rewrite this content using a minimum of 1200 words and keep HTML tags

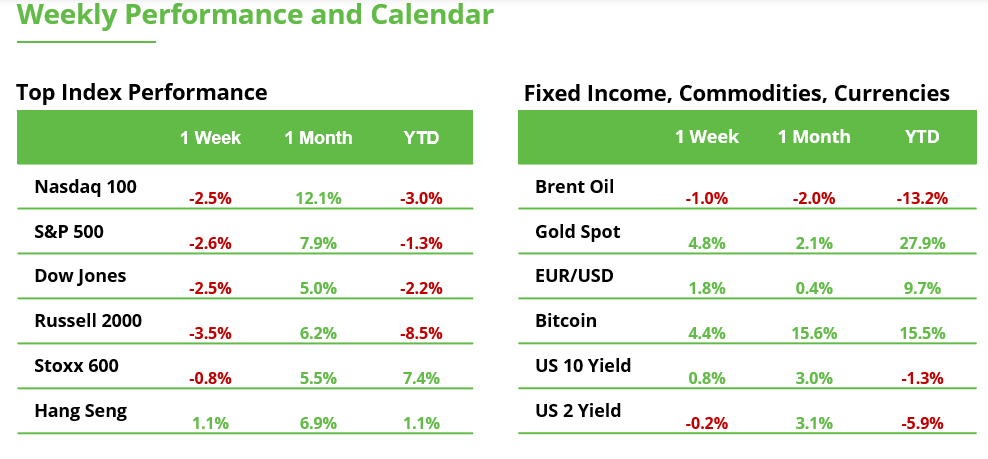

Analyst Weekly: May 26, 2025

While AI devours electricity like it’s on an all-carb diet, nuclear energy’s making a comeback. Meanwhile, Bitcoin’s hit ATH, tariffs got personal, and long-term bond yields sent a global warning flare. Now you’ve got a market rethinking where to park capital next.

AI’s Power Hunger Fuels Nuclear Renaissance

Remember when AI was just about chatbots taking our jobs? Now it’s about taking our electricity. The global AI boom is fueling insatiable demand for power: those massive data centers training algorithms 24/7 consume megawatts like there’s no tomorrow. That trend sparked a nuclear comeback story.

The US administration had declared an “energy emergency” in January and fast-tracked plans to quadruple US nuclear power capacity over the next 25 years. On Friday, the US administration signed orders to cut red tape and even build reactors on federal land, aiming to boost reliable power for AI growth.

Why nuclear? It’s 24/7, carbon-free (if done right), and not at the mercy of weather, perfect to keep AI factories humming. The US, once a nuclear leader, has fallen behind as China races ahead in reactor construction. Now, policymakers see a chance for a “Nuclear Renaissance” to reclaim the crown and meet surging electricity needs. In fact, nuclear energy generation is set to hit a record high in 2025 globally as many countries rethink the atom.

Talk of a nuclear revival lit a fire under related stocks- uranium producers and nuclear tech names surged on the news. Oklo Inc. ($OKLO),backed by OpenAI’s Sam Altman, saw its shares soar over 23% following the executive orders. NuScale Power Corp. ($SMR), specializing in small modular reactors, experienced a 19% jump. Constellation Energy Corp. (CEG), a major US nuclear utility, rose 2%, while Canadian uranium producer Cameco Corp. ($CCJ) climbed 11%.

