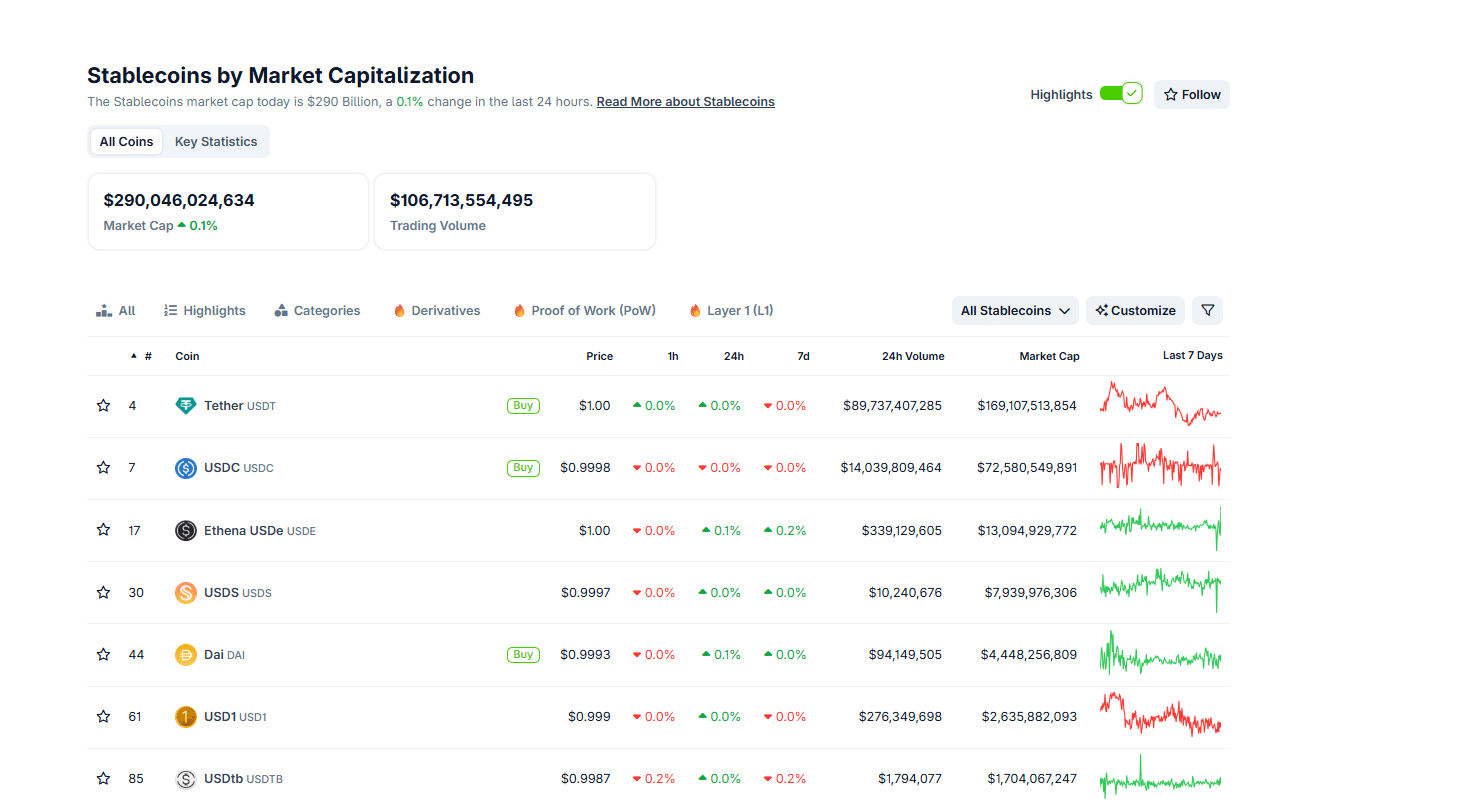

Since Circle, Tether, and other top stablecoin issuers generate billions in profits, and some of these tokens fuel the Hyperliquid ecosystem, the perpetual exchange aims to redirect profits to HYPE holders. To achieve this, Hyperliquid plans to have a third-party issue for USDH. As of September 10, several bidders are competing, with Hyperliquid validators set to choose the winner by September 14.

Interested parties include Paxos, the team behind BUSD; Ethena, which recently partnered with Binance for its USDe stablecoin; Sky, a major player in decentralized money markets; Agora; Native Markets; and others. On Polymarket, punters think Native Markets will issue USDH.

(Source: Polymarket)

Circle, which dominates USDC trading on Hyperliquid, is not interested in issuing USDH but instead plans to continue with USDC. USDC powers 95% of Hyperliquid’s trading pairs, enabling smooth trading of assets like PUMP and HYPE. In a post on X, Circle’s CEO, Jeremy Allaire, stated they will engage the “HYPE ecosystem in a big way” and “intend to be a major player and contributor to the ecosystem.”

Don’t Believe the Hype

We are coming to the HYPE ecosystem in a big way. We intend to be a major player and contributor to the ecosystem.

Happy to see others purchase new USD tickers and compete

Hyper fast native USDC with deep and nearly instant cross chain…

— Jeremy Allaire – jda.eth / jdallaire.sol (@jerallaire) September 7, 2025

Agora, Paxos, Ethena, Sky, and Frax are all vying to issue USDH, offering to share reserve yields with the community to accelerate HYPE buybacks or fund community development.

Circle, however, aims to integrate USDC natively into Hyperliquid’s layer-1, eliminating bridging costs from Arbitrum, while refusing to share profits. Any attempt to divert revenue to Hyperliquid will be consequential, directly harming CIRCL shareholders.

DISCOVER: Next 1000X Crypto: 10+ Crypto Tokens That Can Hit 1000x in 2025

Will Circle Fall? CIRCL Stock Already Selling Off

As such, how Circle will navigate the stablecoin scene in Hyperliquid remains unclear, especially as validators prepare to vote for a USDH issuer willing to channel a big chunk of revenue back to HYPE holders.

If traders immediately shift to USDH and buy in anticipation of gains, Circle’s profitability could shrink rapidly. This situation could worsen, as the U.S. Federal Reserve is likely to cut rates in September, reducing yields on Treasuries and bonds.

Despite Circle’s liquidity, regulatory compliance, and market cap advantages, USDC’s dominance on Hyperliquid could diminish, impacting CIRCL stock.

(Source: CIRCL, TradingView)

As of September 10, CIRCL stock is down 60% from July highs, and with turbulence in Hyperliquid, the likelihood of CIRCL stock falling below $100 has increased.

DISCOVER: 20+ Next Crypto to Explode in 2025

Hyperliquid USDH vs. Circle USDC: Will CIRCL Stock Crash?

Hyperliquid is setting up for a native stablecoin, USDH

Native Markets likely to be the next issuer

Circle sticking to USDC

Will CIRCL stock crash below $100?

Why you can trust 99Bitcoins

Established in 2013, 99Bitcoin’s team members have been crypto experts since Bitcoin’s Early days.

90hr+

Weekly Research

100k+

Monthly readers

50+

Expert contributors

2000+

Crypto Projects Reviewed

Follow 99Bitcoins on your Google News Feed

Get the latest updates, trends, and insights delivered straight to your fingertips. Subscribe now!

Subscribe now

and include conclusion section that’s entertaining to read. do not include the title. Add a hyperlink to this website [http://defi-daily.com] and label it “DeFi Daily News” for more trending news articles like this

Source link