rewrite this content using a minimum of 1000 words and keep HTML tags

Centralized exchange (CEX) listings have long been seen as a milestone for crypto projects, promising increased exposure, liquidity, and price surges. However, the reality often follows a predictable pattern: a sharp initial pump, followed by a more dramatic dump. CryptoNinjas, in collaboration with Storible, analysed top 6 major CEXs (Binance, Bybit, Upbit,..), to uncover the actual impact of CEX listings on token prices, revealing just how fleeting the benefits can be.

Key Findings

98% of Binance listed tokens are dumped.

Binance listing has the most positive impacts on price, pumping tokens by 87%.

On average, CEX listing pumps tokens by 54%.

On average, 89% CEX listed tokens are dumped.

Methodology

We began by gathering all tokens listed in 2024 from six major CEXs: Binance, Bybit, OKX, Coinbase, Bithumb, and Upbit, totalling 389 tokens. We then collected the price at listing, current price (at Feb 4th, 2025), and ATH price of collected tokens.

The data was gathered between Feb 2nd and Feb 4th, 2025.

The Initial Surge: CEX Listings Pump Tokens by 54%

Listing on a major exchange often triggers a buying frenzy. On average, newly listed tokens experience a 54% price surge upon listing. This phenomenon is largely driven by FOMO (fear of missing out) and deep liquidity, as traders rush to buy the token before it skyrockets further.

The ATH Effect: 37% of Tokens Reach Peak Prices at Listing

A staggering 37% of newly listed tokens hit their all-time high (ATH) at the time of listing, never reaching such valuations again. This highlights how CEX listings are often the peak of a token’s market performance, driven by speculation rather than long-term fundamentals.

The Harsh Reality: Dumping Follows Quickly

While the initial surge creates excitement, the sell-off that follows is almost inevitable. Our findings reveal that 89% of listed tokens experience a significant price drop post-listing, with an average decline of 52% from their peak at CEX listing.

The Lifecycle of a CEX-Listed Token

Pump: Token price spikes 54% on average at listing.

ATH: 37% of tokens reach their peak price at listing.

Dump: 89% of tokens decline sharply post-listing.

Price drop: Tokens lose an average of 52% of their value after the listing hype fades.

This pattern suggests that many traders view CEX listings as exit opportunities rather than long-term investments.

