rewrite this content using a minimum of 1200 words and keep HTML tags

Gold ($GOLD) has always been a symbol of wealth and stability, but its recent performance has captured the attention of investors worldwide. The precious metal has surged to a historic high of $3,000 per ounce, marking an impressive 50% increase over the past year. This remarkable rally has left many wondering: what is driving this surge, and should investors consider adding gold to their portfolios? In this article, we’ll explore the factors behind gold’s rise, its role as a safe haven, the potential risks, and how investors can approach this asset in today’s uncertain economic climate.

Gold’s Historic Rally: Breaking Records

Gold’s ascent has been nothing short of extraordinary. Over the past year, the price of gold has climbed by 50%, reaching an all-time high of $3,000 per ounce. This surge has defied traditional economic indicators that would typically weigh on gold prices, such as declining inflation, a strong U.S. dollar, and elevated interest rates. So, what’s behind this unprecedented rally?

Why Gold is Rising Against the Odds?

Gold’s recent performance is particularly intriguing because it contradicts several economic trends that usually suppress its price. Let’s break down the key factors driving this surge:

Uncertainty as a Catalyst

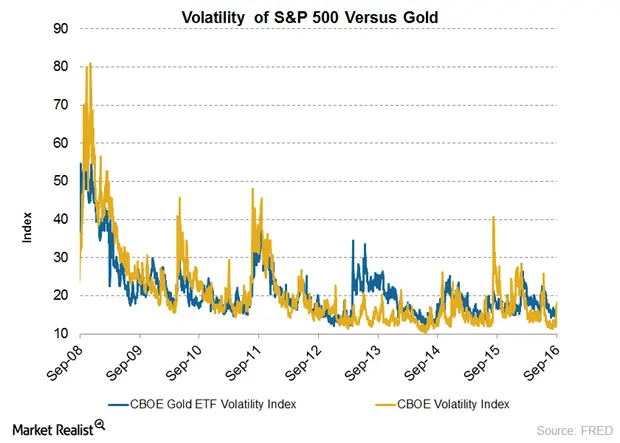

Gold has long been considered a “safe haven” asset, meaning investors flock to it during times of uncertainty. Today, the world is grappling with a perfect storm of political, geopolitical, and economic instability. From escalating trade tensions to unpredictable policy shifts, the global landscape is rife with risks. In such an environment, gold becomes a reliable store of value, offering protection against volatility in other asset classes like stocks and bonds.

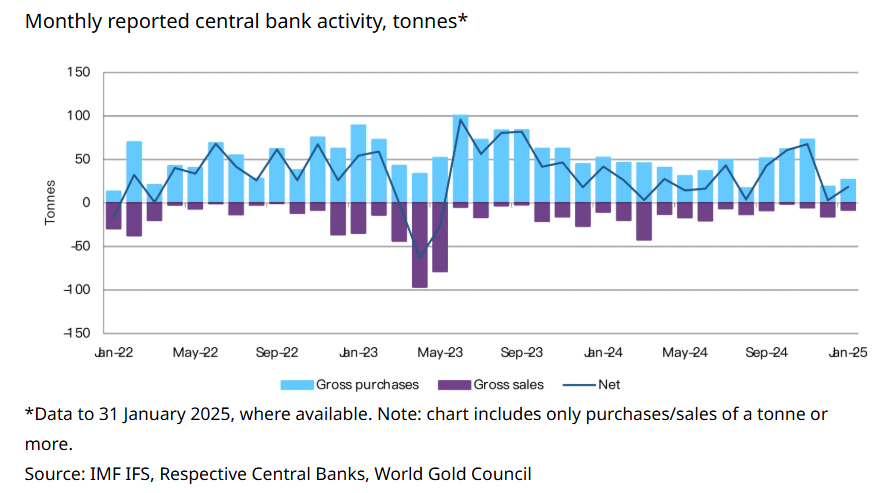

Central Banks’ Gold Rush

Another major driver of gold’s rise is the aggressive accumulation of gold reserves by central banks worldwide. Countries like China, Russia, and Iran have been stockpiling gold at an unprecedented rate. This trend has intensified in response to the threat of U.S. sanctions, which often leverage the dominance of the U.S. dollar in global trade and finance. By increasing their gold reserves, these nations aim to reduce their reliance on the dollar and insulate themselves from potential financial or trade wars.

Contradictory Economic Indicators

What makes gold’s rally even more fascinating is that it’s occurring despite several economic conditions that would typically dampen its appeal:

– Falling Inflation: Gold is traditionally seen as a hedge against inflation. However, inflation rates have been declining in many parts of the world, yet gold continues to rise.

– Strong Dollar: Historically, gold tends to perform well when the U.S. dollar weakens. This time, however, gold is climbing even as the dollar remains strong.

