rewrite this content using a minimum of 1200 words and keep HTML tags

Approximately two days ago, a whale initiated a short position on Hyperliquid with an initial stake of $300 million USD against BTC. Subsequently, the trader augmented this position, culminating in a total short volume exceeding $518 million USD as of today.

A strong conviction in the anticipated depreciation of Bitcoin

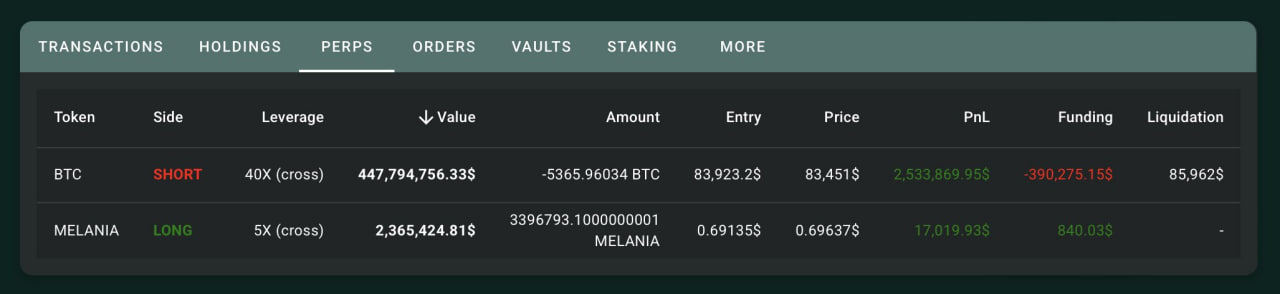

Commencing with a $300M stake leveraged at 40x to execute the BTC short trade, the trader briefly realized a profit surpassing $6 million USD, with the position’s value escalating to $366 million USD.

Learn more: A Trader Opened a $366M Value Short Position on Hyperliquid

This confidence is further evidenced by the concurrent initiation of a short position on ETH and a long position on the memecoin, MELANIA token, with a 5x leverage amounting to $2.3 million, immediately following the closure of the ETH short. This strategic maneuver appears to be predicated on the anticipation of a continued bearish trend within the cryptocurrency market this week, thereby fostering an environment conducive to the outperformance of memecoins.

However, the memecoin investment deviated from the projected trajectory, resulting in substantial losses for the associated wallet address.

Source: Hypurrscan

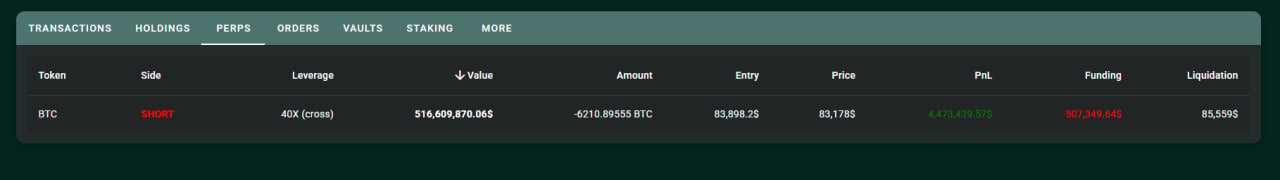

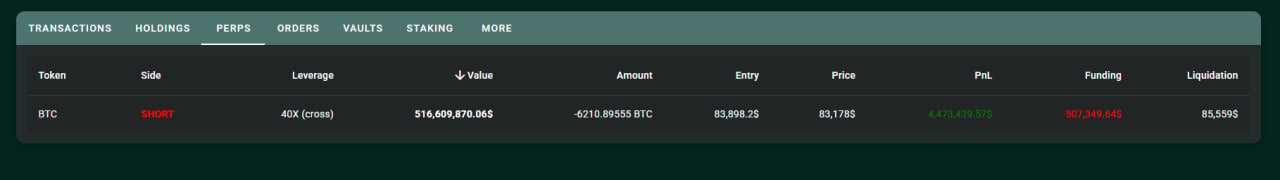

Current Position of the Whale

On March 17th, the whale further augmented the BTC short position on Hyperliquid, elevating the total value to $518 million—a remarkable figure for a decentralized exchange (DEX). Consequently, the liquidation price was adjusted to $85,559 (indicating liquidation if BTC surpasses this threshold by approximately $2,500). Concurrently, the current market, including Bitcoin BTC, exhibits a relatively sluggish trading pattern, oscillating within the $82,100 – $84,700 range.

As of this writing, the profit accrued by wallet address 0xf3…57c has exceeded $4.8 million.

The funding fee has reached -$507,349.

Source: Hypurrscan

This seemingly audacious scenario is unfolding as the cryptocurrency community meticulously monitors the trader’s every move.

Hyperliquid itself has expressed pride on X, stating:

Hyperliquid has redefined trading.

When a whale shorts $450M+ BTC and wants a public audience, it’s only possible on Hyperliquid.

When headlines say “Bitcoin Market on Edge,” they are equating “Hyperliquid” with the “market.”

Anyone can photoshop a PNL screenshot. No one can… pic.twitter.com/0fmBmXNOOg

— Hyperliquid (@HyperliquidX) March 17, 2025

The community is particularly keen to liquidate this whale’s position

Specifically, the CBB account on X announced its intention to initiate the liquidation of this whale’s position on March 16th.

If you are willing to hunt this dude with size, drop a DM, setting up a team right now and already got good size. pic.twitter.com/2lPtXxIitd

— CBB (bera era) (@Cbb0fe) March 16, 2025

At the same time, a Long BTC order was also executed to “block” the other wallet address, but it was still not enough to prevent wallet 0xf3…57c from continuing to increase its position. This order had to be canceled.

About Hyperliquid

Hyperliquid, a Layer 1 protocol specializing in decentralized perpetual futures trading, has experienced a surge in popularity in recent days. Hyperliquid currently holds a position among the top three decentralized exchanges (DEXs) in terms of trading volume, trailing only Uniswap and Raydium.

Learn more: Hyperliquid Price Prediction

The project demonstrates strong growth momentum amidst the evolving regulatory landscape for centralized exchanges (CEXs), and is considered one of the most lucrative avenues for profit generation within the current cryptocurrency market.

and include conclusion section that’s entertaining to read. do not include the title. Add a hyperlink to this website [http://defi-daily.com] and label it “DeFi Daily News” for more trending news articles like this

Source link