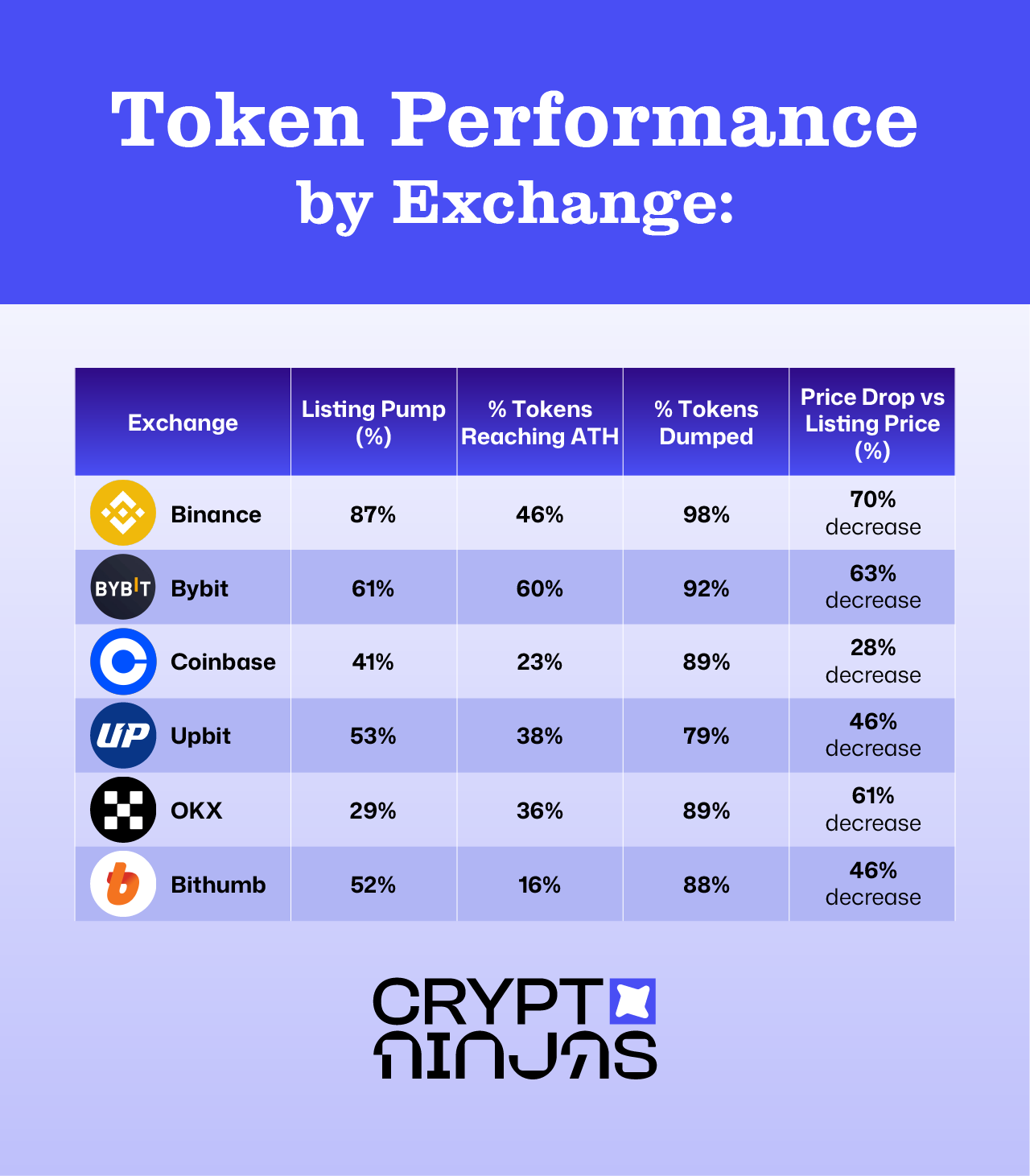

Exchange Comparisons: Which CEX Pumps and Dumps the Most?

Different exchanges have varying impacts on token performance. Our research compares six major exchanges—Binance, Coinbase, Upbit, OKX, Bithumb, and Bybit—to assess their influence on token prices.

