EyeEm Mobile GmbH/iStock via Getty Images

It’s been a little under a year since I last covered Rumble (NASDAQ:RUM) for Seeking Alpha. In three articles between November 2022 and September 2023, I’ve rated the stock a “hold” every single time. My hesitation over these last 2 years has generally stemmed from the company’s overvaluation and the uphill battle Rumble’s flagship platform has against the current UGC-streaming media giant that is Google-owned (GOOG) YouTube. Last September, I pointed out Rumble’s glaring Achilles heel; dependency on advertising revenue:

Through the first half of 2022, a little over 56% of Rumble’s total revenue came from advertising. At the end of June 2023, that figure has spiked to over 81%. This could be a tough line for Rumble to walk without a dramatic shift in how the consumer is willing to support the company and its creators.

The ad-based model in streaming is certainly not a problem on its own. However, when the major selling point of your platform is the ability of users to say almost anything they want, there is more perceived risk in brand/marketing professionals running campaigns in that kind of content environment. We’ve seen this clearly manifest in the company’s recent litigation against the World Federation of Advertisers and WPP plc (WPP).

Today, Rumble has to navigate litigation, competition, and a quickly depleting cash pile.

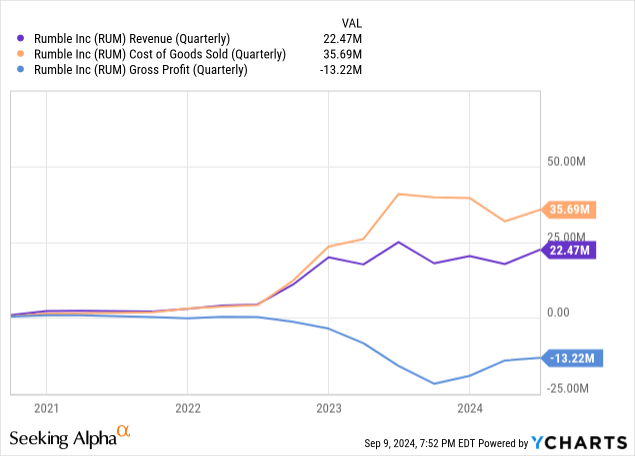

Q2-24 Performance

In the quarter ended June, Rumble reported $22.5 million in revenue. While this was up 27% sequentially, the figure represents a 10% year-over-year decline against $25 million in Q2-23 revenue. This marks the first year-over-year decline in quarterly revenue for Rumble, and it is, frankly, not a great sign for a company that is still very much valued as though its growth stage at 13x sales.

Cost of revenue, while down year over year, did move higher sequentially with $35.7 million in quarterly COGS. Gross profit of -$13.2 million in Q2-24 was actually an improvement over previous quarters. Still, operating expenses continue to rise with SG&A coming in at $16.7 million, a 29.4% year-over-year increase. All told, the business lost 13 cents per share in Q2-24, which was a modest improvement over the prior year.

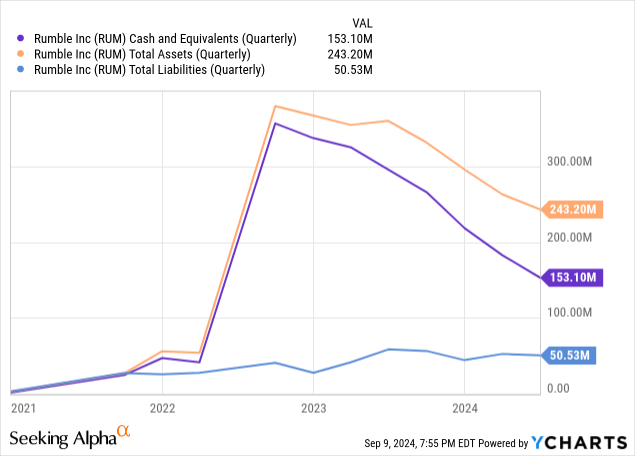

Shifting gears to the balance sheet, what was once a large hoard of cash has been steadily declining quarter after quarter. At the end of June, Rumble had $153 million in cash and equivalents remaining. Rumble still has very little in the way of liabilities, at just $50.5 million against $243.2 million in total assets. But the larger point is it took 7 quarters for the company to rip through over $200 million in capital, and platform growth simply hasn’t lived up to what I’d imagine shareholders have been hoping for.

