rewrite this content using a minimum of 1000 words and keep HTML tags

Is Rocket Money Worth It? (Quick Answer)

The honest answer in 2025: it depends on your financial habits and willingness to DIY.

Rocket Money can absolutely be worth the monthly fee if you fall into a specific category of users. If you have multiple streaming services, gym memberships, or app subscriptions you’ve forgotten about, the rocket money app can pay for itself quickly by surfacing those recurring charges. If you genuinely won’t pick up the phone to negotiate your internet or cell phone bill, paying someone to do it makes sense. And if you’ve been searching for a Mint replacement since its shutdown in March 2024, Rocket Money offers a similar all-in-one dashboard experience.

However, Rocket Money probably isn’t worth paying for if you’re already disciplined about reviewing your bank statements, comfortable calling customer service to negotiate existing bills, or if you prefer strict zero-based budgeting with granular control over every dollar. The current rocket money cost ranges from $6 to $12 per month for premium, and many of the most useful features—like concierge subscription cancellation, unlimited budgets, and advanced alerts—sit behind that paywall.

At a Glance:

Worth it if: You have forgotten subscriptions, hate negotiating bills, want an easy post-Mint dashboard

Skip it if: You already track everything, prefer DIY approaches, or want strict budgeting tools

Premium cost: $6–$12/month (sliding scale) with 7-day free trial

Key trade-off: Convenience comes at a price, and bill negotiation fees can be substantial (35–60% of first year’s savings)

What Is Rocket Money (and What Happened to Truebill)?

Rocket Money is a personal finance app that consolidates your subscriptions, bills, budgets, savings goals, credit monitoring, and net worth tracking into a single dashboard. It’s owned by Rocket Companies—the same parent company behind Rocket Mortgage, Rocket Loans, and Rocket Homes.

Here’s the quick brand history:

2015: Truebill launches as a subscription-focused tool helping users identify and cancel unwanted subscriptions

Late 2021: Rocket Companies acquires Truebill

August 2022: Full rebrand to Rocket Money, expanding beyond subscriptions into comprehensive budgeting

2024–2025: Positioned as an all-in-one money dashboard and popular Mint alternative

All former Truebill users were migrated to the new platform, and the subscription-cancellation feature that made the original app popular remains a flagship tool. The key difference now is that Rocket Money aims to be your complete financial life command center rather than just a subscription tracker.

How Does Rocket Money Work?

Getting started with Rocket Money takes under 10 minutes for most users. Here’s what the sign-up flow looks like in 2025:

Download the app from the Apple App Store or Google Play (or access via web browser)

Create an account with your email

Link your bank accounts, credit cards, loans, and investment accounts through Plaid

Wait for the app to auto-import your past transactions (typically the last 90 days or more)

Once your accounts are connected, you’ll see a home dashboard displaying your current balances, recent transactions, and upcoming bills. From there, you can navigate to separate tabs for budgets, subscriptions, savings goals, credit monitoring, and net worth tracking.

Most U.S. banks and major credit cards work seamlessly through Plaid, though some smaller credit unions may occasionally experience sync delays or require re-authentication. This isn’t unique to Rocket Money—it’s a common quirk across all Plaid-based budgeting apps.

