Once heralded as the beacon of deflationary currency, Ethereum (ETH) has recently been scrutinized under a lens that questions its steadfast claim to being “ultra-sound money.” This skepticism arises amidst emerging challenges that have caught the attention of crypto enthusiasts and analysts alike. Among those sharing insights is Thor Hartvigsen, a name closely followed in the crypto community for his in-depth analyses and perspectives.

In an enlightening exposition on X, Hartvigsen delved into the intricate dynamics of Ethereum’s fee generation and its broader supply implications. What has emerged from his analysis paints a somewhat concerning picture for Ethereum and its advocates.

Reevaluating Ethereum’s Ultra-Sound Money Status

Highlighting a stark observation, Hartvigsen notes that Ethereum is on a trajectory to witness its lowest fee generation since the early days of 2020. This decline is linked to the introduction of blobs in March, a move that enabled Layer 2 (L2) solutions to circumvent the hefty fees usually payable to the Ethereum network, consequently impacting ETH holders.

The fallout from this is an observable shift in activity from the Ethereum mainnet to these L2 platforms, where most of the transactional value now resides. This shift underscores a significant reduction in the fees funneling into Ethereum, raising the annual inflation rate of the network to approximately 0.7%, a figure that overshadows the ETH being burned.

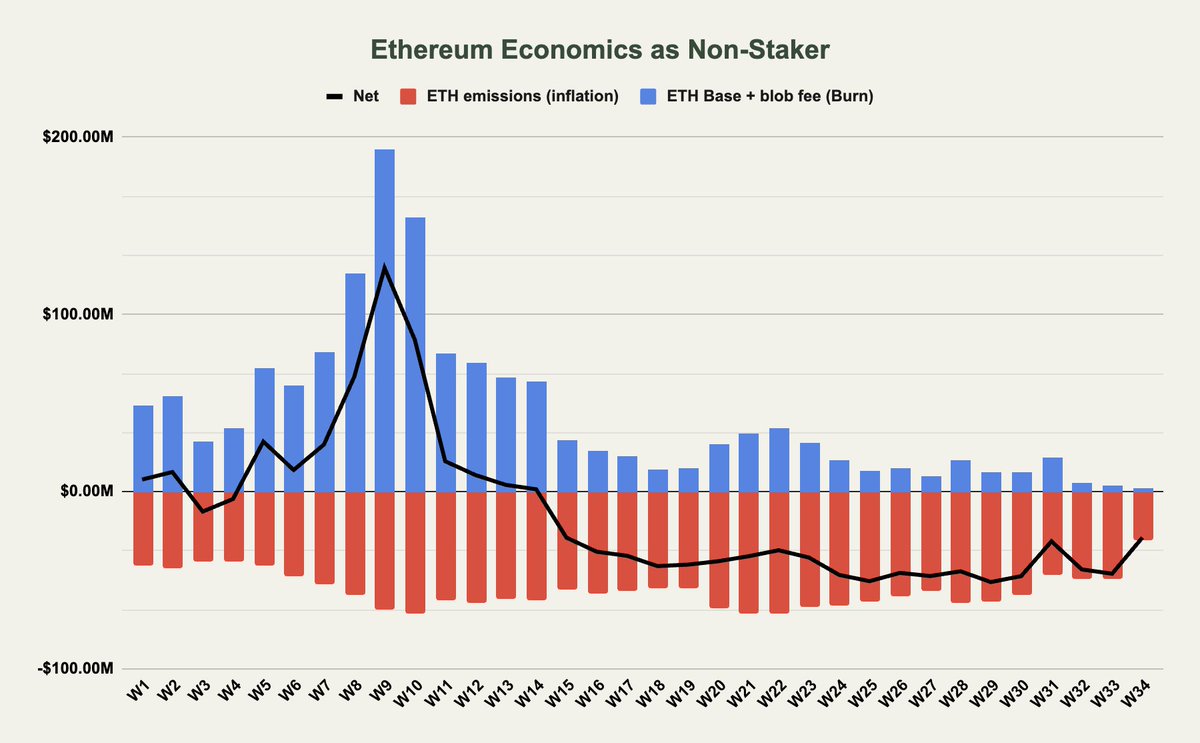

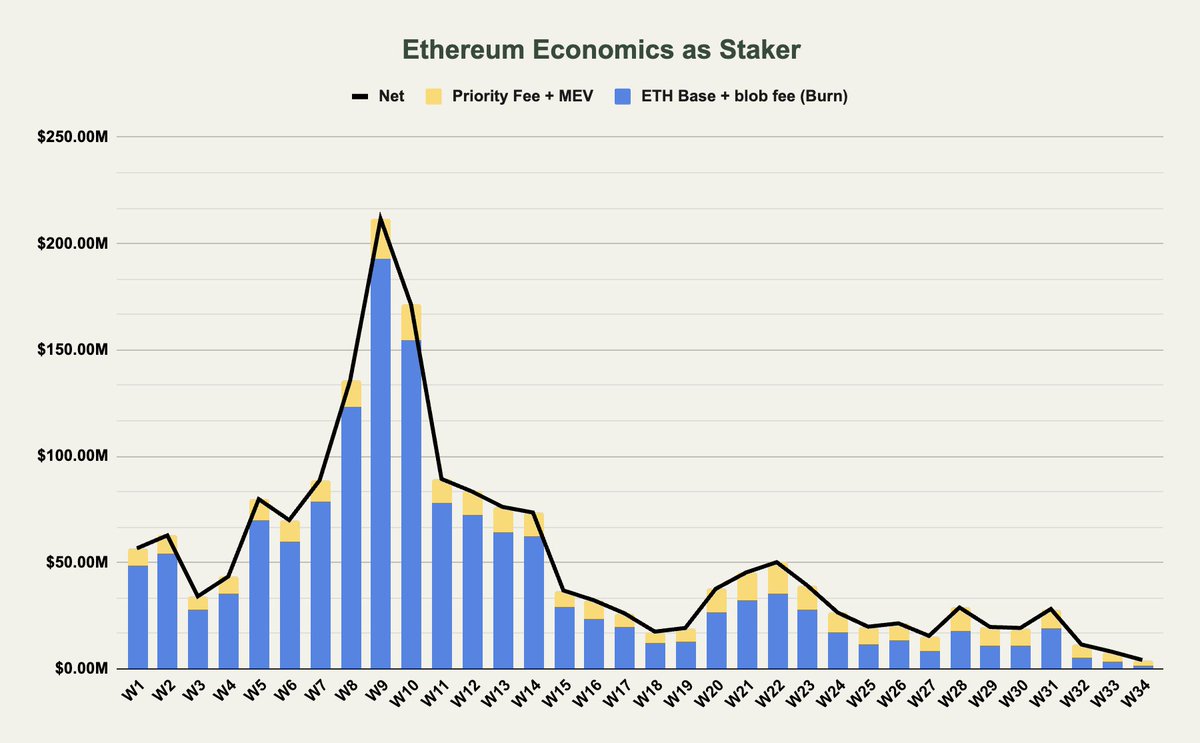

Hartvigsen meticulously discusses the repercussions for non-stakers and stakers within the Ethereum ecosystem. He illustrates a scenario where non-stakers, who historically reaped benefits from the burning of base and blob fees—thus reducing ETH supply—are now at a disadvantage. With decreased fee generation and blobs often incurring zero costs, the anticipated reduction in ETH supply isn’t materializing as expected. Concurrently, the benefits accruing to validators and stakers from priority fees and Miner Extractable Value (MEV), which are not subject to burning, are not trickling down to non-stakers.

Accounting for the inflationary effect brought about by ETH emissions to validators/stakers, non-stakers find themselves on the losing end, a stark contrast to the scenario prior to blobs’ introduction. Stakers, by contrast, seem to stand in neutral territory regarding net impacts, thanks to fees and staking yields offsetting ETH emissions. However, the substantial decline in fees being allocated to stakers, plummeting over 90% since earlier this year, leaves much to ponder about the sustainability of staking yields.

In a striking pivot from previous assertions, Hartvigsen suggests,