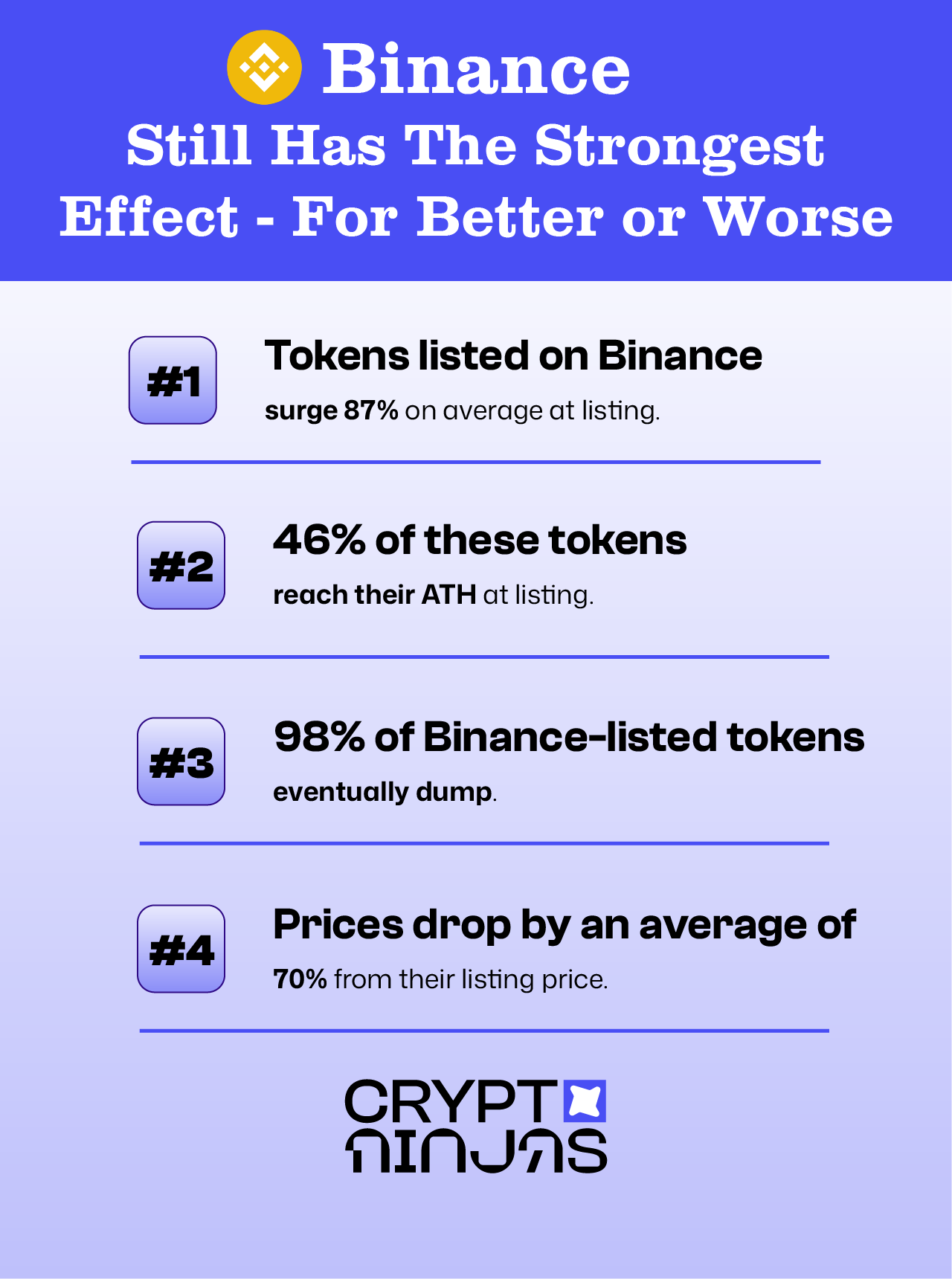

Binance Still Has the Strongest Effect—For Better or Worse

Binance remains the most influential CEX for token listings, delivering the strongest initial pump but also the most severe dumps:

Tokens listed on Binance surge 87% on average at listing.

46% of these tokens reach their ATH at listing.

However, 98% of Binance-listed tokens eventually dump.

Prices drop by an average of 70% from their listing price.

While a Binance listing can generate massive short-term gains, the aftermath is often brutal for late buyers.

Bybit: The Second Strongest Listing Effect

Bybit emerges as the second most impactful exchange, with notable price movements:

Tokens listed on Bybit pump 61% on average.

Bybit boasts the highest percentage of tokens reaching ATHs at listing (60%).

92% of these tokens experience a post-listing dump.

Prices fall by 63% on average.

Bybit listings attract high speculation, but the sustainability of these price gains remains questionable.

Coinbase: The Weakest Pump and the Least Severe Dump

Unlike Binance or Bybit, Coinbase listings have a weaker initial pump but also a less drastic decline:

Tokens listed on Coinbase rise 41% on average at listing.

Only 23% reach ATH at listing—the lowest among all exchanges.

89% of tokens still experience a post-listing decline, but the drop is milder (28% decrease).

Coinbase-listed tokens tend to have less extreme price movements, possibly due to a more conservative investor base.

Conclusion: CEX Listings Are a Double-Edged Sword

CEX listings remain a crucial moment for crypto projects, offering immediate liquidity and exposure. However, our data proves that the price action follows a predictable pump-and-dump cycle, making it a risky bet for investors.

For traders, the lesson is clear: CEX listings are often the peak of a token’s price performance, and buying into the hype can lead to significant losses. Understanding the market dynamics behind these listings is crucial to avoiding the pitfalls of speculative trading.

and include conclusion section that’s entertaining to read. do not include the title. Add a hyperlink to this website [http://defi-daily.com] and label it “DeFi Daily News” for more trending news articles like this

Source link