In the ever-evolving landscape of cryptocurrency, analyzing market trends and making predictions can often feel like decoding a complex puzzle. Yet, Patric H., a renowned crypto analyst from CryptelligenceX, has recently shared his insights on X, providing a compelling case for why the Bitcoin market is poised for an upward trajectory. In his detailed analysis, Patric unveils seven pivotal reasons that should have investors leaning towards a bullish stance on Bitcoin’s price movement in the upcoming week.

At the heart of Patric’s optimism is a simple question: “How can anyone be bearish here?!” He accentuates that Bitcoin has shattered the weekly downtrend by securing a close above crucial levels, leaving skeptics who foresaw a drop below $40k in a state of disbelief. According to Patric, the last two weeks have been instrumental in altering the market’s fundamental outlook, leaving little room for bearish sentiment.

#1 Mt. Gox Bitcoin Repayment Deadline Extension

The saga of the defunct exchange Mt. Gox took a new turn when it successfully obtained a court’s approval to delay its repayment deadline. The shift from the originally set October 2024 to October 31, 2025, means that the market breathes a sigh of relief as the anticipated selling pressure of approximately 44,905 BTC, valued around $2.9 billion, is postponed. This development is crucial as it tempers immediate market volatility by spreading out potential sell-offs.

#2 China’s Economic Stimulus

In a move to rejuvenate its economy, China has announced a massive bond issuance worth $325 billion. Parallelly, the crypto exchange OKX makes a strategic entry into the United Arab Emirates (UAE) with a fully licensed trading platform. This move is not just a win for OKX but is also seen as a beacon for Chinese investors seeking a compliant route to engage in cryptocurrency trading. Patric H. sees this as a precursor to a significant influx of Chinese capital into crypto markets in Q4.

Related Reading

#3 Declining Bitcoin Exchange Reserves

The narrative of dwindling Bitcoin reserves on exchanges is gaining momentum, with institutional investors and whales scooping up Bitcoin at an unprecedented pace. This dwindling supply, juxtaposed with a steady or increasing demand, sets the stage for a potential supply shock. Patric notes, “Eventually, this will cause a supply shock, leading to higher prices in due time,” reinforcing the bullish sentiment.

#4 Surge In Bitcoin Whale Accumulation

Recent on-chain data has shone a spotlight on the surge in Bitcoin accumulation by new whales. CryptoQuant’s CEO, Ki Young Ju, remarked on the volatility being a byproduct of futures market maneuvers while highlighting that real market movement stems from spot and OTC trading, underscored by on-chain data’s importance. He observed the aggressive accumulation by new whales, hinting at their long-term hold strategy until sufficient liquidity from retail investors enters the market.

Related Reading

This wave of accumulation, as emphasized by Ki Young Ju, is unparalleled, pointing out that such strategic moves are not linked with the inflows into US spot ETFs, indicating these might be orchestrated by institutional investors with a long-term vision.

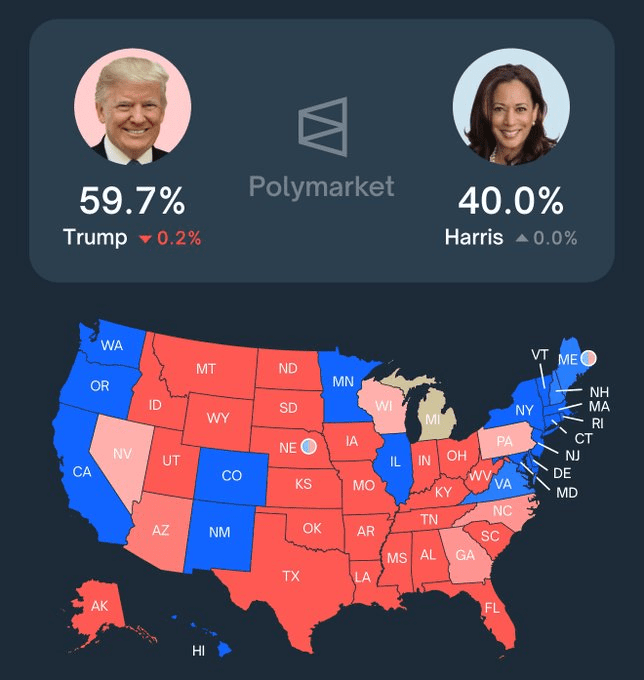

#5 Trump Is Leading The Polls

The political landscape in the United States is heating up with former President Donald Trump gaining traction in key swing states. Data from Polymarket suggests Trump is poised for a sweep in all seven vital swing states. This development is particularly notable for the crypto community as Patric reminds us, “Trump is pro-crypto; Elon Musk will lead a Department of Government Efficiency (DOGE).”

#6 S&P 500 As Trailblazer

Historically, the performance of the S&P 500 has been a harbinger for Bitcoin and the wider crypto market. Patric draws attention to the index trading at an all-time high, debunking the naysayers with a reminder, “There has not been a time in history when Bitcoin and altcoins did not eventually align with the S&P 500’s performance.” This correlation underpins the intertwined relationship between traditional markets and the burgeoning world of cryptocurrencies, suggesting that a bullish equities market often preludes favorable outcomes in the crypto domain.

#7 Seasonality

The fourth quarter (Q4) is historically the launching pad for Bitcoin’s most bullish phases, particularly in halving years. Patric emphasizes, “Bitcoin and the crypto market tend to outperform all asset classes in a halving year,” underscoring the cyclical nature of this digital asset’s growth trajectory. Furthermore, technical indicators, such as Bitcoin’s breakout above its weekly downtrend line and its steadfast position above the 50-week EMA alongside a bullish MACD cross, all hint towards an impending bullish momentum.

In light of these compelling factors, including the technical analysis and fundamental shifts observed in the market, Patric concludes with confidence, “Yes, there will be pullbacks every now and then. But from now on, dips are for buying as the market structure clearly shifted from a downtrend to an uptrend.” As BTC traded at $68,397 at press time, the mood amongst investors is increasingly optimistic.

The narrative spun across these seven points paints a vivid picture of a Bitcoin market on the precipice of a bullish trend. With foundations laid by strategic economic moves, political undercurrents, dwindling supply against rising demand, and a harmonious alignment with traditional market signals, the stage is set for an exciting journey ahead. As investors navigate through these opportune times, it’s essential to stay informed and ahead of the curve. For more intriguing and up-to-date news articles like this, visit DeFi Daily News.

As we wrap up this comprehensive dive into the bullish indicators lighting up the Bitcoin market, remember, the world of cryptocurrency is dynamic and ever-changing. While the analysis provides a deeply optimistic outlook, the crypto market’s intrinsic volatility requires investors to approach with caution, diligence, and, most importantly, a sense of adventure. The journey of Bitcoin is much like a roller coaster — thrilling highs, unexpected turns, and everything in between. So, strap in, stay informed, and perhaps most crucially, enjoy the ride!