rewrite this content using a minimum of 1200 words and keep HTML tags

Hey Everyone!

There’s been a lot of noise lately around Google ($GOOGL). Between lawsuits, AI battles, and aggressive headlines, it’s easy to wonder: Has Google lost its moat? For many, the story has shifted from “invincible tech giant” to “dinosaur under siege”, with some headlines comparing it to Yahoo in the 2000s.

I get the concerns… Epic Games trials, DOJ breathing down their neck, regulators in Europe getting more aggressive, and Microsoft ($MSFT) with OpenAI — it’s enough to make anyone hesitate. Even YouTube is under pressure, fighting for attention against TikTok.

But here’s the thing — when everyone’s looking at the headlines, getting brainwashed by the noise… I like to look under the hood of the car, same as I do when I hear some weird noise in my old Toyota Prado 2006. So let’s have an in-depth look:

The Noise: AI Wars, Lawsuits & Risks

U.S. Department of Justice (DOJ) antitrust case

E.U. investigations, lawsuits and fees

Intense AI competition from powerhouses like OpenAI, Microsoft, and Meta

Rising competition in Search from AI-driven alternatives (Chat GPT)

YouTube’s battle with TikTok for user attention

Aggressive cost-cutting and layoffs in non-core “moonshot” projects

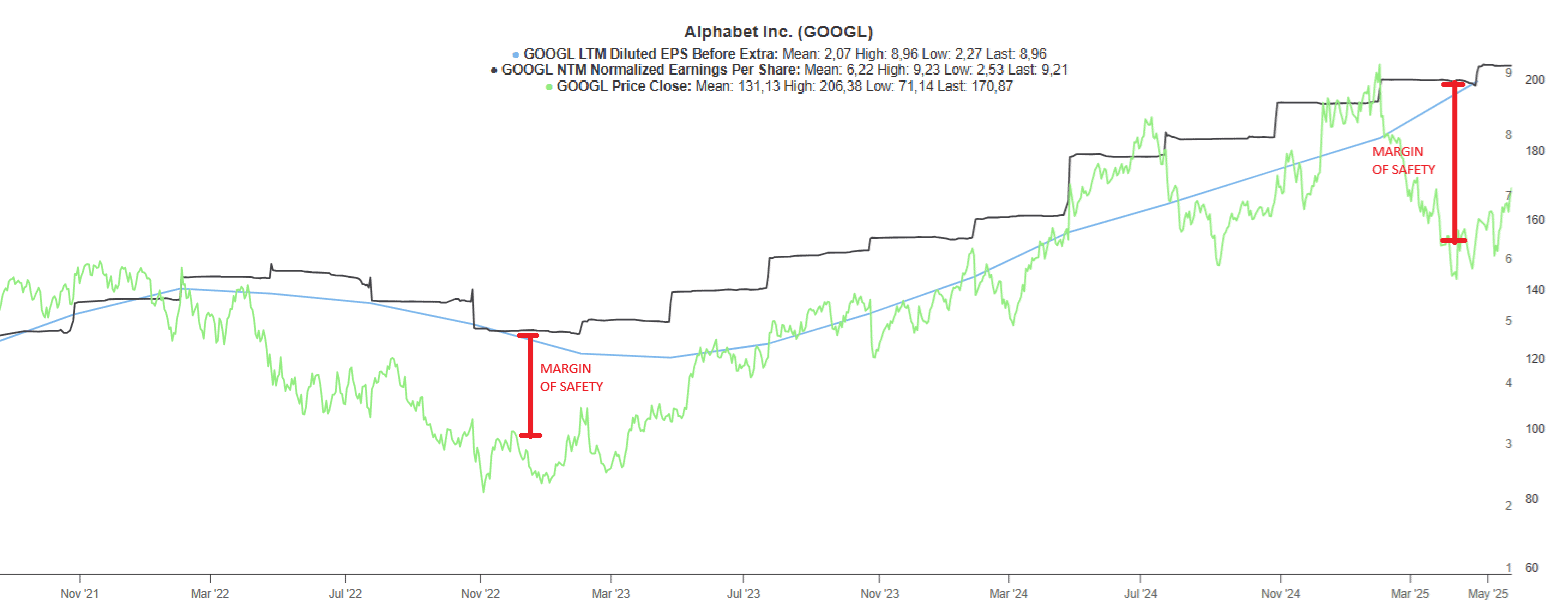