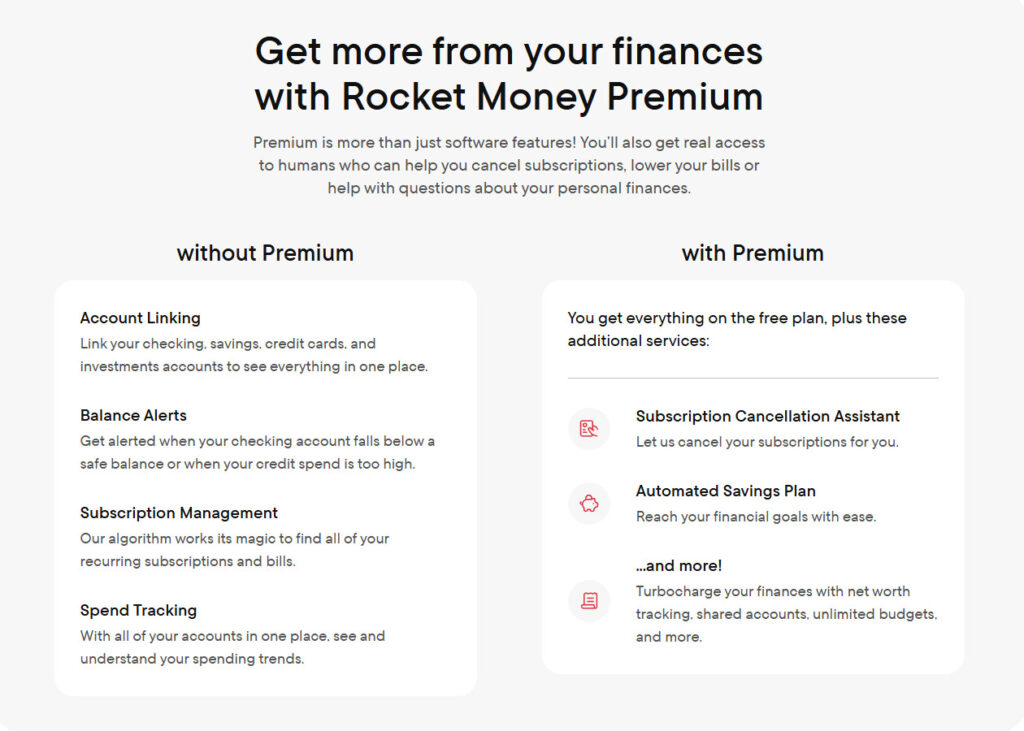

The important distinction: the free version gives you aggregated views and basic spending insights, but most of the “hands-off help” like concierge subscription cancellation, advanced budgets, and premium support requires a paid subscription.

To learn more about how Rocket Money works, check out our Rocket Money review.

Core Features: What You Actually Get

This section breaks down each major Rocket Money feature and whether it meaningfully adds value beyond what you can do yourself. The goal is to help you determine if rocket money’s features justify the monthly fee for your specific situation.

Subscription Management

Rocket Money automatically monitors your linked accounts to identify recurring charges—streaming services, software subscriptions, gym memberships, app purchases, and more—and groups them on a dedicated subscriptions screen.

What it catches:

Free trials about to convert into paid plans

Price increases on services you forgot you had

Duplicate subscriptions (like multiple music services)

Unwanted subscriptions you’re paying for but never use

Free vs. premium:

Free users can view their subscription list and manually cancel subscriptions themselves

Premium users may access a concierge service that can cancel subscriptions on their behalf

Limitations to understand:

Some “hard-to-cancel” services (certain gyms requiring in-person visits or certified mail) may still require you to take action

Concierge processing can sometimes be slower than just doing it yourself

Not every subscription can be cancelled through the service

When this is worth it: If Rocket Money helps you cancel subscriptions and save money—say, $20 to $50 per month in forgotten charges—the premium subscription pays for itself quickly. If you already track your spending habits carefully and review statements monthly, this feature adds less value.

Use Rocket Money to find and cancel forgotten subscriptions you didn’t even know you were paying for.

Bill Negotiation

The bill negotiation service works by contacting your service providers (internet, cable, mobile, sometimes utilities) to negotiate lower rates or promotional pricing on your behalf.

How the fee structure works:

Rocket Money charges 35% to 60% of the first year’s savings

Example: If they negotiate $200 in annual savings, you might pay $70 to $120

Fees are typically charged upfront or in installments

The trade-off reality:

Convenient for people who absolutely won’t call providers themselves

You can often call yourself and keep 100% of the savings

Some negotiated deals may downgrade your service tier or add 1-year promo pricing that expires

Before accepting a negotiation result: Check exactly what was changed on your account. Sometimes “savings” come from service downgrades you didn’t want.

