rewrite this content using a minimum of 1000 words and keep HTML tags

imaginima/iStock via Getty Images

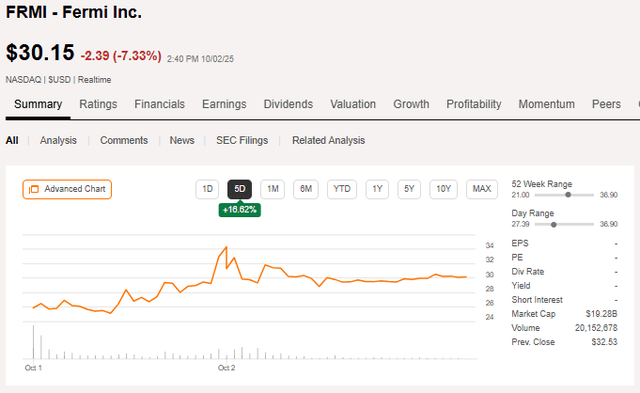

Fermi Inc. (NASDAQ:FRMI) is a fresh IPO that landed right in the middle of AI excitement. It plans to build a mega-campus of energy infrastructure, connectivity, transmission, and top-end data centers to fuel the development of AI. It is fortuitous timing for such a company to come out when the hype for its archetype is off the charts. Unsurprisingly, it was priced at the high end of its planned IPO pricing and has moved up considerably since its listing.

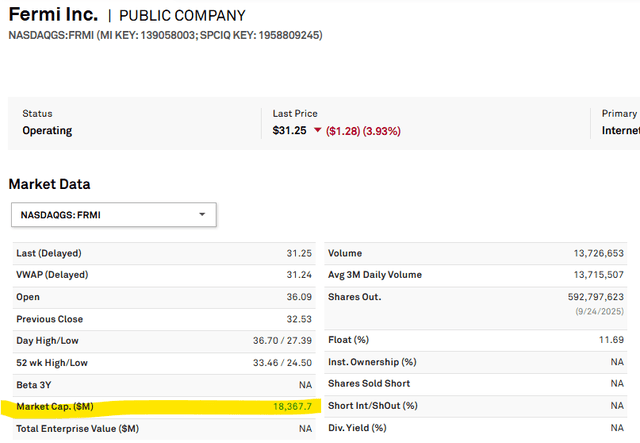

SA

A new infrastructure REIT is right in our wheelhouse, so we began analyzing it right away. Here are our 2 main takeaways:

Fermi is a great idea: There is strong demand for this sort of infrastructure, and putting it into a tax efficient REIT shell could set it above the competition Fermi stock is dangerously overvalued. The ratio of market cap to actual paid-in capital is absurd to the point where even if the company is a success, I think shareholders will lose.

The analysis behind these conclusions will be detailed below.

Fermi concept and potential

Fermi is not technically a blank check company, but it is close in the sense that it is mostly an idea rather than hard assets or IP.

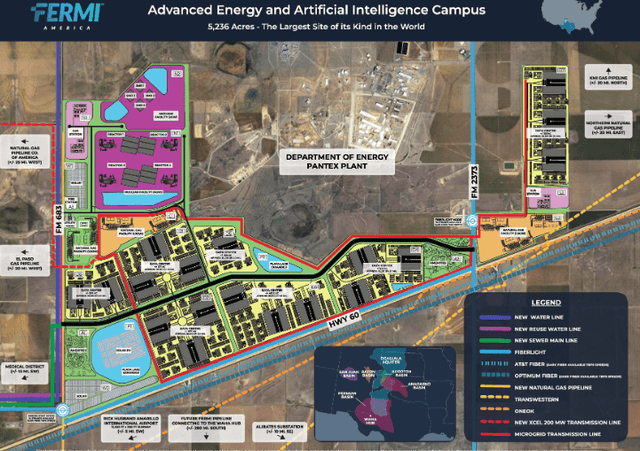

The main asset they have secured is a 99-year ground lease on 5,236 well-located acres.

Presentation

This land has excellent access to fiberoptic connectivity and can easily connect to the electric grid. It is near important companies like the DOE Plantex Plant and has proximity to skilled workers.

Fermi plans to turn this plot of land into an AI powerhouse with 11 GW of onsite power from reliable 24/7 sources like nuclear and natural gas. The large-scale data centers that will be built will draw from the onsite power as well as having access to grid power for redundancy.

Fitting this into a REIT shell

Energy generation is not a REITable asset. It does not fit the definition of real estate, which the IRS defines as passive. Energy generation is active, so a power plant is not a REIT-qualifying asset.