In 2022 and early 2023, ($GOOGL) underperformed as interest rates rose and margins compressed. Wall Street doubted its ability to adapt. However, we see something different: a fortress business currently at a rare valuation disconnect.

Key Highlights: Why Google Remains a Powerhouse

Despite the noise, Alphabet (parent company of Google ($GOOGL)) continues to dominate in crucial areas:

Dominates 90%+ of global search via Google.

Owns market-leading platforms: YouTube, Android, Google Cloud, Gmail….

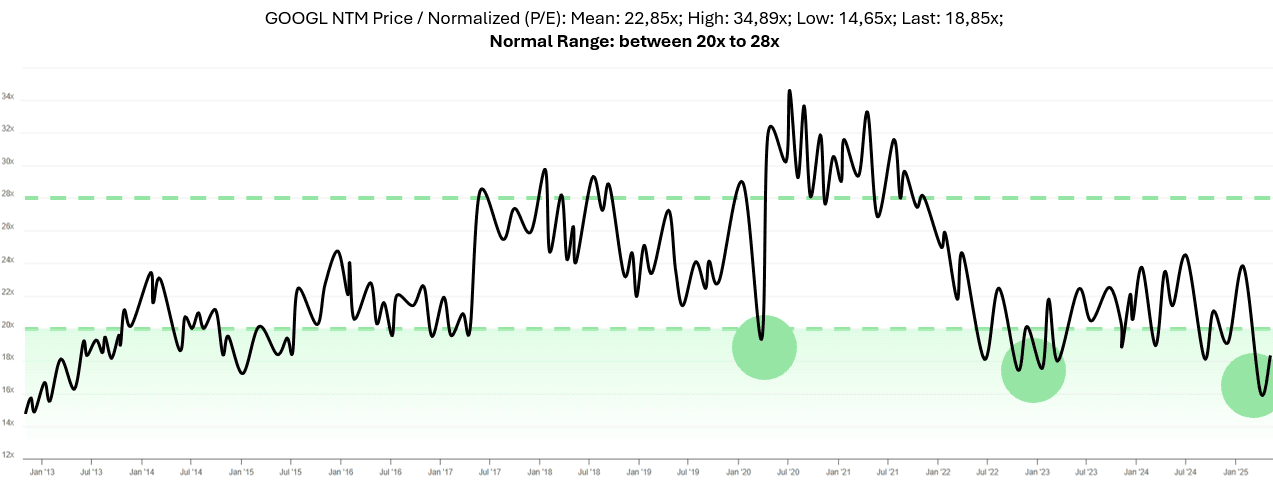

Compelling valuation: less than 20x earnings with a massive net cash position.

Gemini AI is deeply integrated across Workspace, Cloud, and Ads.

Still growing revenue at double digits – even at a colossal $300B+ scale.

Cost discipline: over $7B in annualized savings from layoffs and efficiencies.

Robust capital returns: $70B+ in share buybacks as margins recover.

Possesses one of the strongest balance sheets globally.

Business Model Overview: Unpacking Google’s Moats & Competition

🔒 Google’s Enduring Moats

Search Monopoly: As mentioned above.

Data Advantage / Network: Billions of users and data across platforms.

Scale: Google has a huge scale and cash to compete and outrun others.

High Switching Costs: Google services are deeply embedded in user workflows.

Source: Rand Fishkin @randderuiter on X

⚔️ Key Competitors

While fierce, Google ($GOOGL) maintains dominance due to unmatched scale and distribution.