–High Interest Rates: Gold does not generate yield, making it less attractive in a high-interest-rate environment. Yet, demand for gold remains robust despite elevated rates.

These contradictions highlight gold’s unique role as a financial asset. While it may not always follow conventional economic logic, its value as a safe haven and store of wealth continues to resonate with investors.

The Risks of Investing in Gold

While gold’s recent performance has been impressive, it’s important for investors to understand the potential risks associated with this asset. Gold is not without its drawbacks, and its price can be influenced by a variety of factors that may lead to volatility or losses.

Price Volatility

Gold prices can be highly volatile, experiencing sharp fluctuations over short periods. While it is often seen as a stable asset, external factors such as changes in interest rates, currency movements, or shifts in investor sentiment can lead to significant price swings. Investors should be prepared for the possibility of sudden declines, especially if economic conditions stabilize or improve.

No Yield or Income

Unlike stocks or bonds, gold does not generate any income, dividends, or interest. Its value is purely based on price appreciation, which means investors rely entirely on market demand to realize gains. In a high-interest-rate environment, this can make gold less attractive compared to yield-generating assets.

Geopolitical and Market Risks

While gold is often seen as a hedge against geopolitical risks, these same risks can also impact its price unpredictably. For example, if tensions ease or global markets stabilize, demand for gold as a safe haven may decline, leading to price corrections. Additionally, changes in central bank policies or large-scale selling of gold reserves by institutions can also affect its value.

Storage and Liquidity Concerns

For those investing in physical gold, storage and liquidity can be significant challenges. Storing gold securely often incurs additional costs, and selling physical gold can be less convenient than trading other assets like stocks or ETFs. Moreover, physical gold may carry premiums or discounts depending on market conditions, which can impact returns.

Speculative Nature

Gold is often subject to speculative trading, which can amplify price movements. While this can lead to significant gains, it also increases the risk of losses, particularly for short-term investors. Long-term investors should carefully consider whether gold aligns with their overall financial goals and risk tolerance.

Should You Invest in Gold?

Given gold’s impressive performance, many investors are wondering whether they should add it to their portfolios. The answer depends on your financial goals, risk tolerance, and investment strategy.

Gold as a Financial Anxiolytic

For some investors, gold serves as a form of financial insurance. If holding gold provides you with peace of mind during turbulent times, experts recommend allocating a small portion of your portfolio typically 2-3% to the precious metal. This modest allocation can act as a hedge against market volatility and economic uncertainty.