So how do they meet the REIT tax law that at least 75% of income be derived from REIT qualifying sources?

Well, they are using the power as a packaged deal with a data center in what is called a powered shell. The tenant leases the data center and the power capacity that comes with it in exchange for rental payments.

These rental payments are REIT qualifying,intent, as it is rent for a building (a data center in this case).

Everything is still in early stages, but Fermi has managed to secure a rather substantial letter of intent or LOI as per their prospectus:

“On September 19, 2025, we entered into a letter of intent (the “Tenant LOI”) with an investment grade-rated tenant (the “First Tenant”) to lease a portion of the Project Matador Site on a triple-net basis for an initial lease term of twenty years, with four renewal terms of five years each. The Tenant LOI provides for phased delivery of over 1 GW of powered shell spread across 12 separate powered shells (each, a “Tenant Facility”) to be constructed by the Company. Additionally, the Company and the First Tenant are negotiating a cost reimbursement agreement and prepayment as part of their ongoing negotiations.”

If this is to become the main business line of Fermi, it is worth looking into the unit economics of this sort of powered shell lease. As contracts are still in negotiation, Fermi did not give exact numbers on this particular LOI, but they shared their market analysis as to some ballpark figures.

“More specifically, market analysis indicates that a tenant lease could generate $1.5 billion of revenue when normalized for 1 GW of gross capacity and power purchase agreements. The substantial majority of our operating costs consist of fuel purchases, the expense associated with which we have estimated based on prevailing natural gas prices multiplied by expected operating time at the heat rates specified for the equipment we have secured to date. Other operating costs are expected to be approximately 15% of our total operating costs and are based on management estimates derived from prior operating experience and market knowledge. Taken together, we expect to incur $500 million in operating expenses attributable to such normalized GW which would result in $1.0 billion of NOI for such normalized GW”

Fermi is implying that each GW of powered shell capacity can generate $1.5B in annual rental income, which, after expenses, is about $1B in NOI.

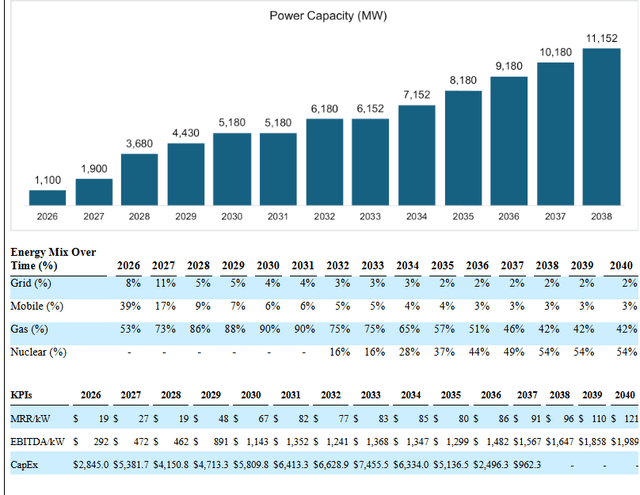

It remains unknown if Fermi can actually get such terms with the LOI tenant or with future tenants, but if we take those numbers at face value, it looks compelling. Fermi outlays the following plan to expand to 11 GW by 2038:

Presentation

To turn plans into reality, Fermi will need at least the following:

Successful development of power plants Development of data centers Tenants to occupy data centers

The first is by far the most challenging, as development of energy infrastructure has a history of being exceedingly slow. Nuclear plants in recent years have taken sometimes a full decade longer than intended to complete. Natural gas is faster, but it also often hits regulatory snags. In addition to the regulatory side, it can be quite difficult to source the key parts such as turbines, which are largely produced by just a small handful of companies like GE Vernova (GEV) and Siemens.

Fermi’s potential to streamline power development

Fermi Co-founder, Rick Perry, is arguably a significant advantage in getting through regulatory hurdles. As the former U.S. Secretary of Energy, Rick Perry is likely quite familiar with all the layers of red tape and may have relationships that can help expedite their regulatory applications.

Regarding the physical aspects of development, Fermi has made some headway into securing the gear. Per the prospectus:

“Fermi America, in partnership with the Texas Tech University System, has announced two landmark letters of intent with Siemens Energy (OTCPK:SMEGF) to secure 1.1 GW of Frame F Class Generation Equipment for 2026 delivery.”

Fermi has also secured some external power sources, such as their preliminary capacity agreement with Xcel Energy (XEL).

“To date, Fermi has contracted for approximately 720 MW of generating capacity, has a preliminary commitment from Xcel to provide Fermi with an additional 200 MW of expected capacity,”

The external power will be the primary capacity for the first data center builds, and over time, as Fermi’s proprietary power generation comes online, that will take over as the main source.