10-Q (Rumble)

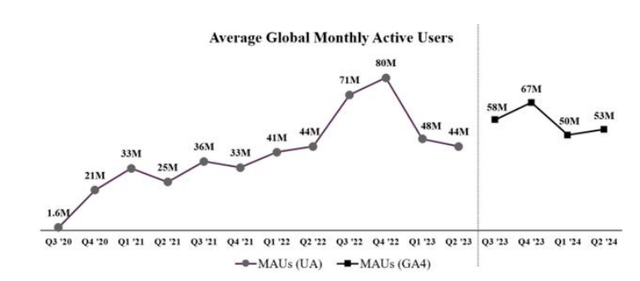

The chart above shows Rumble’s estimated average monthly user figures over the last four years. It should be noted that there was a methodology change in Google Analytics that might make comparing the data from the last four quarters to previous quarters slightly dubious. Per page 25 of Rumble’s 10-Q:

Because Google has publicly stated that metrics in UA “may be more or less similar” to metrics in GA4, and that “[i]t is not unusual for there to be apparent discrepancies” between the two systems, 3 we are unable to determine whether the transition from UA to GA4 has had a positive or negative effect, or the magnitude of such effect, if any, on our reported MAUs. It is therefore possible that MAUs that we reported based on the UA methodology (“MAUs (UA)”) for periods prior to July 1, 2023, cannot be meaningfully compared to MAUs based on the GA4 methodology (“MAUs (GA4)”) in subsequent periods.

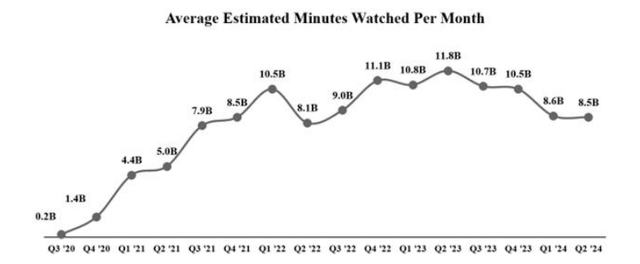

While there is no guarantee the methodology change had an impact on MAUs either for or against Rumble, the trend in average estimated minutes watched has been down:

10-Q (Rumble)

Rumble posted 8.5 billion monthly minutes watched in Q2-14. That was down 28% year over year and the fourth consecutive decline in estimated monthly minutes watched. The good news for Rumble is we’re well into yet another Trump-era general election cycle in the United States.

The overwhelming majority of Rumble’s revenue comes from the US segment and as an alternative platform, Rumble gets a viewership boost during times of political polarization in America. That said, I question whether a streaming insurgent can live and die by election cycles and I suspect even if we see a meaningful move higher in both MAUs and Average Minutes Watched in the next two quarters, it may not be enough longer term. Especially given the possible rise of X as a video streaming platform, combatant to YouTube.

Key Risk: X Is Friend And Foe

In the introduction to the article, I mentioned Rumble’s litigation against the World Federation of Advertisers. What I have not yet mentioned is Rumble is actually joining X (formerly Twitter) in filing antitrust suits that allege a conspiracy from advertisers to withhold revenue from digital media platforms like X and Rumble. What aligns each of these platforms conceptually is a self-proclaimed commitment to more speech freedom than incumbent social media companies.

However, that aligned vision may also foretell a future where X and Rumble may not be able to ultimately co-exist as ‘free speech’ alternative platforms without fracturing the market for such creators.

