rewrite this content using a minimum of 1200 words and keep HTML tags

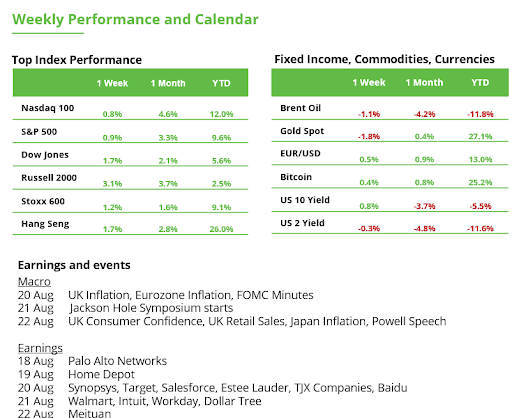

Jackson Hole is in the spotlight, and Powell’s words on rates could steer markets for months. Investors are betting peak rates are behind us, with cuts on the horizon. That’s good news for rate-sensitive corners like REITs, where earnings are stabilizing and selective opportunities are emerging. Add in resilient investor behavior and a still-intact Bitcoin uptrend, and the week is shaping up with more reasons for optimism than fear.

Sector Focus: REITs – Beyond the ‘Office Apocalypse’

The Setup: Rates Are Peaking, Cuts Looming

The real estate sector, particularly REITs, has been battered over the last two years by rising interest rates. Higher discount rates compressed valuations, while refinancing risk loomed large for levered balance sheets.

Now, with rate cuts on the horizon and markets beginning to price in a 2026 recovery, sentiment is slowly shifting. Despite uneven Q2 earnings results, most subsectors are guiding to stabilization or recovery.

Where’s the Value?

The strongest outlooks came from datacenters, healthcare, industrial, manufactured housing, net lease, single-family rental, and towers. More challenged groups included cold storage, lodging, multifamily, and self-storage.

The market assumes rate cuts into 2026 will reflate the space. That may help, but relying on macro alone is dangerous. The better strategy is to focus on an active selection process, gauge resilient tenants, balance sheets, and cash flows and to buy only where prices already reflect excessive pessimism.

Office: More Noise Than Weight

The “office apocalypse” still dominates headlines, but listed REIT exposure tells a different story. Office now makes up just ~1% of the sector’s weighting after big NYC names like Vornado and SL Green were dropped. The real estate index is ~80% concentrated in residential, industrial, healthcare, and specialized REITs, which don’t face the same structural challenges.

That said, selective opportunities exist. Douglas Emmett and Hudson Pacific delivered solid results, but coastal offices remain fragile. Cousins Properties (Sunbelt) and COPT Defense (government/IT tenants) offer more defensible niches where tenant demand is stickier.

Datacenters: Secular Growth, But Mind the Price

Datacenters remain one of the sector’s strongest stories. Earnings outlooks are intact, supported by secular drivers such as cloud adoption, AI workloads, and rising demand for digital infrastructure. Operators like Equinix and Digital Realty continue to benefit from pricing power in interconnection and long-term contracts.

But, enthusiasm is high, and valuations already reflect a good portion of the growth. The group has become a consensus “safe harbor” for investors rotating into REITs. For disciplined capital, that means opportunity only emerges when market sentiment swings too far, either through generalist profit-taking or broader sell-offs that drag the sector down. The better entry points will come in moments of volatility, when strong fundamentals temporarily get marked down with the rest of the sector.

Healthcare: Durable Demographics

Healthcare REITs quietly built momentum. CareTrust is expanding its senior housing pipeline, and execution in the second half of the year could beat longer-term expectations. NHI finally saw its SHOP portfolio deliver margin expansion. With an aging population underpinning steady demand, healthcare remains one of the few areas where defensive cash flows and demographics create a margin of safety.

Lodging: Short Duration, High Beta

Hotels face softer Q3 comps and stronger Q4 expectations. Share repurchases funded by asset sales are a theme, but cash flows remain highly cyclical. Without true distress pricing, lodging lacks the downside protection required for long-term capital.

Macro Watch: What’s Driving REITs Beyond Earnings

Cap rates vs Treasuries: Cap rates have recovered from pandemic lows, but Treasury yields have too. Spreads remain below historical averages, leaving REIT valuations less compelling relative to bonds.