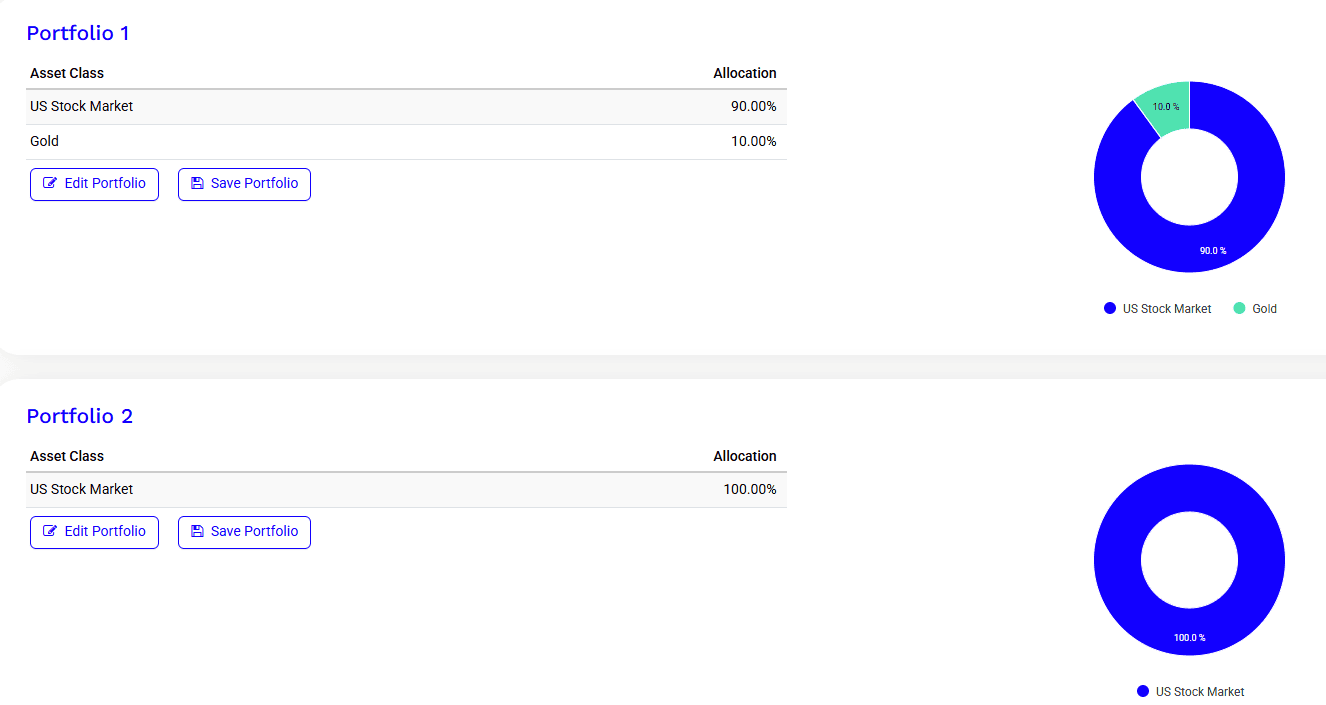

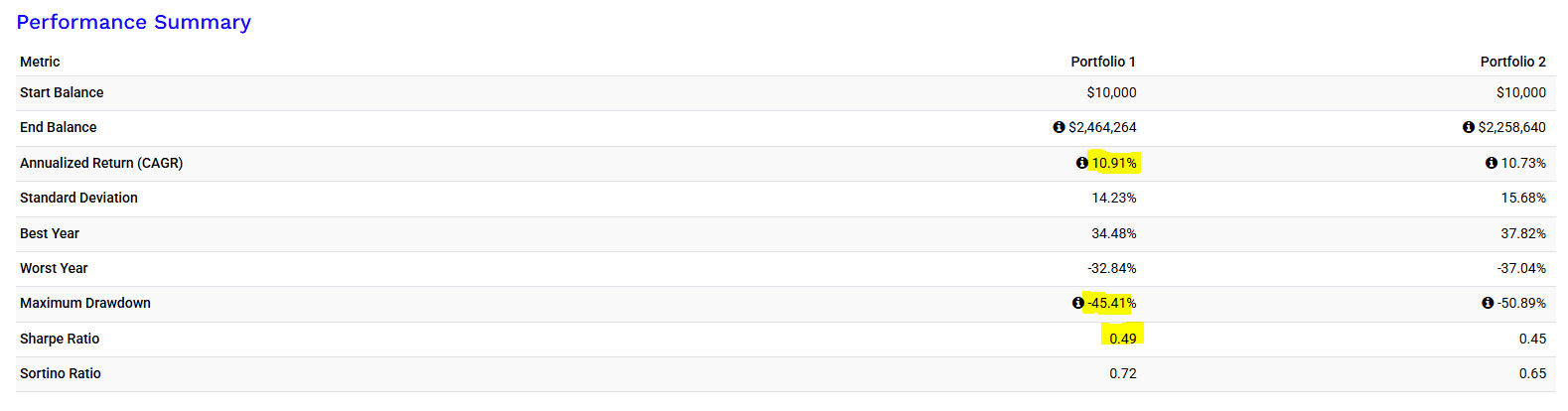

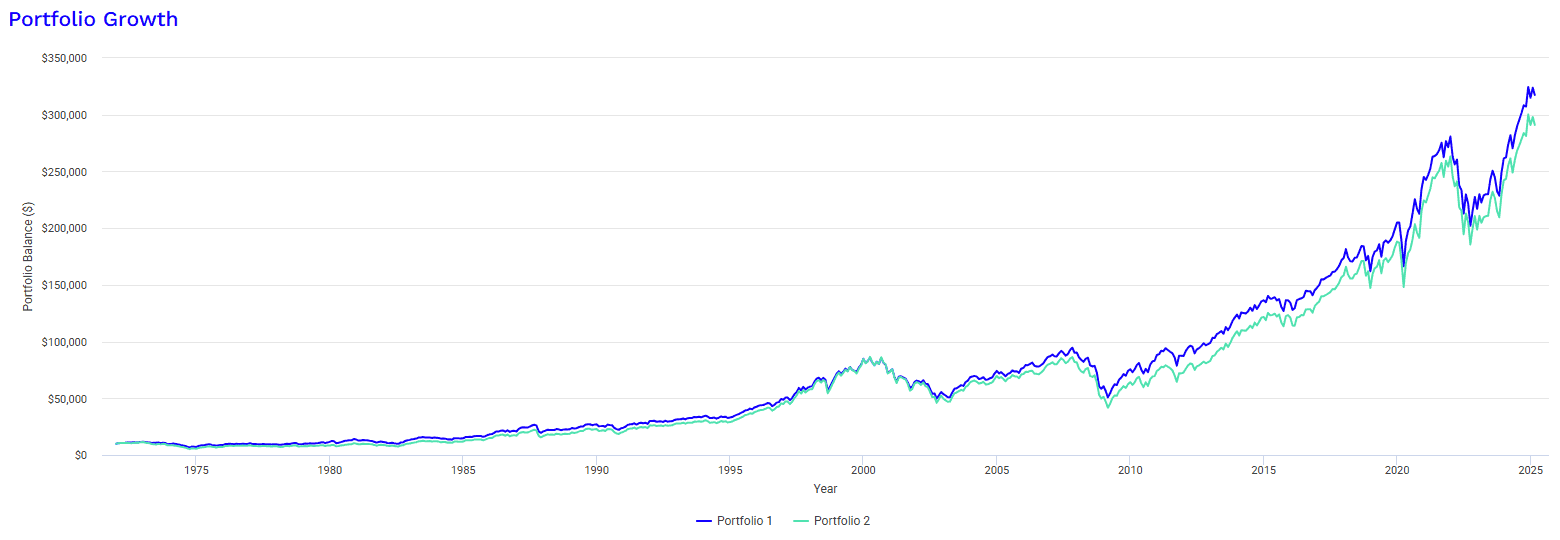

To illustrate this, let’s compare two portfolios: one with 100% U.S. stocks and another with 90% U.S. stocks and 10% gold. Since 1972, the portfolio with 10% gold has outperformed the all-stock portfolio, delivering an annual return of 10.91% compared to 10.73%. Moreover, the gold-included portfolio has shown lower risk, with a maximum drawdown of 45.41% versus 50.89% for the all-stock portfolio. This demonstrates how adding gold can enhance returns while reducing risk over the long term.

Caution Advised

While gold has its merits, it’s important to approach it with caution. Gold is a speculative asset, and its price can experience sharp corrections. Unlike stocks or bonds, gold does not generate income or dividends, making it purely a play on price appreciation. As such, it’s best suited for investors who understand its risks and are comfortable with its volatility.

How to Invest in Gold

If you’re considering adding gold to your portfolio, there are several ways to do so. Each method has its pros and cons, so it’s important to choose the one that aligns with your investment goals and preferences.

Physical Gold

Physical gold includes gold bars and coins, which can be purchased from banks, specialized dealers, or numismatists. While owning physical gold can be satisfying, it comes with some challenges:

– Storage: Physical gold requires secure storage, which can be costly and inconvenient.

– Liquidity: Selling physical gold can be more cumbersome than selling other types of investments.

– Premiums: Coins, in particular, often carry premiums due to their collectible value, making them less correlated with the price of gold itself.

Paper Gold

For most investors, paper gold is a more practical and cost-effective option. This category includes:

– ETFs (Exchange-Traded Funds): Gold ETFs ($GLD) track the price of gold and can be bought and sold like stocks. They offer high liquidity and low costs.

– Certificates: These represent ownership of a specific amount of gold stored by a financial institution.

– Gold spot forex like here on Etoro ($GOLD):