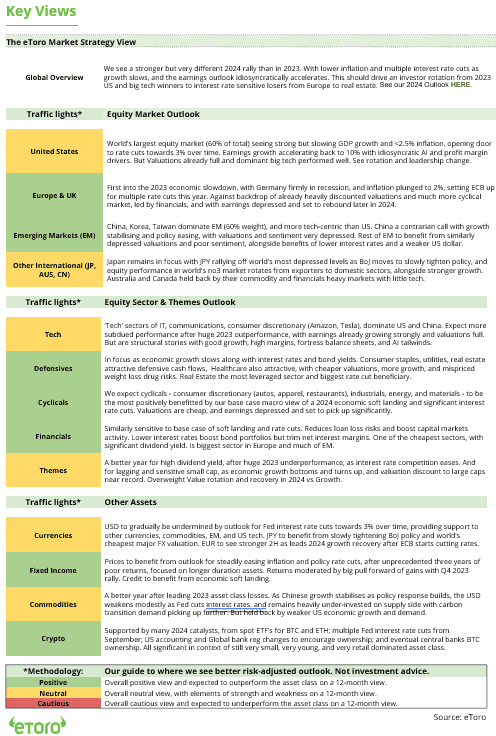

Investment Takeaway: The future of AI isn’t just about advanced chips and software- it’s also about keeping the lights on. Investors with a global, forward-looking lens might position for an era where energy is king in the age of AI. For retail investors, this theme goes beyond one week. It underscores how the AI revolution has real-world ripple effects: benefiting not just Big Tech, but also sectors like energy, industrials, and commodities. Governments worldwide may pour investment into power infrastructure (nuclear, renewables, grids) to avoid an AI-induced energy crunch. That could create opportunities in utility and clean energy ETFs, uranium miners, and even tech firms investing in power solutions. Of course, execution is key: nuclear plants take years to build and come with hefty costs and regulatory hurdles.

Earnings Season Wrap: Margins Still Strong, but Worth WatchingAs Q1 earnings season winds down, corporate America still looks profitable though the shine may be starting to fade. S&P 500 margins dipped about 30 basis points from their cycle highs, now sitting at 17.6%. That’s still elevated by historical standards, which helps justify high valuations but it’s a trend worth watching, especially as we near the end of the 90-day tariff pause this summer.

Inflation Whispers Are Back. One standout theme this quarter? A pickup in mentions of higher costs on earnings calls. We’re not seeing anything close to the cost chatter of 2022, but the upward drift is notable — particularly in a low-inflation environment. If that commentary keeps rising, it could be a leading indicator of inflation making a comeback, especially if firms start passing those costs to consumers.

No Shortage of Certainty (Literally). Interestingly, this uptick in cost talk has not come with concerns about supply chain shortages. Mentions of shortages have stayed muted, suggesting the current cost pressure isn’t tied to any material constraints. Some speculate demand was pulled forward ahead of tariff shifts, but so far, companies aren’t sounding the alarm.

Where the Value Is Hiding. In terms of sector plays, Energy and Healthcare are looking attractive on a forward earnings yield basis, at 7.3% and 6.4%, respectively. Both sectors have been underloved lately, making them potential contrarian bets for value-focused investors. Meanwhile, the market darlings with the most buzz are trading at lower earnings yields than the S&P 500 average, hinting at stretched valuations.

Source: Bloomberg, as of May 25, 2025

Bitcoin at ATH: Are we entering a new cycle?

After breaking above $100,000 and posting gains of 20% in just a few days, the inevitable question returns among investors: are we facing another speculative episode, or a structural shift that is redefining the financial system?

First, the “digital gold” narrative is gaining traction in a context of structural inflation, persistent fiscal deficits, and growing distrust toward sovereign debt markets. Bitcoin’s decoupling from the Nasdaq is one of the clearest signals, showing behavior more aligned with a store of value than a high-beta tech asset.

Second, on the supply side, the data is striking. Over the last 12 months, approximately 165,000 BTC have been mined, while governments, corporations, and funds have acquired over 431,000 BTC during the same period. This structural supply imbalance is exerting upward pressure on price.

Moreover, capital is rotating from retail and short-term speculators to institutions and corporations. This shift reduces volatility, and elevates the market floor. We are witnessing the emergence of a new dominant cohort: whales, corporations, and ETFs. Entities holding between 1,000 and 10,000 BTC now control over 3.5 million coins. Since the launch of spot ETFs, those holdings have risen steadily, now reaching 1.2 million BTC. BlackRock leads with 647,000 BTC. Notably, around 75% of these ETF flows come from high-net-worth individual clients. On the corporate side, more than 90 publicly listed companies now collectively hold close to 748,000 BTC on their balance sheets.