Search: Microsoft ($MSFT) (Bing + OpenAI integration)

Video: TikTok, Netflix ($NFLX), Instagram ($META)

Cloud: AWS ($AMZN), Azure (Microsoft)

AI Foundation: OpenAI, Anthropic, Meta

Autonomy (Waymo): Tesla FSD ($TSLA)

🧱 Key Strengths

Alphabet’s ($GOOGL) strength isn’t just in its brand — it’s in the architecture of the internet. Google Search, Maps, Android, Chrome, YouTube — these aren’t just services. They’re habits. They’re defaults. The kind of tools people don’t just use — they depend on. That dependency is powerful. It’s why despite all the competition Alphabet keeps growing.

Alphabet’s strength is also in scale and adaptability. Google is investing heavily in Propietary TPUs for AI compute, Data Centers, AI across Search, Workspace and Ads. Google culture of changing and shaping necessities will ensure they consistently try and invent.

Fundamentals & Technicals Checklist: A Deeper Dive

Before I invest in any company, I go through a full checklist — not just to see if the numbers look good, but to truly understand how the business works and why/how it might grow over time.

I don’t rely on hype, headlines, or AI-generated content. I like to rely on key data, trends, and financial health. This checklist I built based on rules helps me break things down across fundamentals, valuation, profitability, management, and even technical signals. I give each line item a score, not to be overly scientific — but to stay consistent, remove emotion, and make better decisions over the long term.

If a company doesn’t meet my standards, it doesn’t make it into my portfolio. It’s that simple.

🧰 Financial Strength: Google ($GOOGL) A True Fortress Built to Last

Investor Confidence: Big funds like Ackman, Klarman, Griffin, Loeb are invested.✅

Earnings & Valuation:

EPS (TTM) is $8.96 // P/E around 17x. ✅

Projected growth of 15% CAGR suggests a fair P/E up to 28x, offering a significant margin of safety. ✅

Earnings are stable and growing, from $5.80 in 2023 to ~$8.96 in 2025. ✅

Source: TIKR Terminal. Graph shows the deviation in valuation and the margin of safety.

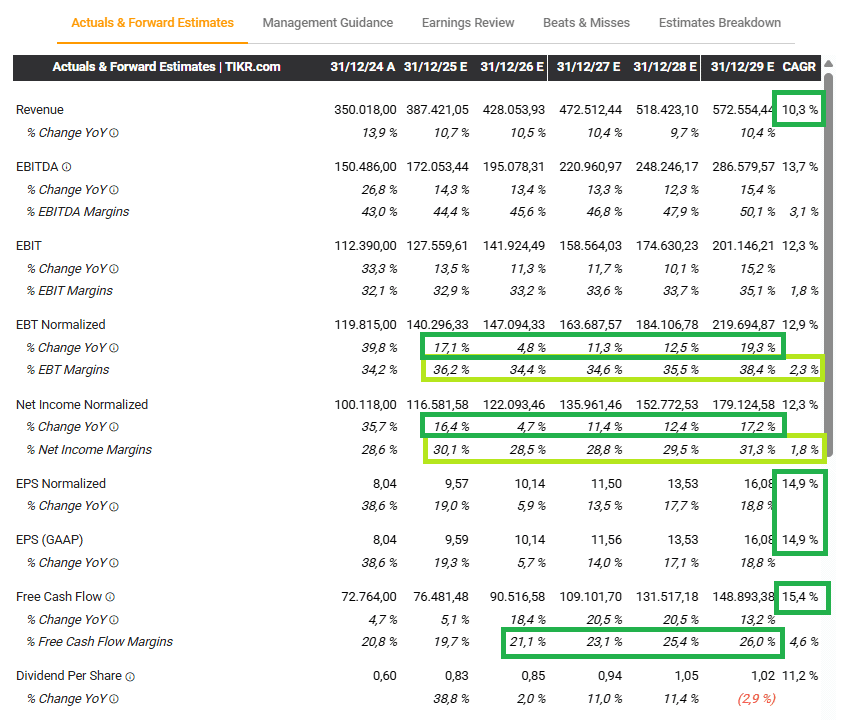

Profitability & Margins:

