rewrite this content using a minimum of 1000 words and keep HTML tags

Bitcoin continues to trade above the critical $100,000 level, showing resilience despite facing resistance near $110,000. Bulls remain in control of the broader trend, but momentum appears to be slowing as macroeconomic tensions intensify. Ongoing global uncertainties, including tariff disputes and bond market volatility, have introduced a new wave of caution across risk-on assets.

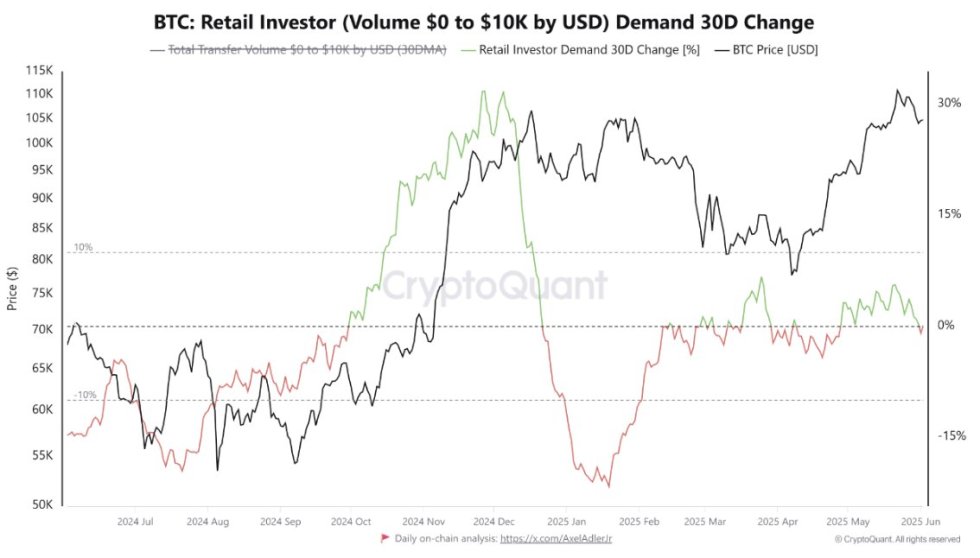

While Bitcoin’s price action remains strong on the surface, undercurrents in on-chain activity reveal a more cautious tone. According to CryptoQuant, retail demand—measured by on-chain transactions involving up to $10,000—has declined by approximately 2.45% over the last 30 days. This drop suggests that smaller investors have not yet entered the market with the enthusiasm typically seen during euphoric phases of a bull run.

Although many retail participants may now be opting for indirect exposure through ETFs or institutional products, the lack of aggressive retail inflows on-chain is a notable signal. For now, the market structure remains healthy, but a stronger wave of demand from smaller investors may be needed to fuel a sustainable push above all-time highs. Until then, Bitcoin may continue consolidating near current levels while awaiting a decisive breakout catalyst.

Bitcoin Faces A Crucial Test As Retail Demand Lags Behind

Bitcoin is now trading at a critical juncture. After reaching an all-time high of $112,000, bulls are fighting to reclaim upward momentum, while bears have yet to trigger a meaningful retrace. The price remains above $105,000, a strong sign of resilience amid growing macroeconomic volatility. Global tensions—particularly the ongoing U.S.-China tariff standoff and rising bond yields—continue to shake markets and keep investors cautious.

Despite Bitcoin’s strength, sentiment remains divided. Many analysts point to the uncertain bond market and systemic risks as key drivers of both opportunity and concern. While institutional flows and ETF activity offer some support, on-chain data suggests the market is far from euphoric.

CryptoQuant data reveals a 2.45% decline in retail demand over the past 30 days, measured by BTC transactions of $10,000 or less. This metric reflects smaller investor behavior, and its downtrend implies that the retail crowd has not yet jumped in with full confidence. While some of this capital may now flow through ETFs and custodial platforms, the lack of strong on-chain signals from retail traders tempers immediate bullish expectations.

However, this may not be entirely negative. The absence of retail euphoria could mean the current structure has room to grow, with the potential for another wave of sustainable upside, if demand returns. For now, Bitcoin holds its ground, but the next move will depend heavily on external catalysts and broader market sentiment.

BTC Technical Analysis: Price Stays Range-Bound

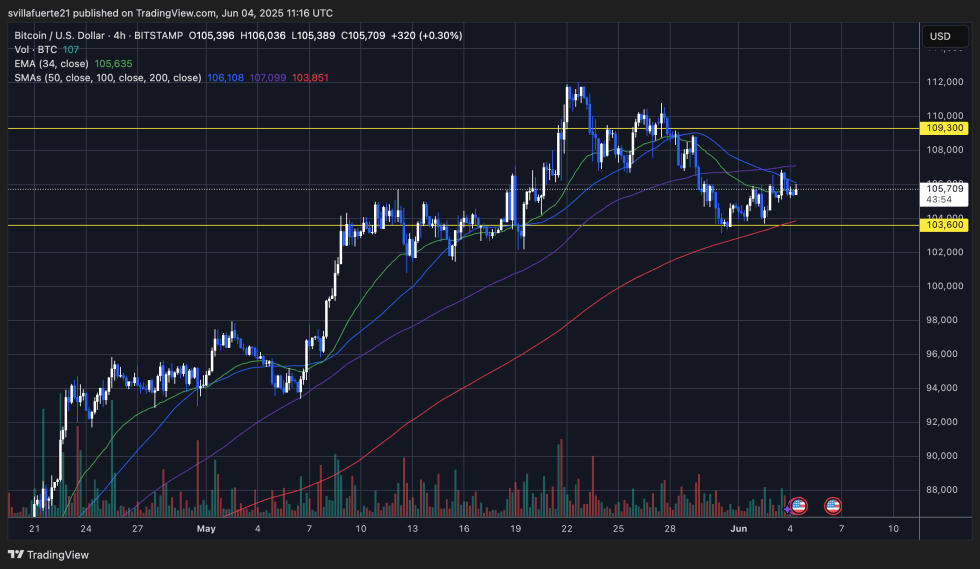

Bitcoin is trading around $105,700, holding above the key support at $103,600 after bouncing off this level multiple times. This area continues to act as a solid demand zone, offering a base for potential upside if momentum builds. On the 4-hour chart, BTC remains range-bound between $103,600 and $109,300, with sideways movement dominating price action since the May rejection at all-time highs.

The 34 EMA is providing short-term dynamic support near $105,600, while the 100 and 200 SMAs sit slightly above and below the current price, compressing BTC within a tight structure. This suggests that a decisive move may be nearing. If Bitcoin breaks and closes above $106,900, the next key resistance at $109,300 could be tested again, with potential to extend higher.

However, a close below $103,600 would break the bullish structure and open the door for further downside, possibly toward the $100,000 psychological level. Volume has remained low, which highlights market indecision, with participants waiting for a macro or technical catalyst.

Featured image from Dall-E, chart from TradingView

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

and include conclusion section that’s entertaining to read. do not include the title. Add a hyperlink to this website [http://defi-daily.com] and label it “DeFi Daily News” for more trending news articles like this

Source link