When bill negotiation is worth it:

Beneficial for busy users who genuinely never negotiate bills and have let rates creep up for years

Not ideal for those comfortable making a 15-minute phone call, or anyone on tight cash flow who doesn’t want large one-time fee charges

Budgeting Tools

Rocket Money builds a starter budget by analyzing your financial data:

Averages your recent income from detected paychecks

Auto-categorizes past transactions into spending categories (groceries, rent, dining, transportation, etc.)

Suggests category-level spending limits based on your spending patterns

Free plan limitations:

Basic budgets with standard budget categories

Limited customization options

Premium unlocks:

Create unlimited budgets

Custom categories and transaction rules

Advanced overspending alerts

The categorization reality: Automatic categorization is imperfect. You’ll find restaurant meals labeled as “groceries,” gas stations categorized as “shopping,” or Venmo payments in random categories. Users should routinely review and correct mis-labeled transactions to keep their budget accurate.

You can create manual rules (premium feature) so future transactions from specific merchants always land in the right category—but this requires upfront effort.

Budgeting style comparison: Rocket Money is more “monitor and adjust” than strict zero-based budgeting. If you want to assign every dollar a job before the month starts, tools like YNAB may suit you better. Rocket Money works well for casual budgeters who want visibility into their spending patterns without intense manual tracking.

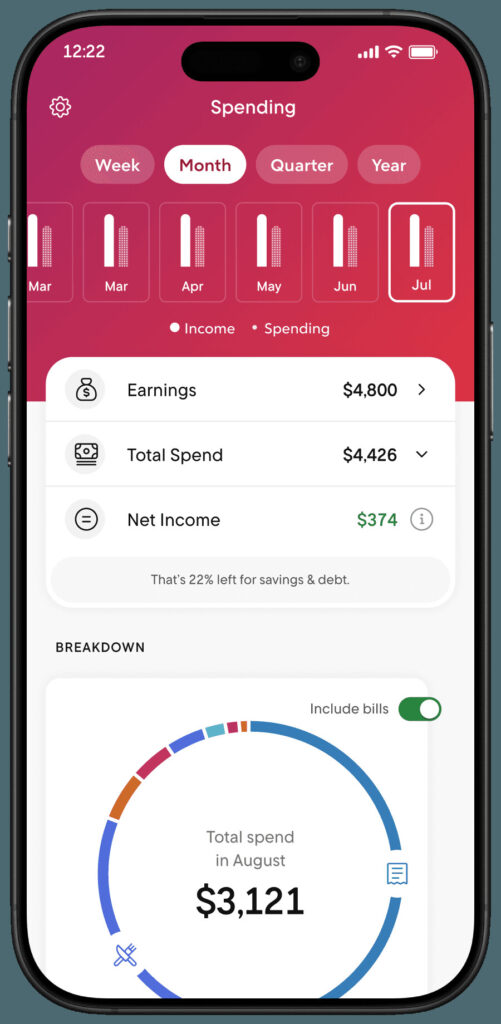

Spending Insights and Alerts

The spending insights dashboard provides visual charts showing:

Total monthly spend vs. previous months

Top spending categories (where most of your money goes)

Top merchants (which stores and services get the most spend)

Income vs. expenses over various time periods (weekly, monthly, quarterly, yearly)

Alerts you can set up:

Large transaction notifications

Upcoming bill reminders

Low balance warnings

Category limit alerts (premium feature)

Practical benefits:

Catch potentially fraudulent activity quickly

Avoid overdrafts with low balance warnings

Identify spending “leaks” like repeated takeout orders or impulse purchases

These tools highlight issues but don’t automatically change your behavior. You still need to act on the information—the app just makes problems visible.

Automatic Savings and Financial Goals

The Financial Goals feature lets you set up automated saving toward specific targets:

Set a target amount (e.g., $1,000 emergency fund, $2,500 vacation)

Choose a deadline and contribution frequency (weekly or monthly)

Rocket Money automates transfers to a linked savings account

Many users connect to Rocket Money’s smart savings account, which may offer competitive APY rates through partner banks.

What you get vs. doing it yourself:

Visual progress bars toward each goal

Consolidated view with your budget and spending insights

Motivation from seeing multiple money goals in one place

You can achieve the same outcome by setting up automatic transfers directly with your bank. Rocket Money’s value here is convenience and visualization, not unique functionality.