– Mining Stocks: Investing in companies that mine gold can provide exposure to the metal, but these stocks are also influenced by company-specific factors and market conditions.

($GOLD.BARRICK)

Paper gold is generally easier to manage and more accessible than physical gold, making it a popular choice for both individual and institutional investors.

The Future of Gold: What to Expect

As we look ahead, gold’s outlook remains closely tied to global economic and geopolitical developments. If uncertainty persists—whether due to trade tensions, political instability, or financial market volatility gold is likely to maintain its appeal as a safe haven. Additionally, the ongoing accumulation of gold by central banks could provide further support for its price.

However, investors should remain vigilant. Gold’s price can be volatile, and its performance is influenced by a complex interplay of factors. While it can be a valuable addition to a diversified portfolio, it’s not a one-size-fits-all solution.

Conclusion: Shining Bright in Turbulent Times

Gold’s recent surge to a record high of $3,000 per ounce underscores its enduring role as a safe haven in turbulent times. Despite defying traditional economic indicators, the precious metal continues to attract investors seeking stability and protection against uncertainty. Whether through physical gold or paper instruments, gold can be a valuable addition to a diversified portfolio but it should be approached with care and moderation.

As the world navigates ongoing geopolitical and economic challenges, gold’s allure is unlikely to fade anytime soon. For investors, the key is to understand its unique characteristics, weigh the risks and rewards, and make informed decisions that align with their financial goals. In an unpredictable world, gold remains a timeless asset, offering both security and opportunity for those who know how to harness its potential.

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.

and include conclusion section that’s entertaining to read. do not include the title. Add a hyperlink to this website http://defi-daily.com and label it “DeFi Daily News” for more trending news articles like this

Source link