rewrite this content using a minimum of 1000 words and keep HTML tags

If you’re like most investors, you’re asking the wrong questions.

I was chatting with a group of advisors about a decade ago in La Jolla and a question arose. I’ll paraphrase:

“Meb, thanks for the talk. We get a steady stream of salespeople and consultants in here hawking their various asset allocation models. Frankly, it can be overwhelming. Some will send us a 50-page report, all to explain a strategic shift from 50% equities to 40%. I want to do right by my clients, but I have a hard time reading all the various research pieces and models, let alone reconciling their differences. Any thoughts?”

The advisor followed up by emailing me this summary of all of the institutional asset allocation models by the Goldmans, Morgan Stanleys, and Deutsche Banks of the world. And as you’ll see, they are HIGHLY different. Morgan Stanley said only 25% in US stocks, while Silvercrest said 54%! Brown Advisory said 10% in emerging markets and JPMorgan 0%.

So what is an advisor to do? What’s the most effective asset allocation model?

Turns out, that’s actually, that’s the wrong question.

The correct starting question is, “Do asset allocation differences even matter?”

In the summary article that the advisor sent me, there’s a link to a data table showing the asset allocations of 40 of the nation’s leading wealth management groups. I teased out all the data from the table to examine three allocations:

The allocation with the most amount in stocks (Deutsche Bank at 74%).

The average of all 40.

The allocation with the least amount in stocks (Northern Trust at 35%).

