rewrite this content using a minimum of 1200 words and keep HTML tags

Bitcoin’s price dropped sharply below $95,000 on Jan. 8, erasing gains made earlier in the week when it briefly surpassed $100,000.

Data from CryptoQuant reveals that short-term holders (STHs)—investors holding Bitcoin for less than 155 days—were key players in this sell-off. Over 26,000 BTC valued at more than $2.4 billion were moved to exchanges at a loss.

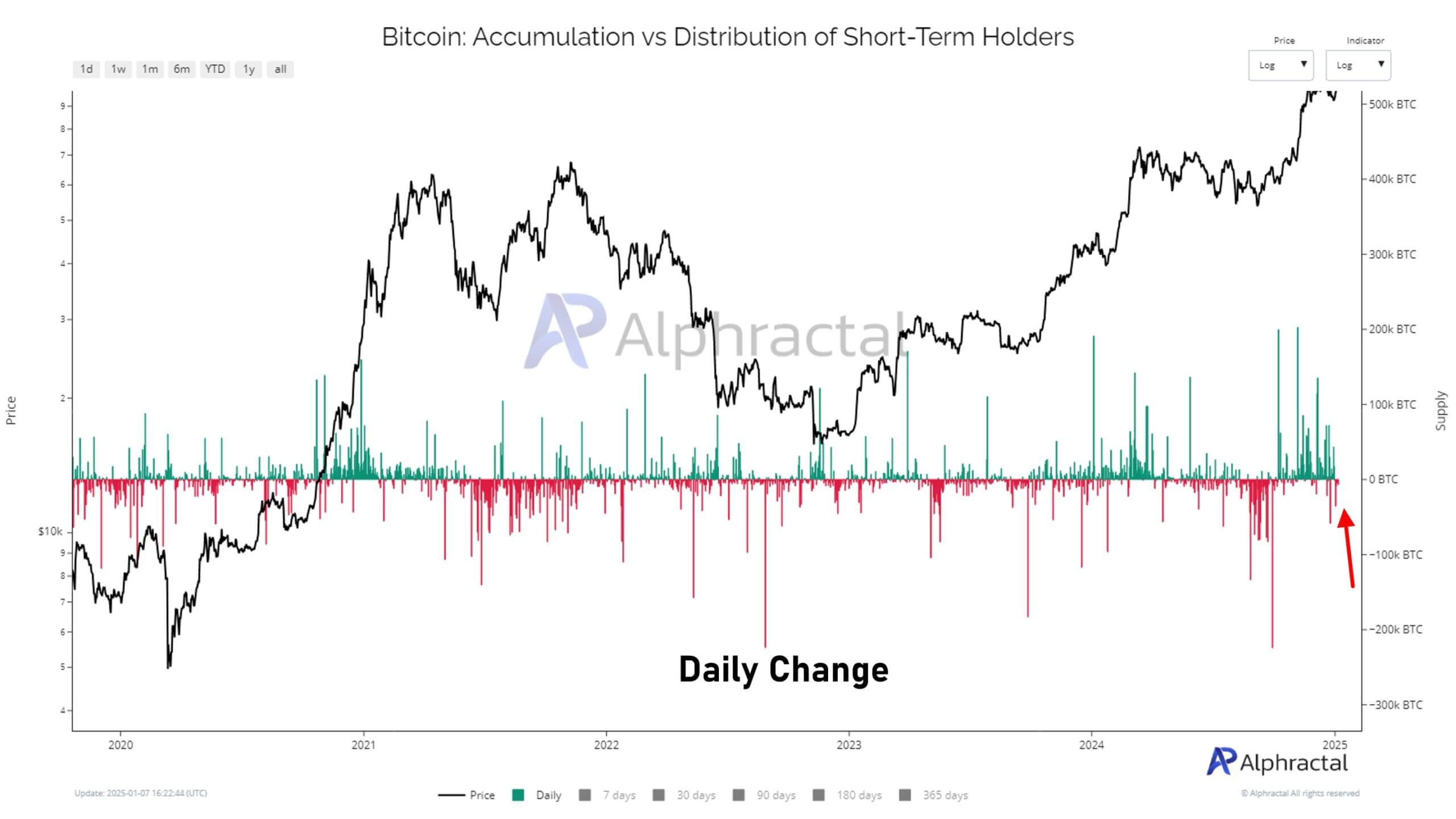

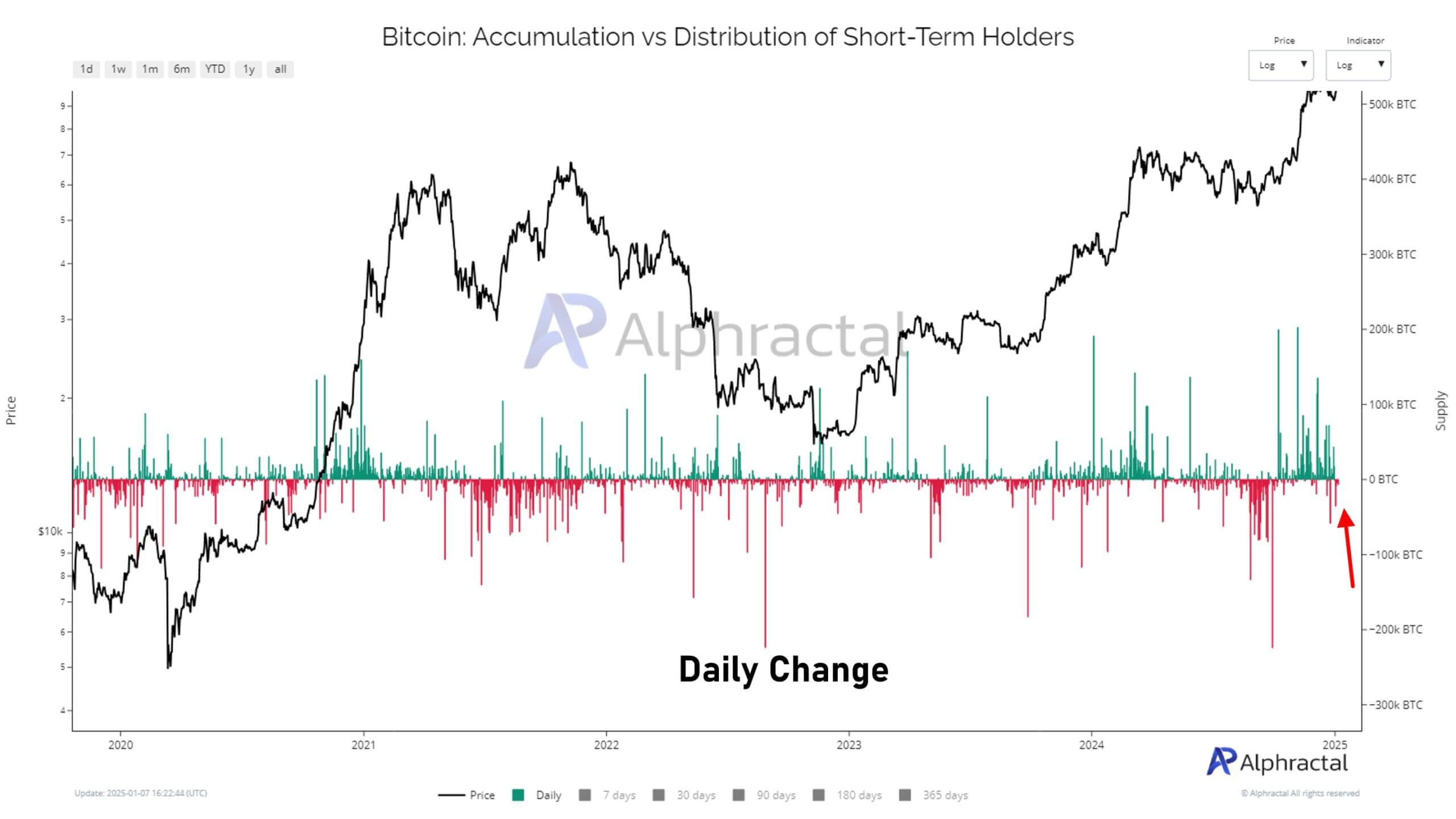

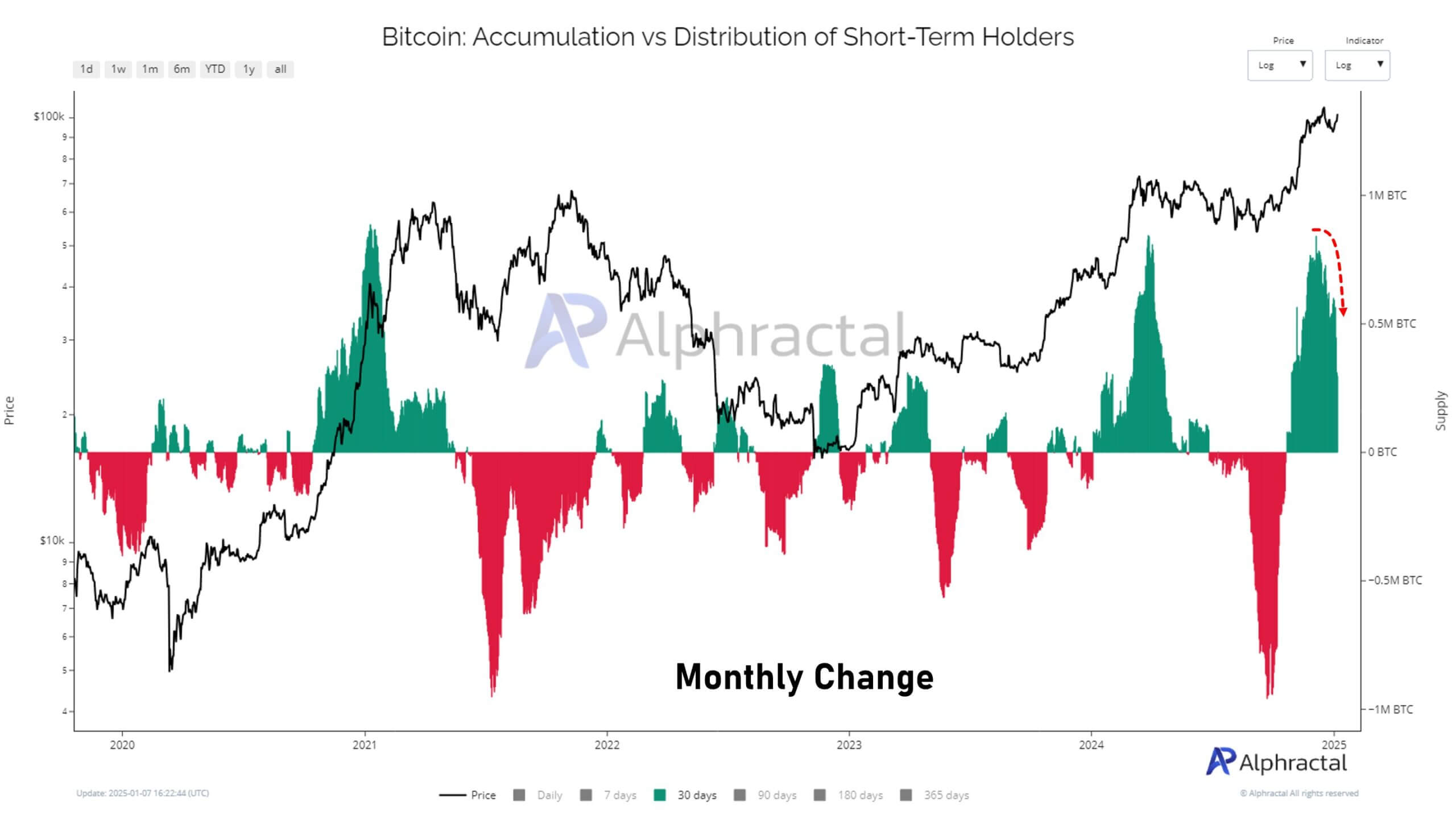

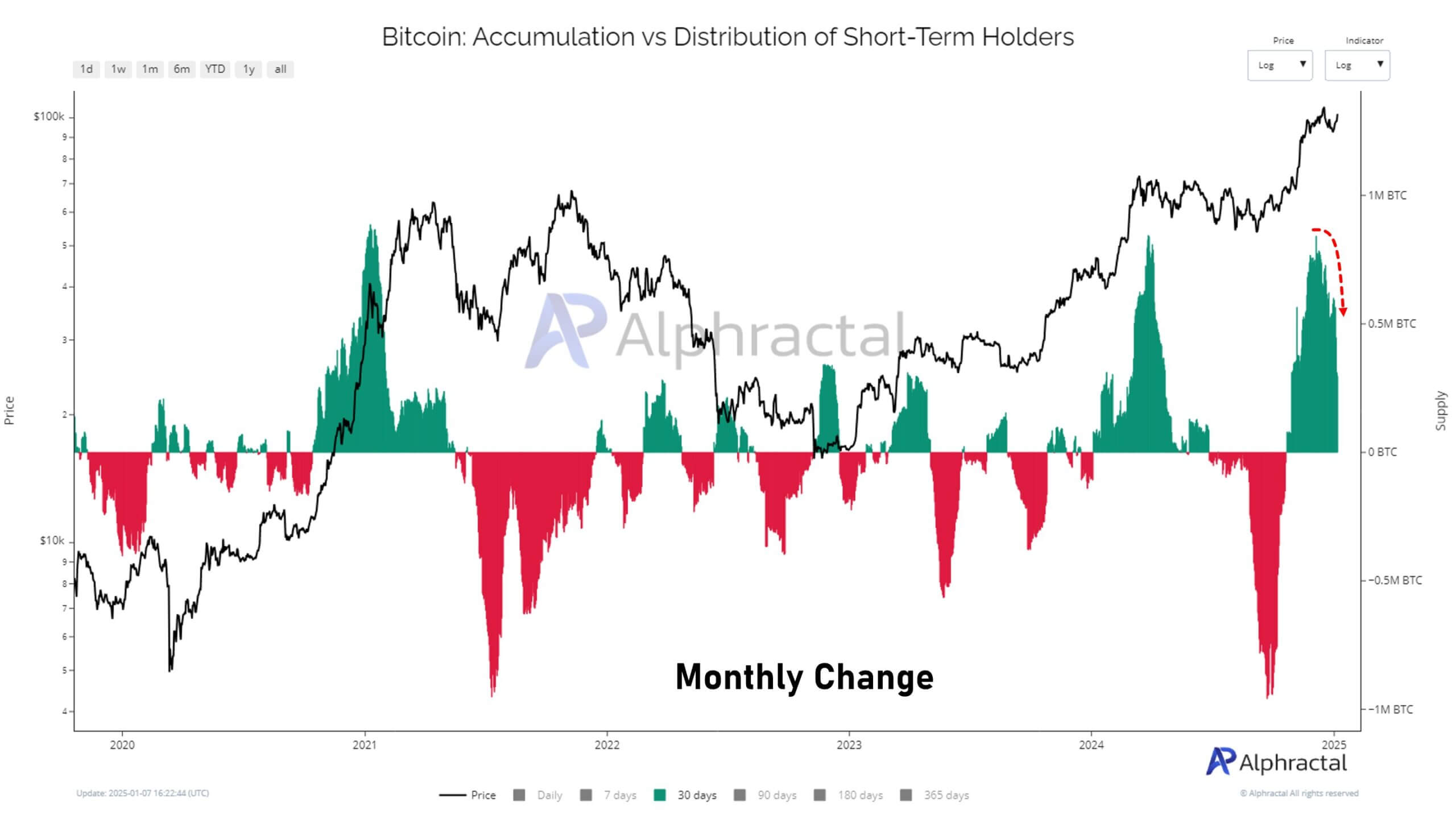

Meanwhile, further analysis from Alphractal showed that this wave of selling pressure coincides with a broader decline in accumulation trends among this cohort of investors.

According to the firm, the “Accumulation vs. Distribution of STH” metric shows that STHs have a growing preference for liquidating rather than accumulating their BTC holdings.

Additionally, STH accumulation has steadily declined since Dec. 5. This weakening demand from these investors aligns with Bitcoin’s recent price volatile movements, demonstrating how their actions can significantly influence market trends.

and include conclusion section that’s entertaining to read. do not include the title. Add a hyperlink to this website http://defi-daily.com and label it “DeFi Daily News” for more trending news articles like this

Source link