Overall take on the business plan

There are undoubtedly risks in execution. There could be delays, and contracts may not be as lucrative as initially hoped. However, I do think it is a reasonable business plan for which there is significant demand. Like any start-up, there will be risks, but I think Fermi is well positioned to execute and overall has a good chance to be successful.

The stock is a different story and strikes me as a disaster.

$18B of market cap on about $2B of raised capital

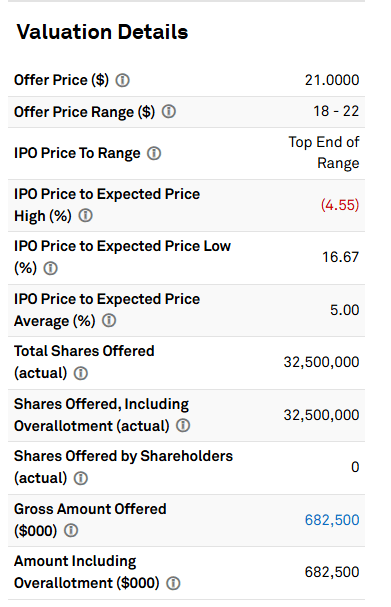

The shares issued in the IPO raised a good amount of capital per share.

S&P Global Market Intelligence

They were issued at $21 per share, and sure, there were your typical underwriting fees, so maybe only 93%-95% went to Fermi’s coffers, but that is normal.

Note, however, that the 32.5 million issued shares in the IPO are a small fraction of the overall 592 million shares.

S&P Global Market Intelligence

592 million shares at the current share price calculates to a market cap of $18.367B

In any sort of startup, some capital is going to be consumed in operations such that the pool of funds is likely to be less than the raise. In this case, however, the actual capital raise itself is minuscule.

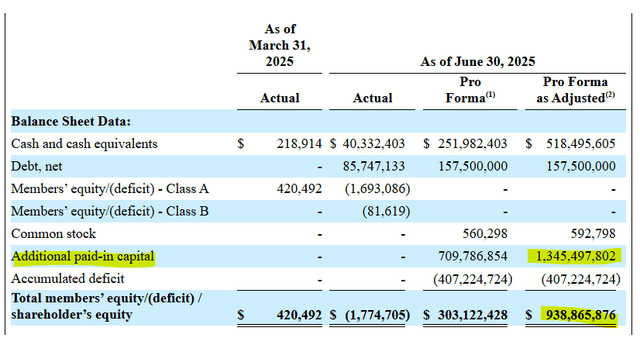

Note the “Additional Paid-in Capital” line:

Prospectus

Only $1.345B was raised as of June 30th. If we add in the IPO proceeds, that takes the total capital raised to about $2B.

So while the IPO shares were issued at $21 apiece, the other 560 million shares raised total proceeds of about $1.345B, implying a weighted average capital raise per share of $2.40.

How can it be that low?

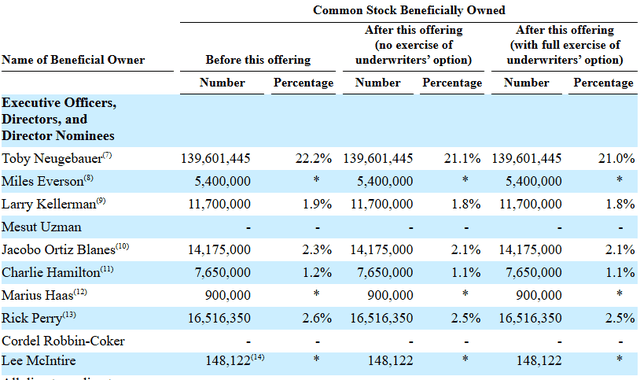

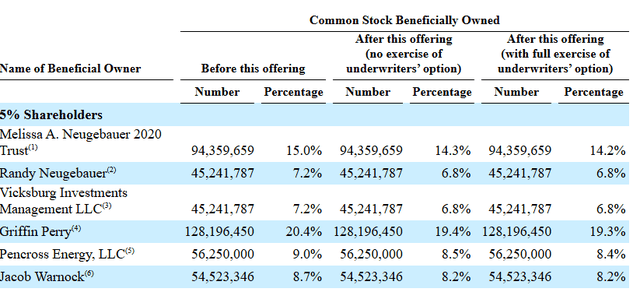

Well, not all of the shares were issued for money. Many were granted to management and affiliates of management.

Prospectus Prospectus

Some of these shares were granted as compensation, some were purchased, some were founder shares.

