rewrite this content using a minimum of 1000 words and keep HTML tags

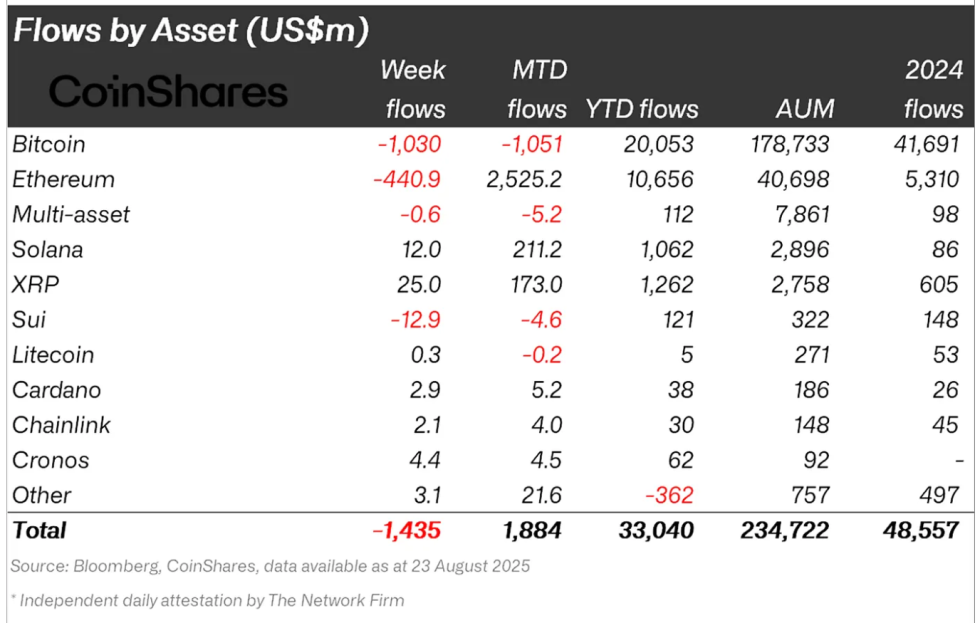

Crypto asset investment products recorded their most significant outflows in months, as investor sentiment swung sharply amid signals from US monetary policymakers. According to the latest report from CoinShares, a total of $1.43 billion exited crypto investment vehicles last week, the heaviest weekly outflow since March.

CoinShares noted that trading volumes in exchange-traded products (ETPs) rose to $38 billion over the same period, around 50% above the 2025 average.

This increase in trading activity reflected polarized market sentiment, as investors weighed the Federal Reserve’s policy outlook. James Butterfill, head of research at CoinShares, explained:

Outflows of $2 billion were recorded in the first part of the week, but sentiment shifted after Jerome Powell’s address at the Jackson Hole Symposium, which many interpreted as more dovish than expected. By the end of the week, we saw inflows of $594 million.

Divergence Between Bitcoin and Ethereum Flows

While the market overall faced pressure, the performance of Bitcoin and Ethereum diverged. Bitcoin bore the brunt of outflows, losing around $1 billion, while Ethereum’s outflows were more limited at $440 million.

The mid-week rebound particularly favored Ethereum, which now shows $2.5 billion in net inflows month-to-date, compared to Bitcoin’s $1 billion in outflows.

This shift has adjusted the year-to-date picture for both assets. Ethereum inflows now represent about 26% of total assets under management (AuM), while Bitcoin accounts for just 11%.

The report pointed out that this could signal a change in how institutional investors are allocating capital between the two leading cryptocurrencies.

Ethereum’s role in most layer two networks and the anticipation around broader adoption through ETFs may be supporting this trend, while Bitcoin continues to face challenges tied to its macroeconomic narrative as “digital gold.”

Altcoin Performance Reflects Broader Market Rotation

Beyond Bitcoin and Ethereum, altcoins recorded mixed results. Several tokens posted positive inflows, including XRP ($25 million), Solana ($12 million), and Cronos ($4.4 million).

These movements suggest selective confidence in certain blockchain ecosystems, particularly those with strong user activity or institutional exposure.

Conversely, some projects faced headwinds. Sui ($12.9 million outflows) and Ton ($1.5 million outflows) were among the most affected, reflecting investor caution or profit-taking in assets that had seen speculative runs earlier in the year.

Butterfill noted that trading behavior remains highly sensitive to both regulatory developments and macroeconomic expectations, with US monetary policy continuing to act as a key driver of crypto investment flows.

Looking ahead, it is expected that fund flows will remain volatile as markets digest further policy signals and macroeconomic data. However, the contrasting performance between Bitcoin and Ethereum suggests that investors may increasingly diversify within digital assets, rather than treating the sector as a single, homogeneous market.

Featured image created with DALL-E, Chart from TradingView

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

and include conclusion section that’s entertaining to read. do not include the title. Add a hyperlink to this website [http://defi-daily.com] and label it “DeFi Daily News” for more trending news articles like this

Source link