The realm of traditional finance has long celebrated the virtues of dollar-cost averaging (DCA), a steadfast approach to investment that endorses the systematic purchase of stocks at periodic intervals, regardless of fluctuating market prices. This methodology not only aims to lower the average purchase price of shares over time but also seeks to mitigate the emotional rollercoaster often associated with investment decisions, potentially paving the way for enhanced returns as time marches on. The burning question that arises, however, is how this time-tested strategy transitions into the volatile world of cryptocurrency investments. Let’s embark on an exploration to uncover the intricacies of dollar-cost averaging within the sphere of digital assets.

Delving Into Dollar-Cost Averaging in Crypto

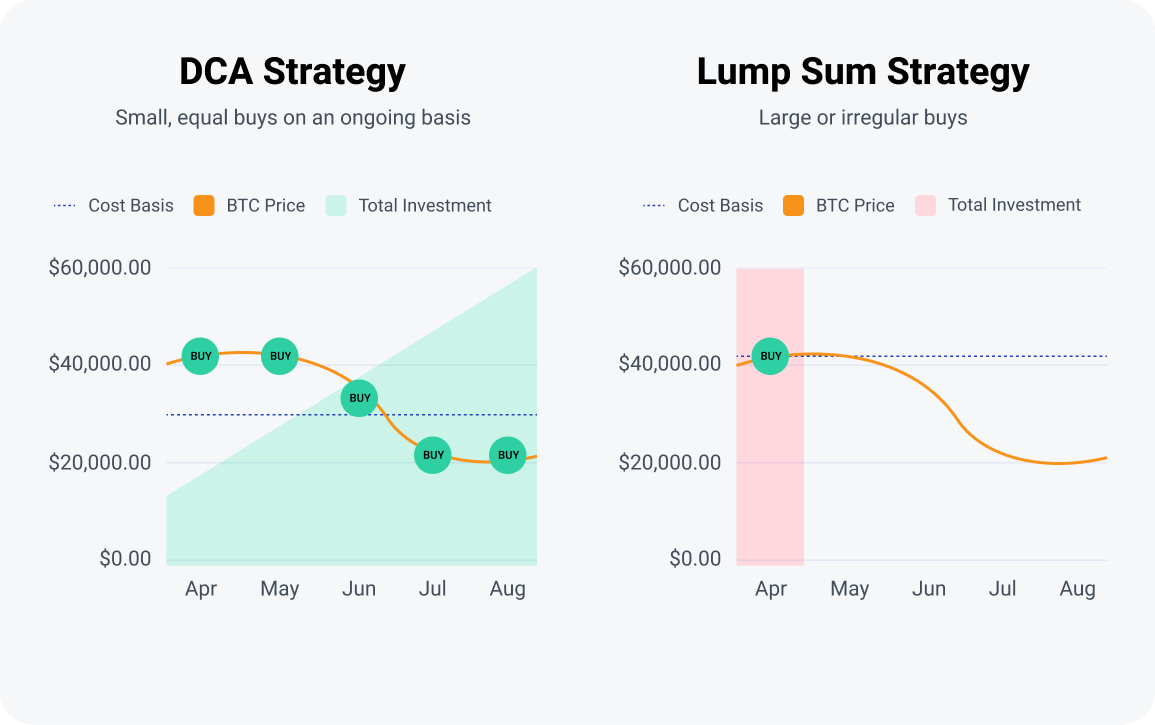

At its core, dollar-cost averaging in the cryptocurrency domain entails the disciplined approach of making consistent, equal investments over time, as opposed to executing sizable, sporadic acquisitions of crypto assets. Given the notorious volatility inherent in cryptocurrencies when compared to traditional stocks, the DCA method can significantly benefit crypto investors by mirroring the advantages that equity traders have long enjoyed. Through regularly timed purchases of preferred cryptocurrencies, investors effortlessly contribute more to their investments over time, irrespective of the market’s vicissitudes. This strategy not only facilitates the accumulation of digital assets but also aids in diminishing the overall acquisition cost, especially during market downturns.

🧠

A quick refresher: The cost basis of an investment refers to its original value or purchase price. For instance, if you acquire 1 Bitcoin for $50,000, your cost basis stands at $50,000.