“Ethereum no longer carries the ultra sound money narrative which is probably for the better.”

Envisioning Ethereum’s Path Forward

This reevaluation of Ethereum’s narrative as ultra-sound money opens a gateway to introspection on its future direction. The juxtaposition of decreasing fees and a slight inflationary edge over the burn rate places Ethereum in a league similar to other Layer 1 (L1) networks like Solana and Avalanche that grapple with inflationary pressures. Hartvigsen points out that even though Ethereum’s inflation rate is relatively lower in comparison, the diminishing profitability of infrastructure layers necessitates a reimagined approach to uphold its value proposition.

Hartvigsen proposes the recalibration of fees paid by L2 solutions to Ethereum as a viable avenue, albeit with potential competitive ramifications. He encapsulates his analysis with a broader perspective:

“Zooming out, infra-layers are in general unprofitable (study Celestia generating ~$100 in daily revenue), especially if viewing inflation as a cost. Ethereum is no longer an outlier with a net deflationary supply and, like other infra-layers, require another way to be valued.”

Featured image created with DALL-E, Chart from TradingView

A Rollicking Future Awaits

In the vast, unpredictable seas of cryptocurrency, Ethereum’s journey is akin to that of a seasoned ship weathering both calm and tumultuous waters. As we stand on the precipice of change, it’s clear that the narrative around Ethereum’s status as ultra-sound money is undergoing an evolution. This shift might not signify turmoil but rather a maturation, a stepping stone towards a more resilient and diversified digital economy.

As the plot thickens and the community eagerly anticipates Ethereum’s next move, one thing is abundantly clear: change is inevitable, and with change comes opportunity. The quest for a sustainable and profitable model continues in earnest, with all eyes set on innovations that could redefine the essence of digital money.

For the enthusiasts, the skeptics, and everyone in between, the unfolding story of Ethereum is not just a tale of ups and downs but a fascinating chapter in the odyssey of decentralized finance. For more intriguing narratives and trending news articles like this, visit DeFi Daily News.

![Which ALTCOINS Can Break Into Crypto’s Top 10 This Cycle? [Where Will Cardano Land?] Which ALTCOINS Can Break Into Crypto’s Top 10 This Cycle? [Where Will Cardano Land?]](https://wp.fifu.app/defi-daily.com/aHR0cHM6Ly9pLnl0aW1nLmNvbS92aS90SEtFNEFMSFNHay9tYXhyZXNkZWZhdWx0LmpwZw/7be578537bad/which-altcoins-can-break-into-cryptos-top-10-this-cycle-where-will-cardano-land.webp?w=75&h=75&c=1&p=14051)