Operating Margins are 32.7%, up from 25% in 2015, consistent growth. ✅

While competitive, Meta and Microsoft margins are higher. 🟨

Return on Equity (ROE) is 34.6%. ✅

Debt: With a low Debt-to-Equity ratio of 0.07x and $74.9 billion in free cash flow (TTM), Google has immense financial flexibility. ✅

Source: TIKR Terminal. Analysts expect next 5 years of double digits growth and margin expansion

Business Model & Moats: Their strong economic moat comes from brand, data, scale, and user switching costs. As per my checklist a (4/5 score) ✅

Resilience & Management: Google ($GOOGL) quickly recovered from past crises, demonstrating strong resilience. Management is highly aligned with shareholders, with founders retaining significant voting power and CEO heavily tied to stock. ✅

Shares buy-backs: Bought back $15 billion in normal shared last quarter. ✅

Attractive Valuation: A P/E of 18x and EV/EBITDA of 12.5x are below the thresholds for this growth, suggesting good value and margin of safety ✅

📉 Technical Analysis: The Price Tells a Story

The stock’s price action reinforces confidence in its trajectory.

Consistent Growth: Google ($GOOGL) has shown a consistent uptrend over 10 years, with average annual growth rate of ~18.6%, often hitting All-Time Highs. ✅

Favorable Entry: The current price could potentially be a good buying opportunity at NTM Forward P/E of 18x. ✅

Source: AMWorld,using datasets from TIKR

Diversification Note: While strong, Google’s tech focus means it might not diversify your portfolio much if you’re already tech-heavy. ❌

As part of this rule-based checklist Google ($GOOGL) scores high over the minimal 70% that I expect for any company to be able to join the list of “Value Growth Compunders” a the final scores sits at:

Alphabet ($GOOGL): ✅ Final Score: 89/100 – EXCELLENT!

What about the Future?

Real Risks (And Why I’m Watching Closely)