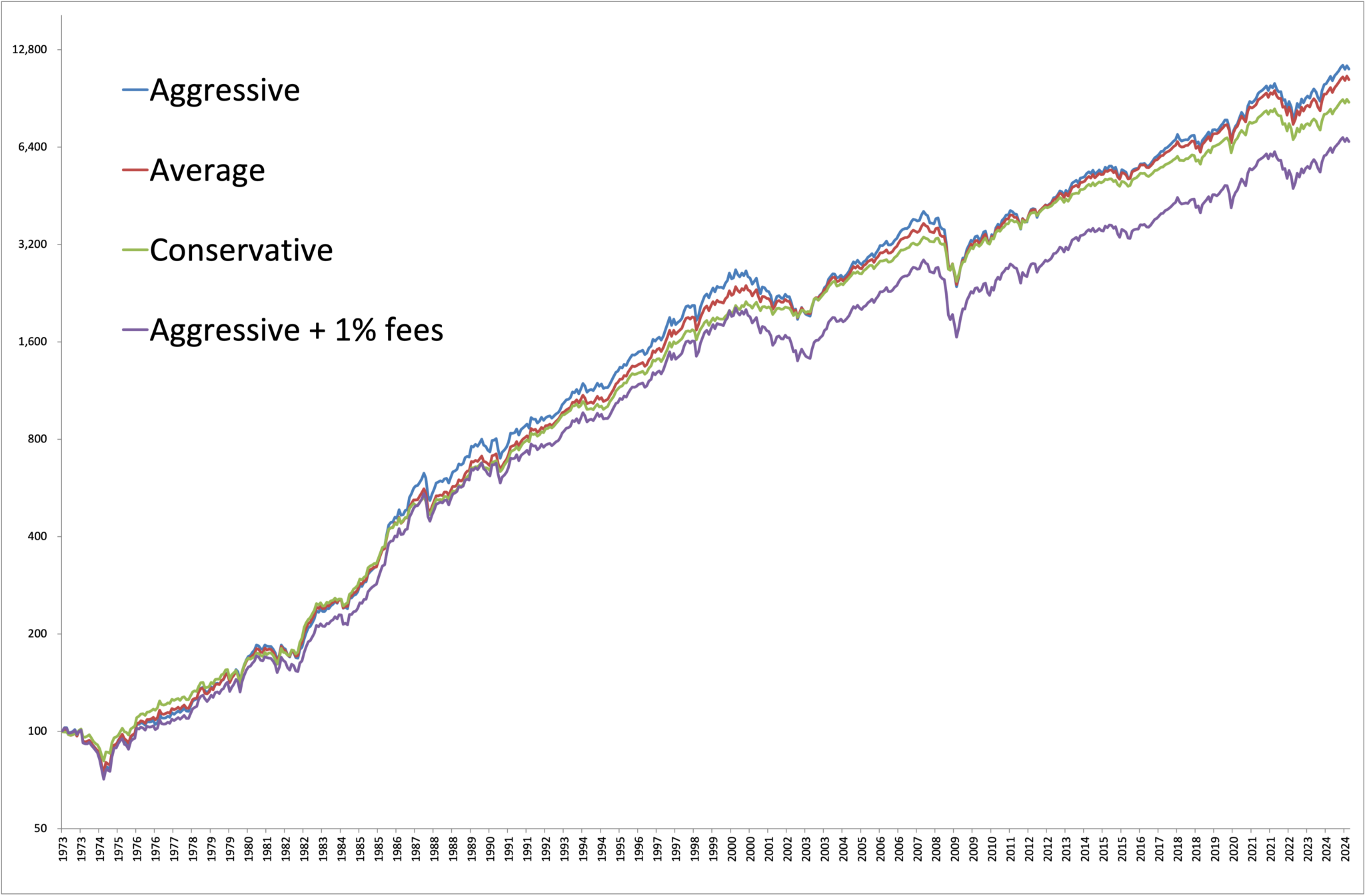

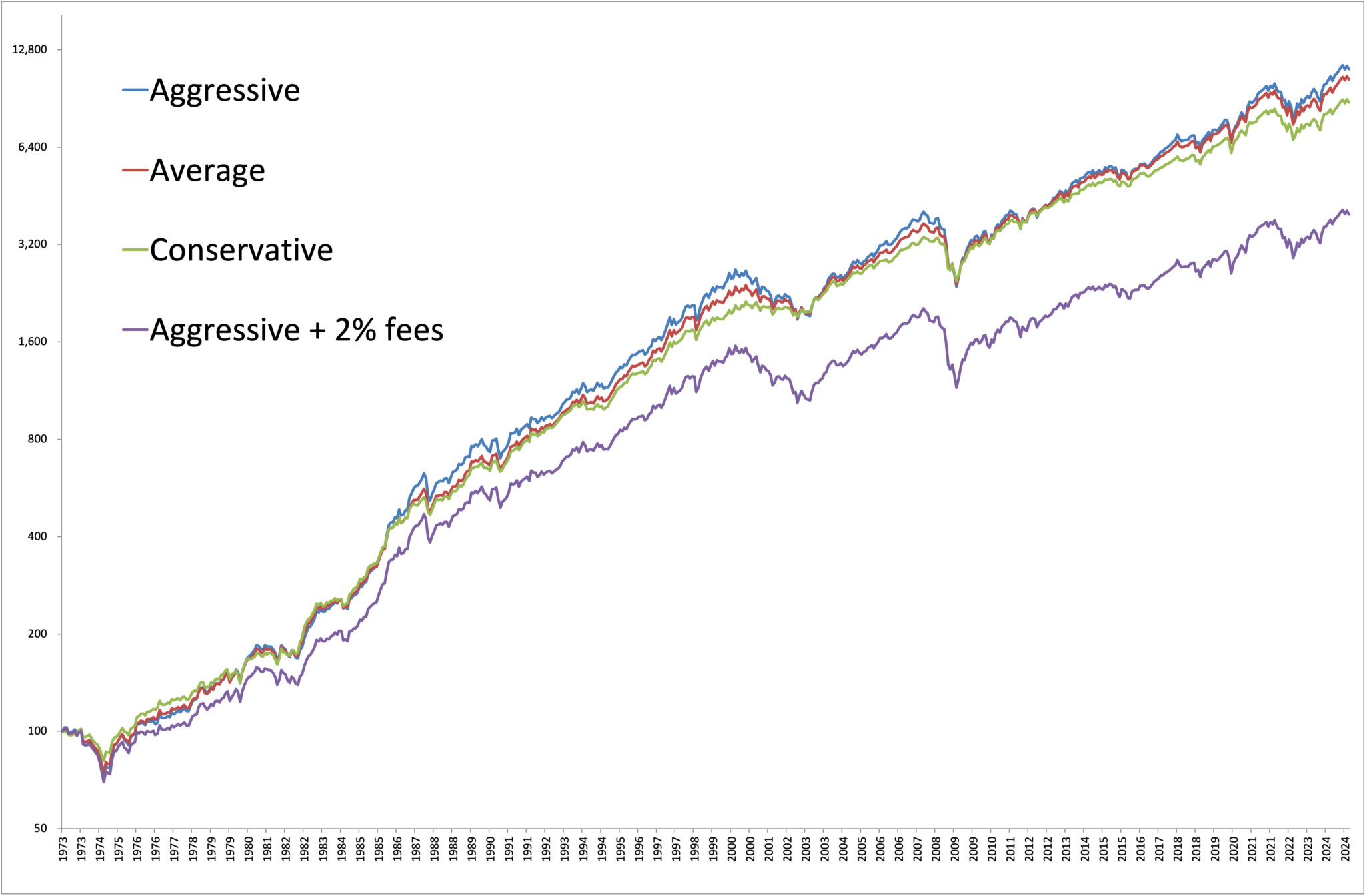

We used public market equivilants for the private strategies. Below is the equity curve for each. Unless you have hawk-like vision, you’ll likely have a hard time distinguishing between the curves, and this is for the most different. The other 40+ firms live somewhere in the middle!!

Below are the returns for each allocation over the entire 1973-2024 period.

Most aggressive (DB): 9.48% update

Average: 9.32%

Least aggressive (AT): 8.98%

There you have it – the difference between the most and least aggressive portfolios is a whopping 0.50% a year. Now, how much do you think all of these institutions charge for their services? How many millions and billions in consulting fees are wasted fretting over asset allocation models?

Let’s try one more experiment…

Overlay a simple 1% management fee on the most aggressive portfolio and look again at the returns. Simply by paying this mild fee (that is lower than the average mutual fund, by the way) you have turned the highest returning allocation into the lowest returning allocation – rendering the entire asset allocation decision totally irrelevant.

And if you allocate to the average advisor with an average fee (1%) that invests in the average mutual fund, well, you know the conclusion.

So all those questions that stress you out…

“Is it a good time for gold?”

“What about the next Fed move – should I lighten my equity positions beforehand?”

“Is the UK going to leave the EU, and what should that mean for my allocation to foreign investments?”

Let them go.

If you had billions of dollars under management and access to the best investors in the world, you’d think you’d be able to beat a basic 60/40 index. Turns out most institutions can’t.

If you’re a professional money manager, go spend your time on value added activities like estate planning, insurance, tax harvesting, prospecting, general time with your clients or family, or even golf.

and include conclusion section that’s entertaining to read. do not include the title. Add a hyperlink to this website http://defi-daily.com and label it “DeFi Daily News” for more trending news articles like this

Source link