Important checks:

Verify which institution holds your savings (should be FDIC-insured, often shown as member FDIC through a partner bank)

Confirm current APY rates, which can change

Understand transfer timing to avoid overdrafts

When automatic savings features are worth it: For users who never get around to setting up recurring transfers, this removes friction. Less valuable if you already automate saving through your checking account or employer.

Credit Score Monitoring

Rocket Money provides your credit score and credit report details (often via Experian data) with:

Historical score trends over time

Factor breakdowns (payment history, credit utilization, account age, etc.)

Alerts for score changes

What this helps with:

Tracking how your financial health evolves

Seeing how credit card balances and new accounts impact your score

Spotting potential errors that may need dispute

The reality check: Similar credit monitoring is available for free from Credit Karma, Experian’s own app, and many bank apps. This feature alone does not justify paying for Rocket Money premium.

One note: The app may surface offers for personal loans, credit cards, or other products from Rocket Companies. Evaluate any such offers separately and cautiously—they’re presented for business reasons, not necessarily because they’re the best option for your personal finances.

Credit score monitoring is a “nice-to-have” within one dashboard, not a core reason to subscribe.

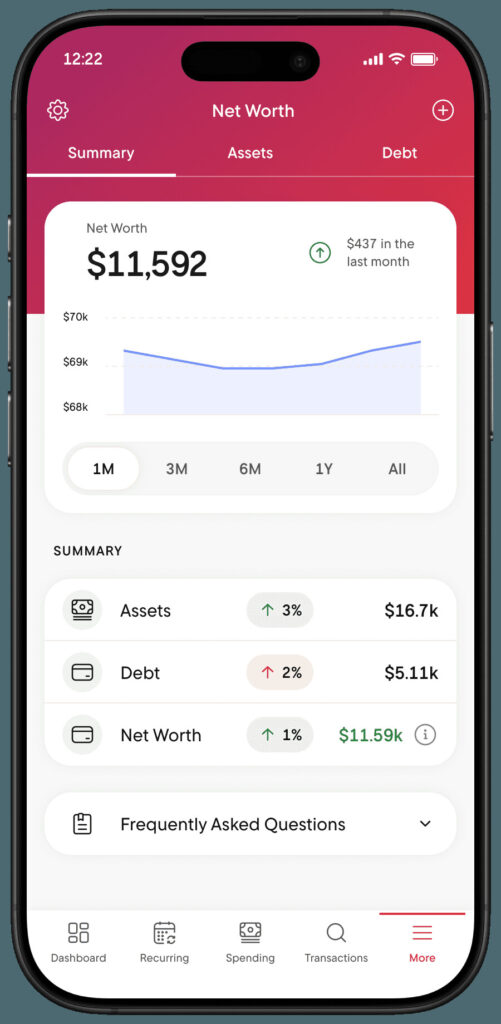

Net Worth Tracker

Net worth tracking combines all your assets and liabilities into a single running graph:

Assets tracked:

Cash in checking and savings accounts

Investment and retirement accounts

Real estate (can be added manually or monitored automatically)

Other assets like vehicles or collectibles (manual entry)

Liabilities tracked:

Credit card balances

Student loans

Auto loans

Mortgages and personal loans

You can track all your assets and all your financial information in one place, watching your net worth trend over months and years.

Benefits:

Simple visual of long-term financial progress

Motivating to see debt fall and investments rise

Consolidated view of your complete financial picture

The DIY alternative: Computing net worth is straightforward in a spreadsheet. Rocket Money’s value is automation and convenience, not unique insight. If you update a simple spreadsheet quarterly anyway, this feature adds less.

Recommendation: Update manual asset values periodically (home values annually, vehicle values when relevant) to keep the picture realistic.

Account Linking and All-in-One View

Rocket Money uses Plaid to connect multiple accounts:

Checking and savings from various banks

Credit cards across issuers

Loans (auto, student, personal, mortgage)

Investment and retirement accounts

The main benefit: A single dashboard instead of logging into multiple bank accounts, brokerage apps, and loan servicers. You see all your finances in one consolidated view.