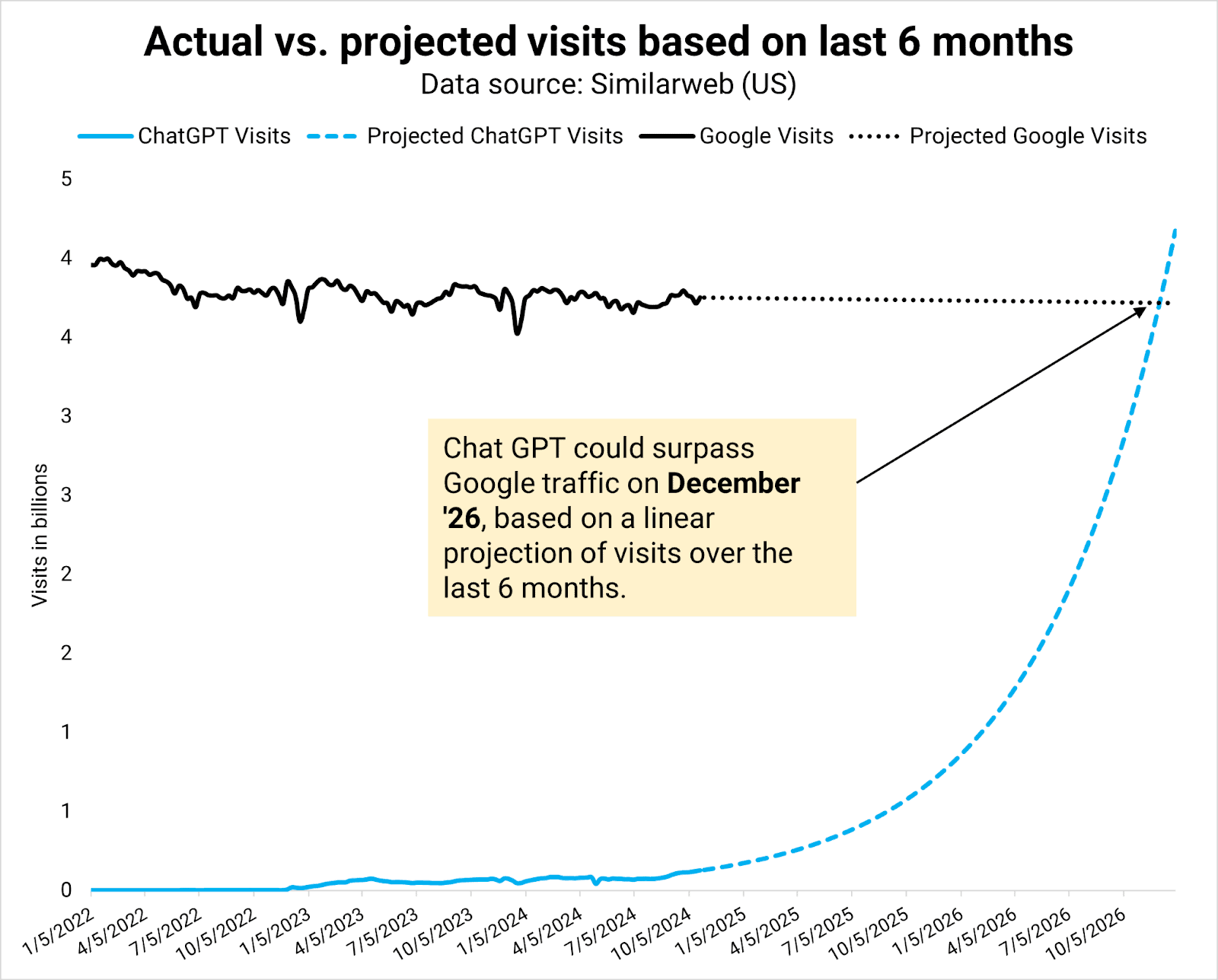

I’ll be honest — if there’s one thing that keeps me up at night about Google ($GOOGL), it’s the shift in how we search for information. For the first time in decades, Google Search feels vulnerable. Tools like ChatGPT and other generative AI models have completely changed the way people interact with the internet. Instead of scrolling through ten blue links, you ask a question — and the answer just appears. It’s fast, natural, and in many cases, more helpful than a traditional search result. If this shift continues, and more people get used to AI-first search experiences, Google ($GOOGL) could face real disruption to its core business — the one that still brings in most of its revenue.

Source: growth-memo.com / gpt-search. ChatGPT forecasted growth

That’s not something I take lightly, and it’s a risk I’m watching very closely by understanding key metrics and KPI’s on AI and search usage at every quarter. But if you think twice history similarly repeats, and similar has happened already with the video app Zoom $ZM, the outcome… $MSFT with it’s scale and network took them out of the race by including Teams for free in their workspace package.

Outlook for the Future: A Generational Compounder?

With Google Search, YouTube, and Android, Alphabet controls the fundamental “pipes and platforms” of the internet. This immense power, combined with its emerging AI leadership and disciplined capital allocation, could transform it into a generational compounder. as the complete leading AI productivity suite provider: Gemini + Workspace + Cloud + Ads. The ultimate free-AI complete workplace.