The Mechanics of Dollar-Cost Averaging with Crypto

Imagine you have earmarked $50,000 for investment in cryptocurrencies. Should you choose to invest this entire sum in Bitcoin at a current price of $50,000 per coin, you would acquire one Bitcoin with a cost basis of $50,000. Contrastingly, by distributing this $50,000 across five evenly spaced purchases of $10,000 each—at varying Bitcoin prices of $50,000, $45,000, $25,000, $25,000, and $55,000—your average cost basis would recalibrate to $40,000, subsequently increasing your holdings to 1.4 Bitcoin. This strategic positioning enables you to amplify your gains when Bitcoin’s value escalates, proving the merit of dollar-cost averaging in crypto by accruing more Bitcoin through market fluctuations.

Mastering the Art of DCA in Crypto

Embarking on your dollar-cost averaging journey with cryptocurrencies involves a series of calculated steps. From selecting your target digital assets to deciding on your investment frequency and amounts, each decision plays a pivotal role in crafting a robust DCA strategy. Here’s a step-by-step guide to refine your DCA approach like a seasoned pro:

- Identify the digital assets you wish to accumulate.

- Determine your investment cadence.

- Allocate a fixed sum of money for your periodic investments.

- Select a reputable exchange or platform for executing your purchases.

- Choose a secure and accessible storage solution for your digital assets.

Exploring each of these steps in detail reveals the importance of thorough research and prudent decision-making in optimizing your crypto DCA strategy for maximum efficacy and safety.

DCA Versus Lump-Sum Investing: A Comparative Overview

The decision between adopting a dollar-cost averaging strategy and making a one-time, lump-sum investment hinges on the inherent volatility observed in the asset’s price. While DCA seeks to smooth out market fluctuations over time, allowing for additional purchases during dips, lump-sum investing rides the wave of market timing—a feat notoriously challenging to master with precision, especially in the crypto realm. As we tread through the uncertain terrain of cryptocurrency markets, characterized by periods of remarkable lows and highs, the allure of DCA becomes increasingly apparent, particularly as a means to potentially capitalize on what many refer to as ‘crypto winters’.

Navigating the Pitfalls of DCA in Crypto Investing

Despite its many merits, dollar-cost averaging is not devoid of risks and limitations. The strategy’s essence—making automated purchases at preset intervals—could inadvertently lead to accruing smaller sums of cryptocurrency if the market experiences a sharp uptrend, ostensibly counteracting the DCA’s purpose by elevating the average cost of acquisition. This highlights the critical balance between leveraging DCA during downswings and the strategic deployment of lump-sum investments in anticipation of market recoveries—a balance teetering on the precipice of market timing acumen.

Is a DCA Crypto Strategy My Best Bet?

Adopting a dollar-cost averaging strategy in the crypto industry offers a straightforward, consistent method for portfolio expansion, especially suited for novices or those wary of the constant market vigilance. Should you find yourself ensnared in the daunting grip of “analysis paralysis,” the deployment of a DCA strategy can offer a much-needed reprieve, enabling the gradual cultivation of a diversified investment portfolio.

FAQs about DCA Strategies in Crypto

Seeking further clarity on dollar-cost averaging in crypto? Here’s a treasure trove of answers to some of the most pressing questions surrounding DCA strategies, from safeguarding your investments to decoding the optimal duration for a DCA approach. For those who may not fancy crunching numbers, there are numerous DCA calculators at your disposal to effortlessly determine how various purchase intervals can influence your cost basis, ultimately arming you with the knowledge to navigate the crypto markets with heightened confidence.

Kick off your DCA strategy with BitPay

Buy Crypto with No Hidden Fees

In conclusion, as we unravel the layers of dollar-cost averaging in the enigmatic world of cryptocurrencies, the journey transcends mere investment strategy; it evolves into an odyssey marked by discipline, resilience, and the strategic oscillation between consistency and timing. Embarking on this odyssey requires not just an understanding of market dynamics but also an introspective assessment of one’s risk tolerance, investment horizon, and the unyielding pursuit of balance in the tumultuous seas of crypto investing. Ready to revolutionize your approach to crypto investments? Find more trending news articles like this at DeFi Daily News.