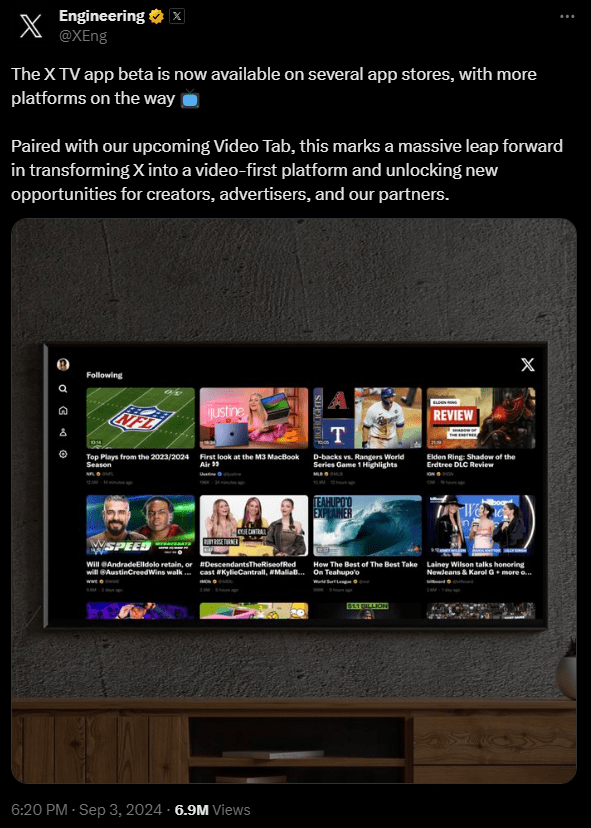

X TV App (X)

X is now entering the video streaming space as well. And given the drastically larger starting position for X from a user base comparison (600 million monthly as of May 2024), I think it’s going to continue to be an uphill climb for Rumble in the battle for eyeballs against both YouTube and now X as well.

July 2024 Worldwide Rank Full Month Visits Bounce Rate

YouTube 2 72.97 billion 34.5%

X.com 9 4.42 billion 49.7%

Rumble 593 94.57 million 54.9%

Click to enlarge

Source: Semrush

From a simple web traffic standpoint, X was the third-largest social media platform by total visits in August, according to data from Similarweb. Comparing the websites by rank and bounce rate shows just how far behind Rumble still is with less than 95 million site visits in July compared with multi-billion site visits for the more mature social platforms X and YouTube. As I see it, X’s desire to be a video-first platform is a significant risk to Rumble going forward due to the similarities that the sites now share in terms of content moderation strategy.

Investor Takeaways

My own personal view on this is that competition is good, and speech freedom is better than censorship. Having been a user of both YouTube and Twitter since the early days of social media, I can empathize with what I’ve felt have been poor content moderation policies in recent years. Thus, I find myself rooting for both Rumble and X personally, despite not having monetary skin in the game. X is no longer a public company, so it’s a bit more difficult to gauge how that fundamental business is doing since Elon Musk took over ownership.

What is far more clear is the financial situation that Rumble is currently in. The latter is a company that is burning quite a bit of cash each quarter and is battling not only YouTube, but even X as well from both UGC creative and viewer attention standpoints. Creators have generally flocked to YouTube without much coercing because of the vast reach of the platform. As the insurgent, Rumble has been relegated to seducing high-profile creators to come on the platform through monetary incentive. X is now entering the video streaming app space. The two companies may be aligned on fighting the ad industry, but however those chips end up falling, Rumble and X as platforms are likely to be battling each other for the same revenue. Given that and Rumble’s recent financial performance, I don’t know that an investment bet on Rumble is a long-term winner at this point.

Conclusion

In conclusion, Rumble faces significant challenges in the competitive streaming media landscape, particularly with the dominance of platforms like YouTube and the emergence of X as a formidable competitor. The company’s reliance on advertising revenue and its struggle to generate sustainable growth are key concerns for investors. Additionally, legal battles and a dwindling cash reserve further complicate Rumble’s path forward.

As the market continues to evolve and new players enter the video streaming space, Rumble will need to adapt and innovate to stay relevant. The ongoing litigation and competition from other platforms highlight the precarious position Rumble currently finds itself in.

While the commitment to free speech and competition in the industry is commendable, it remains to be seen whether Rumble can overcome these obstacles and emerge as a long-term success. Investors should carefully assess the risks and challenges faced by Rumble before making any investment decisions in the company.

For more trending news articles like this, visit DeFi Daily News.

:max_bytes(150000):strip_icc()/Health-GettyImages-2230781421-bc1a65c8a3af4701a8b1b9e3658e9fab.jpg?w=120&resize=120,86&ssl=1)