All of this is legal and, unfortunately, quite common in the world of start-ups. The issue I take with it is that it was a very large magnitude of shares for very little proceeds.

As a result, the value per common share is wildly diluted. I find it dangerous to buy a start-up at an $18B market cap when they have less than $2B in actual equity.

I think it is a strong business model, and maybe they can turn $2B of equity into $4B, but it would take something extraordinary to turn $2B into $18B.

Beyond shares to management, there were many shares that got issued through various capital raises.

“On August 29, 2025, the Company issued and sold approximately $107.6 million of its Preferred Units in a private placement to a consortium of third-party investors led by Macquarie. The holders of Preferred Units receive a cumulative in-kind dividend at a rate of 15% per annum, compounding annually. Upon the Company’s election, it may satisfy such dividend in cash. Additionally, the holders of the Preferred Units are entitled to receive, on an as-converted basis, the same dividends (as to amount and timing) as any dividends paid by the Company on its Class A Units and Class B Units.”

15% is a heavy interest rate, but also quite normal for a start-up. In my opinion, the more damaging part of these Macquarie preferreds is their conversion terms.

“Conversion Rights: The Preferred Units are convertible into the equity securities (the “Qualified Financing Securities”) issued upon the consummation of a Qualified Financing (as defined below). Upon a Qualified Financing, the Preferred Units will automatically convert into a number of Qualified Financing Securities issuable in respect of each outstanding Preferred Unit that is the quotient of (i) $1,000 plus any accrued and unpaid dividends under each converting Preferred Unit by (ii) the Conversion Price (as defined below). The Preferred Units are not otherwise convertible.

For purposes of the Preferred Units, certain capitalized terms set forth above have the following meanings:

“Conversion Price” shall equal the Discount Percentage (as defined below) multiplied by the price per Qualified Financing Security, which shall be no less than the price per Qualified Financing Security derived from a $3,000,000,000 pre-money enterprise valuation of the Company. “Discount Percentage” means (i) 68.4%, if the Qualified Financing closes within six months following the issuance of the Preferred Units, (ii) 61.3%, if the Qualified Financing closes within the period that is six to 12 months following issuance of the Preferred Units and (iii) 55.7%, if the Qualified Financing closes after 12 months following the issuance of the Preferred Units.

So the conversion to common units was at a significantly discounted percentage of a $3B enterprise value. That works out to a small fraction of what public investors paid at the IPO.

Other financing was perhaps even more expensive in terms of dilution to per share value.

Prospectus

The convertible debt converted into over 10 million shares at a price of $2.67 per share.

The problem

It seems as though everyone else got to buy their shares at very cheap prices somewhere in the $2 to $10 range, while public investors had to pay $21 in the IPO or even more for those who bought in the higher market prices since then.

Given that the vast majority of shares were issued at capital raises of less than $10 per share, I find it difficult to believe the company is worth anywhere near the current market valuation.

Share Price Catalysts

Given the low amount of book equity, how has the share price gotten so high?

I think it has to do with the very small float.

560 million of the 592 million shares are locked up.

Prospectus

Thus, the float is only a fraction of the total shares.

Fermi is a reasonably large company at an $18B market cap, so it gets the proportional amount of attention. Perhaps it gets even more attention because it is in a hot sector.

All that attention is concentrated into just 32.5 million shares of float. Given that ratio, it only takes a small percentage of people looking at it to be bullish for the stock to be priced highly.

Perhaps the stock will remain overvalued for a while.

However, as the lock-ups expire, I anticipate the price falling back much closer to the amount of capital that was actually raised.

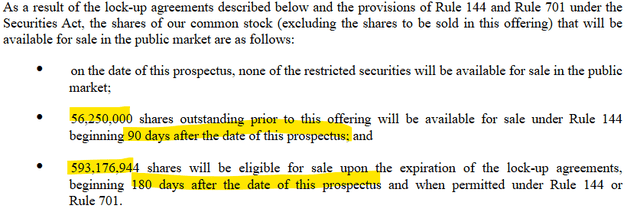

Some of the lock-up expires 90 days after the IPO.

Prospectus

The majority expires 180 days after the IPO.

Each lock-up expiry will represent a flood of new shares that potentially want to sell and cash-in. I think Fermi will drop to about $10 after the 180 day lock-up. There are large error bars around my $10 guess, but the main point is that the $18 billion market cap is absurd relative to the $2B of capital that was actually paid in.

and include conclusion section that’s entertaining to read. do not include the title. Add a hyperlink to this website http://defi-daily.com and label it “DeFi Daily News” for more trending news articles like this

Source link