rewrite this content using a minimum of 1200 words and keep HTML tags

Decoding the 2025 Outlook

Goldman Sachs (GS) delivered a stellar 52% shareholder return in 2024, and with a dynamic 2025 on the horizon, the question on everyone’s mind is: can this momentum continue? This deep dive explores GS’s potential, analyzing key highlights, catalysts, risks, and ultimately, asking: is GS a bullish or bearish prospect? (Source: Goldman Sachs Q4 2024 Earnings)

A Legacy of Leadership

Founded in 1869, Goldman Sachs has cemented its position as a global financial powerhouse. Navigating the turbulent waters of the 2008 financial crisis, GS emerged stronger, solidifying its reputation for resilience and strategic prowess.

2024: A Year of Triumph

GS crushed expectations in 2024, boasting a 16% revenue surge and a 77% earnings explosion. This impressive performance was fueled by record equities revenues, coupled with robust investment banking fees and FICC performance. Furthermore, GS reigned supreme in worldwide Mergers & Acquisitions (M&A) completions and saw a 12% boost in assets under supervision.

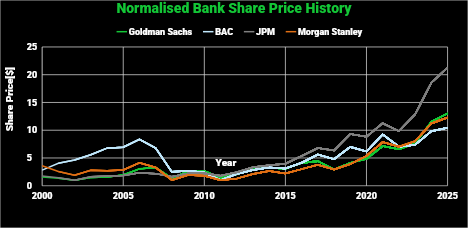

Above a visual display of the recent strong stock price growth of GS versus the market.

2025: Catalysts for Growth

Several factors point towards a promising 2025 for GS:

M&A Boom: Anticipation of eased regulations and a more competitive financial landscape, combined with pent-up demand for portfolio transformation, suggests a significant uptick in M&A activity. GS’s own client survey reveals that nearly half of respondents see strategic growth and new capabilities as primary M&A drivers.

IPO Resurgence: The IPO market is showing signs of life, with a 50% year-over-year increase in total value. This bodes well for GS, a dominant player in investment banking.

AI Revolution: While 2024 saw the recognition of AI’s potential, 2025 is poised for practical application. Companies are gearing up for substantial investments in AI and machine learning, creating new opportunities for GS.

Sector-Specific Dynamics: The retail banking sector, in particular, witnessed increased M&A activity in 2024, a trend likely to continue in 2025 with potential interest rate reductions further incentivizing inorganic growth. The rise of “Group” structures and cross-border deals could also unlock further growth avenues.

The Goldman Sachs Business Model: A Four-Pronged Approach

GS operates across four core segments:

Investment Banking: Advisory, underwriting, and financing activities. The bedrock of GS’s reputation.

Global Markets: FICC intermediation and financing, along with investing activities.

Asset Management: Wealth preservation and growth services through diverse investment strategies.

Consumer & Wealth Management: Consumer platforms and transaction banking.

The Goldman Sachs Edge

GS’s dominance in investment banking is undeniable. Its reputation for top talent, elite clientele, and political connections fuels its profitability and market influence. The firm’s unique approach of combining traditional investment banking services with principal investments provides an additional revenue stream and strengthens its balance sheet.

Competitive Landscape

GS faces stiff competition from other financial giants like Bank of America, JPMorgan Chase, Morgan Stanley, and Citigroup. While market capitalization isn’t a perfect comparison metric, GS’s slightly higher PE ratio suggests market optimism regarding future profitability. Excluding Citigroup, GS’s PB ratio indicates it may be trading below its intrinsic value.

Competitor analysis

Stock Price [$]

Mkt Cap [$Billion]

PE

PB

The Goldman Sachs Group Inc (GS)

655.90

205.89

16.2

3.71

Bank of America Corporation (BAC)

47.40

360.75

14.8

3.59

JPMorgan Chase & Co (JPM)

275.80

766.47

14.0

4.33

Morgan Stanley

139.98

224.95

17.6

4.13

Citigroup Inc

81.72

154.55

13.7

1.91

Average

15.3

3.53

GS’s stock price growth compares well to that of the other main players in the industry.

Strategic Vision & Leadership

Under CEO David Solomon, GS is focused on enhancing its market position and driving sustainable growth. Key strategic initiatives include strengthening market presence, diversifying services, and achieving ambitious financial targets.

Financial Health

GS boasts healthy profits and returns, with expectations of continued success. While a high debt-to-equity ratio presents challenges, the firm is actively pursuing strategies to improve margins and build a sustainable future.

Valuation

The valuation models suggest significant upside potential for GS stock, particularly in a high-growth scenario.

Growth

LT-growth

WACC

Fair value

Vs current

High

17.5%

2.9%

10.9%

$ 809.32

24%

Medium

14.2%

2.9%

10.9%

$ 732.99

13%

Low

10.9%

2.9%

10.9%

$ 662.68

2%

Average

$ 734.99

13%

Book value

$ 336.77

93%

Current

$ 650.53

Risks & Challenges

GS faces inherent risks, including regulatory scrutiny, market dependency, high operational costs, and the constant pressure to maintain high margins.

The Verdict: Bullish with Cautions

Goldman Sachs is well-positioned for continued growth in 2025. The confluence of favorable market trends, strategic initiatives, and GS’s inherent strengths makes a compelling bullish case. However, investors should be mindful of the inherent risks and potential volatility associated with the financial sector. GS is not just a market performer; it’s a market shaper. Its influence and adaptability make it a compelling investment opportunity, but one that requires careful consideration.

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.

and include conclusion section that’s entertaining to read. do not include the title. Add a hyperlink to this website http://defi-daily.com and label it “DeFi Daily News” for more trending news articles like this

Source link