Debt maturities: About 8% of REIT debt comes due in the next 12 months. Rising refinancing costs are biting, though still manageable. Credit charge-offs are climbing but remain far below recessionary peaks.

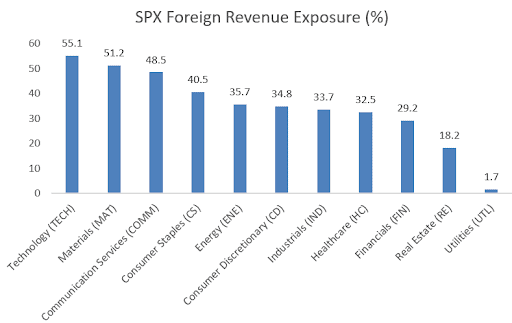

Tariffs: Real estate is one of the least exposed sectors to tariffs (only ~18% of revenues from abroad). Still, tariffs could push up construction costs and indirectly pressure yields.

Valuations: REITs trade at ~17x forward FFO, in line with post-GFC averages, not stretched, but not screamingly cheap either.

Sentiment Shift

Investor tone is moving from “Should we reset expectations?” to “Where do we buy the dip?” Generalist money is starting to sniff around, which can support near-term performance. But true value usually emerges where capital has already left, in underfollowed niches and misunderstood balance sheets.

Investor Takeaway: The rubble in REITs offers selective opportunity. The real story is less about an office collapse and more about finding resilient tenants, stable balance sheets, and cash flows that can withstand higher rates. Those are the places where capital is most likely to compound, with or without the Fed’s help.

Volatility Is Not a Flaw, It’s Part of the Game

Today’s market structure is significantly more resilient than it was a few decades ago. Today’s investors are more informed, long-term oriented, and disciplined. This shift is supported by automated ETF savings plans, regular portfolio rebalancing, and a generally higher level of financial literacy. According to the Q2 Retail Investor Beat, 35% of German investors make their purchases regularly or through automation, regardless of market conditions. Volatility remains a part of everyday market activity, but it is no longer seen as something to fear. It is increasingly accepted as a natural feature of functioning capital markets.

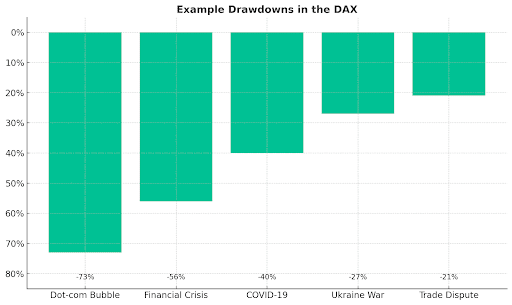

Many investors now view periods of weakness not as a threat but as an entry opportunity. One in five German investors buys during a market pullback of 11% to 20% (Retail Investor Beat). Dips of 3% to 5% in indices like the DAX or S&P 500 are common and occur multiple times a year. Corrections, defined as declines of 10% or more, typically happen about once a year. Even bear markets with losses exceeding 20% haven’t disappeared over the past 25 years, but they often unfold more moderately than they once did (see chart). This reflects a rising degree of market resilience.

Investors who stay calm during such phases and buy in consistently tend to outperform over the long term. Historically, patience combined with disciplined buying during downturns has often delivered better results than trying to perfectly time the market. Even someone who invested in the DAX at the peak of the dot-com bubble would have nearly tripled their capital by now, much more with regular contributions.

Bitcoin: Failed Breakout, but Uptrend Intact

Last week, bitcoin formed a candlestick with a long upper wick. At one point, BTC climbed to a new all-time high above $124,500. The breakout lacked follow-through, leading to a round of short-term profit-taking. The Fair Value Gap between $109,500 and $115,900 now acts as a key support zone. As long as this area holds, the potential for another upward breakout attempt remains intact. Based on the Fibonacci extension, possible upside targets are located at $128,000, $132,000, and $138,000. If support fails to hold, the correction could extend towards the low of $97,000.

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.

and include conclusion section that’s entertaining to read. do not include the title. Add a hyperlink to this website http://defi-daily.com and label it “DeFi Daily News” for more trending news articles like this

Source link