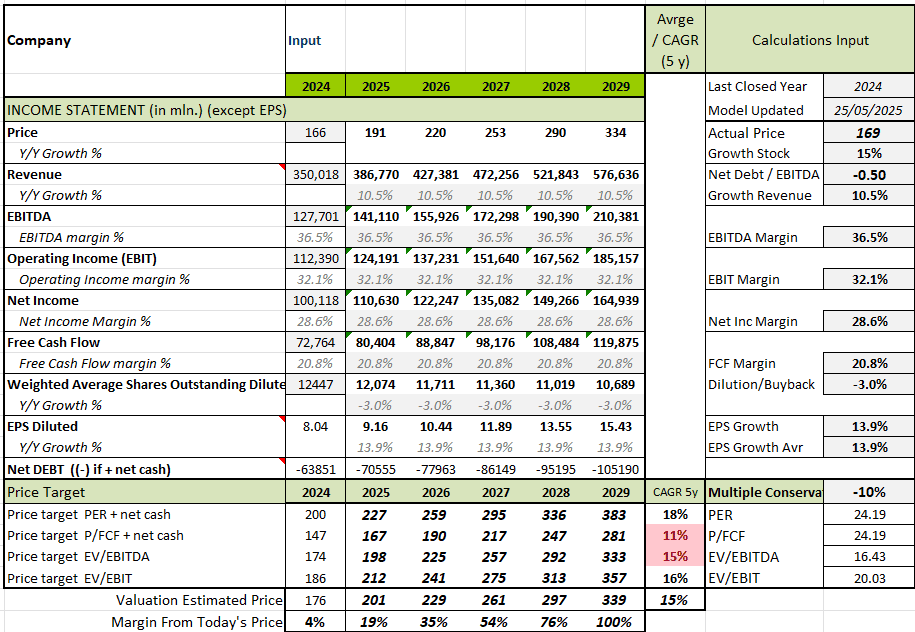

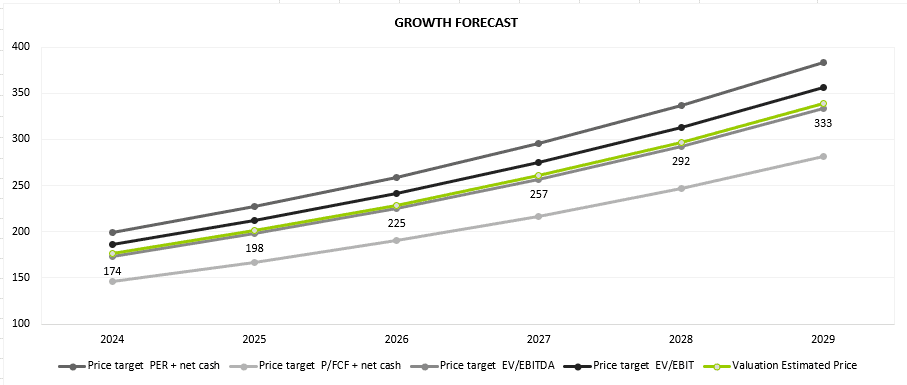

🎯 My Forecast Price: A Conservative Estimate

After analysing a company score, I go then to analyse its intrinsic valuation and its forecast over the next 5 years. In this case, for this analysis I have not taken into account any margin increase. This is my “Normal” scenario based, “Bear” and “Bull” cases are extremes I may share in the future.

Source: AMWorld

($GOOGL) Forecasted 5-Year CAGR > +15% ➔ Excellent long-term growth potential!

✅ Conclusion: A Misunderstood Compounder

So after this analysis, in a similar fashion as when I hear some noise in my 20 year old Toyota Prado, I check under the hood, and I realise after checking everything with the mechanic, that those are normal noises of daily operations and that a Prado is a car built to last, same as Google ($GOOGL). Both around 20 years old, but still with a lot of potential. Both were built to last.

Anyways, after this funny comparison of my old car with Google ($GOOGL)…

I’ve seen this pattern before — with Netflix, Meta, and now Google. The market overreacts to change. Most investors get caught up in the noise: lawsuits, TikTok, the AI arms race. We choose to focus on the robust fundamentals. Alphabet ($GOOGL) is undeniably a top-tier business currently trading at what we consider mid-tier valuations. And that’s where long-term investors find their edge.

Google with its scale, adaptability and MOATs will still be one of the most important companies in the digital world in 2, 5 and 10 years.

🟢 My Verdict: A High-Quality Compounder. Alphabet – Google ($GOOGL) remains a core position in our portfolio.

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.

and include conclusion section that’s entertaining to read. do not include the title. Add a hyperlink to this website http://defi-daily.com and label it “DeFi Daily News” for more trending news articles like this

Source link