Altogether, this shows that structural supply pressure is real and without precedent.

It’s also worth noting a natural selection process among altcoins. New capital flows primarily into bitcoin, and to a lesser extent, Ethereum and Solana. The rest must now justify their existence. The era of capital inflows based solely on promises is over. Product, usage, and adoption are the new minimums. Tokens without utility or value are being left behind.

Looking at the question of whether the market is overheated, on-chain metrics suggest it is not. The realized profit ratio for holders remains well below historical peaks from previous cycles, which implies additional upside potential, assuming macro conditions remain supportive.

Looking ahead, attention should focus on upcoming US regulation, especially regarding which assets will be classified as securities. Also crucial will be any fiscal policy actions implemented in the US, along with global capital flow trends and credit dynamics.

In short, we are witnessing a structural shift. Bitcoin is entering the global financial architecture. And that has far-reaching consequences.

Tariff Temp Check: 45 Days In, and the Heat’s Rising

We’re halfway through the 90-day chill period on new tariffs over 10% but so far, only one deal’s been inked (shoutout to the UK). The rest? Still stuck in customs.

On Friday, the US administration turned up the trade talk again, threatening a 25% tariff on iPhones made outside the US. That’s not legally doable (you can’t just target one company), but the White House has hinted before that smartphones could get swept up in broader critical mineral tariffs. Translation: Apple might want to brush up its “Made in America” game. Apple ($AAPL) felt the heat, with shares dipping over 3% following the announcement. Key suppliers like Qualcomm Inc. ($QCOM), Qorvo Inc. ($QRVO), and Skyworks Solutions Inc. ($SWKS) also saw declines, reflecting investor concerns over potential disruptions in the tech supply chain

But the EU got the sharpest jab: 50% tariffs on EU goods starting June 1 unless Brussels plays ball. The US wants lower EU tariffs without lowering its own, arguing that Europe’s strict product rules and digital tax are unfair barriers. So far, the EU’s not budging.

Why the tough talk? After scoring a tariff-trimming deal with China, other countries think America’s eager to deal and they’re playing hard to get. Now, the US is upping the pressure. Treasury Secretary Bessent put it plainly: he hopes the threats will “light a fire under the EU.”

What’s Driving the Global Surge in Long-Term Bond Yields?

Global Long-End Pain: Yields on 30-year government bonds are rising sharply across major economies, including the US, UK, and Japan as investors demand higher compensation to lend long-term. This reflects a broad loss of confidence in fiscal sustainability, not just inflation concerns.

US Trigger: Weak Treasury Auction + Budget Worries: A poor 20-year Treasury auction sparked the latest jump in US yields. But the real issue is growing discomfort with America’s fiscal trajectory. The proposed “One Big Beautiful Bill Act” is expected to widen the deficit by $472 billion next year, mostly through tax cuts without meaningful spending restraint, a red flag for bondholders.

Political Gridlock Makes It Worse: The US fiscal framework is relatively rigid, once a budget is passed, it tends to stick for years. Investors realize that if this bill passes, there may be no course correction until after the next election cycle. That locks in high deficits and growing debt service costs.

Downgrade Adds to Jitters: Moody’s recent US credit downgrade didn’t have major direct effects, but it reinforced the perception that Washington is not serious about debt control- a sentiment that’s now moving markets.

Currency Impact: Higher yields usually support a currency, but the dollar fell, signaling that the US may be losing its safe-haven appeal amid fiscal uncertainty.

Pain for Bondholders: Rising yields are crushing the value of long-dated bonds. For example, Austria’s 100-year bond has lost 75% of its value since yields climbed.

Japan and UK Add Fuel: Japan’s fiscal credibility took a hit after its PM compared their finances to Greece’s pre-crisis. Meanwhile, UK inflation surprised to the upside, reviving stagflation fears. Both saw their long bond yields surge as well.

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.

and include conclusion section that’s entertaining to read. do not include the title. Add a hyperlink to this website http://defi-daily.com and label it “DeFi Daily News” for more trending news articles like this

Source link