Setting expectations: Many competitors now offer similar linking capabilities, so this is table stakes for budgeting apps in 2025, not a unique differentiator. Occasional sync delays or re-authorization requirements happen across all Plaid-based apps.

This unified view is often what makes the app feel “worth it” to visual, big-picture budgeters who want to see their complete financial life without jumping between apps.

Check out Rocket Money to discover where your money is really going and start saving automatically.

How Much Does Rocket Money Cost in 2025?

The rocket money app is free to download on iOS, Android, and web. Here’s how the pricing breaks down:

Free Plan Includes:

Basic account linking and balance views

Limited budgets with standard categories

Simple subscription list (view only, no concierge cancellation)

Basic alerts and spending insights

Basic budgeting capabilities

Premium Membership Includes:

Unlimited budgets and custom categories

Advanced notifications and granular spending insights

Subscription cancellation concierge (where available)

Full Financial Goals automation with smart savings features

Complete credit and net worth tracking tools

Priority customer support

Additional features like transaction rules and same features across web and mobile

Premium Pricing:

Sliding scale: $6 to $12 per month (you choose what you pay)

Annual billing options available (starting around $7/month when paid yearly)

7-day free trial before commitment

Important: Set a reminder to cancel before the trial ends if you’re unsure about continuing.

Bill Negotiation Fees (Separate from Monthly Pricing):

35% to 60% of the first year’s savings

Charged upfront or in installments

Can result in substantial one-time charges

Read the bill negotiation agreement carefully before authorizing. Much does rocket money charge? For negotiation, it’s that percentage of savings—which can be significant if they negotiate large reductions.

Is Rocket Money Safe?

A common question: is rocket money safe to use with your banking credentials and financial information?

Security practices:

Uses Plaid for account connections—Rocket Money never sees or stores your actual bank login credentials

Employs bank-level AES-256-bit encryption for data at rest and in transit

Uses secure HTTPS connections with industry-standard security controls

Ongoing security monitoring and updates

Savings account protection:

Rocket Money’s smart savings account is held at partner banks that are FDIC-insured

Protection up to $250,000 per depositor, per institution, per ownership category

Verify the current partner bank name in-app for your records

What users should still do:

Use strong, unique passwords for your Rocket Money account

Enable device-level security (Face ID, fingerprint, PIN)

Know how to remotely wipe your phone if lost or stolen

Be cautious of phishing emails pretending to be from Rocket Money or Plaid

Perspective on complaints: Most negative feedback online involves bill negotiation fees, unexpected charges, or cancellation confusion—not security breaches or hacking. This is an important distinction between “safety” concerns and “satisfaction” issues. The app’s security infrastructure aligns with 2024–2025 industry standards.

Who Is Rocket Money Best For (and Who Should Probably Skip It)?

Rocket Money isn’t one-size-fits-all. It works exceptionally well for certain types of budgeters while adding minimal value for others.

Ideal users:

People transitioning from Mint (shutdown March 2024) who want a familiar, automated dashboard experience

Busy professionals with multiple cards, bank accounts, and subscriptions who rarely review statements

Users who avoid making customer service calls and would rather pay for bill negotiations or concierge cancellations

Beginners who want a simple, visual overview of their personal finances rather than complex spreadsheets

Anyone who wants to see all your finances in one place without logging into multiple apps

Who might not find it worth paying:

Advanced budgeters who love zero-based budgeting and detailed rule systems (YNAB or manual methods may work better)

Frugal users who don’t want to share account data with third-party apps

People disciplined enough to cancel subscriptions and negotiate bills themselves

Users already getting free credit monitoring from their bank or dedicated apps

Anyone who already tracks spending closely through their checking account app

Questions to ask yourself:

Do you routinely discover recurring charges you forgot about?

Have you procrastinated calling your cable, internet, or cell phone company for months or years?

Do you open your banking app daily already, or do statements go unreviewed?

Does the idea of managing money in a spreadsheet appeal to you or stress you out?

Would you benefit from seeing your financial health visualized in one dashboard?

Your answers determine whether the premium version delivers enough value to justify the monthly fee.

Join millions of users who’ve used Rocket Money to reduce bills and cut wasteful spending.

Is Rocket Money Worth It? Final Verdict

For many casual budgeters with subscription clutter, multiple accounts, and no existing system, Rocket Money premium at the lower end of the scale (around $6/month) can quickly pay for itself. The combination of subscription management, consolidated account views, and spending alerts surfaces problems you’d otherwise miss. If the app helps you cancel subscriptions even one or two $10+ subscriptions in your first month, you’ve already covered the cost.

For detail-oriented, DIY-inclined users who already track spending, negotiate their own bills, and maintain their own budgets, the free plan—or entirely different tools—may be a better fit. The premium features solve problems these users don’t have.

Key upsides worth remembering:

Easy consolidated view across all bank accounts, cards, loans, and investments

Strong subscription management that catches forgotten recurring charges

Hands-off convenience for users who won’t manage money manually

Solid security through Plaid integration and encryption

Competitive with other budgeting apps as a best budgeting app contender for visual learners

Key downsides to weigh:

Premium paywall locks the most useful features

Bill negotiation success fees (35–60% of first year’s savings) can be substantial

Auto-categorization still requires user review and correction

Not ideal for strict, zero-based budgeting enthusiasts

Recommended approach:

Try the 7-day free trial

Intentionally test subscription tools, alerts, and budgets for a full month

Track whether you actually save time and money

Decide if the value justifies your specific monthly fee

In the 2025 environment—post-Mint, with more competition among budgeting apps than ever—Rocket Money offers a compelling package for the right user. Whether it’s worth it ultimately depends on one thing: how actively you’ll engage with whichever tool you choose. The app can surface every problem, but you still have to act on what it finds.

FAQs

Rocket Money offers a free plan that lets you link accounts, view balances, track spending, and see a list of subscriptions. However, most hands-off features—like concierge subscription cancellation, advanced budgeting tools, and enhanced alerts—require a paid premium plan.

Premium users can request subscription cancellations through Rocket Money’s concierge service. Rocket Money contacts the provider on your behalf and attempts to cancel the service, saving you from calling or navigating cancellation policies yourself. Some subscriptions still require user action, especially those with in-person or written cancellation requirements.

It can—but results vary. Rocket Money is most effective for users with forgotten subscriptions or long-neglected bills. If you cancel even one or two unused subscriptions, the app can quickly pay for itself. Users who already track spending closely may see less benefit.

Rocket Money premium uses a sliding-scale pricing model ranging from $6 to $12 per month, depending on what you choose to pay. There is also a 7-day free trial, after which billing begins unless you cancel.

For many users, yes. Rocket Money offers account aggregation, spending insights, subscription tracking, and net worth monitoring similar to Mint. However, it is less focused on strict budgeting and more geared toward convenience and automation.

Top U.S. Brokers of 2025

Features:

✅ U.S. stocks, ETFs, options, and cryptos✅ Now 23 million users✅ Cash mgt account and credit card

Sign-up Bonus:

Free stock up to $200 with new account, plus up to $1,500 more in free stock from referrals

Get Free Stock

Features:

✅ Free Level 2 Nasdaq quotes✅ Access to U.S. and Hong Kong markets✅ Educational tools

Sign-up Bonus:

Deposit $100, get $20 in NVDA stock; Deposit $2,000, get $50 in NVDA stock; Deposit $10,000, get $300 in NVDA stock; Deposit $50,000, get $1,000 in NVDA stock

Get Free Shares

Features:

✅ Access 150+ global stock exchanges✅ IBKR Lite & Pro tiers for all✅ SmartRouting™ and deep analytics

View Full List

and include conclusion section that’s entertaining to read. do not include the title. Add a hyperlink to this website http://defi-daily.com and label it “DeFi Daily News” for more trending news articles like this

Source link

★ ★ ★ ★ ☆

★ ★ ★ ★ ☆ ★ ★ ★ ★ ☆

★ ★ ★ ★ ☆