rewrite this content using a minimum of 1000 words and keep HTML tags

On May 12th, a Reuters report revealed that Blackstone (NYSE:BX) was in talks with TXNM Energy (NYSE:TXNM). It was later confirmed on May 19th that BX had, in fact, made a buyout offer. In the all-cash deal, shareholders of TXNM are to receive $61.25 per share. It represented a 20% or so premium to the unaffected share price and remains a significant premium to the current share price, which only partially adjusted.

The Arbitrage Tracker on Portfolio Income Solutions continuously updates pricing and deal information to monitor the arbitrage spread.

Portfolio Income Solutions

As of the time of writing on 5/28/25, there is an 11% remaining upside to the buyout price.

That is a very large spread, especially considering the buyer has demonstrably enough capital to easily make the purchase. As such, it is a potentially interesting arbitrage opportunity.

This article will discuss:

Brief overview of TXNM Deal terms and valuation Why the spread might be so large Arbitrage opportunity Risks to the trade

TXNM Energy

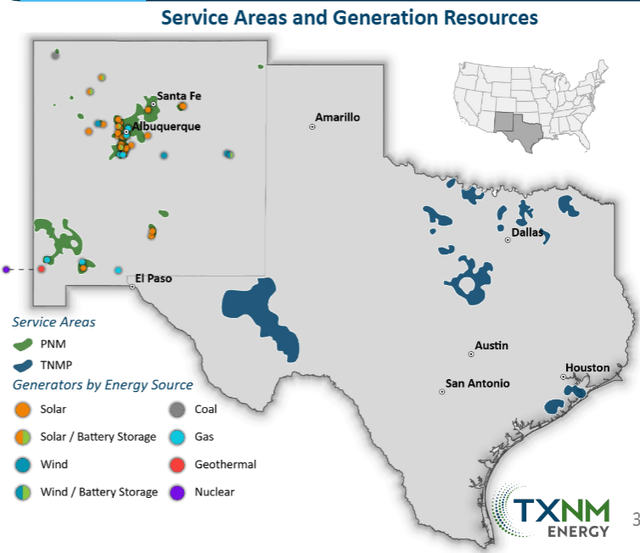

This small, regulated electric utility serves parts of New Mexico and Texas through its subsidiaries PNM and TNMP, respectively.

TXNM

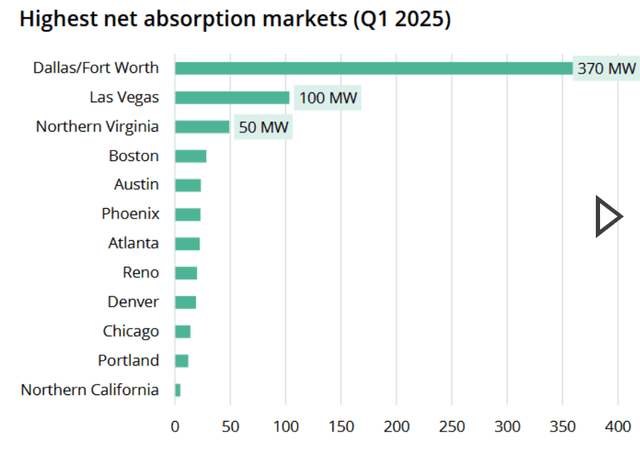

These are generally fairly strong markets with respect to energy demand. The flecks of exposure in Dallas may be particularly valuable as it is presently the number 1 market in the country for data center net absorption.

Commercial Property Executive

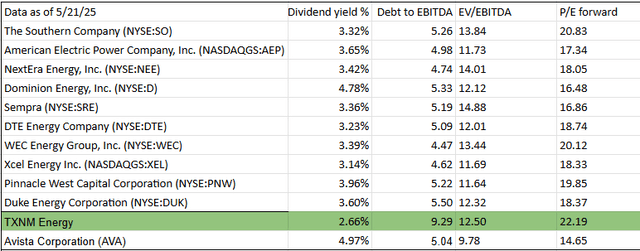

Overall, TXNM Energy is quite typical of regulated utilities and has similarly performed reliably with a fairly long streak of dividend increases. Two notable differences are that it is smaller than most with an enterprise value of just over $11B, and it has a bit more debt as a percentage of assets.

The smaller size may have made it a bite-sized target for Blackstone, and the debt is not concerning given BX’s access to vast amounts of capital.

Deal Terms and Valuation

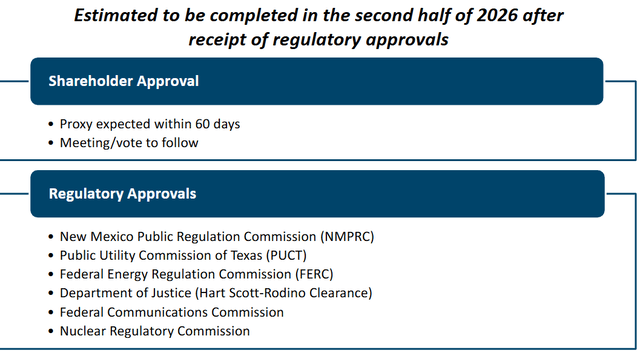

Blackstone is to pay $61.25 for each share of TXNM, with an expected close in the 2nd half of 2026. In the interim, Blackstone will buy $400 million of newly issued TXNM shares at $50 apiece.

Should Blackstone back out or fail to complete the transaction, there is a $350 million break-up fee.

TXNM is expected to continue paying dividends through the close of the transaction, which implies 4 or 5 more payments at the current quarterly rate of $0.4075. For our arbitrage calculation, we are assuming 4 quarterly dividends. It is left up to the board to potentially raise the dividend at the usual pace, so it is possible that shareholders would get a few pennies more.

We estimate total proceeds to shareholders of $62.88 if the closing is successful. This implies an 11.5% return over a roughly 1.3-year hold. That is a potentially interesting return, depending on one’s degree of certainty that it will close.

The buyout price is slightly high relative to typical electric utility valuation.

2MC

The TXNM numbers above are using the buyout price of $61.25. The deal represents a roughly 12.5X EBITDA multiple and a 22.19X earnings multiple.

Both metrics are toward the higher end of electric utility valuation. A company like TXNM would not typically trade at the higher end of sector valuation because of its smaller size and slightly higher debt.

As such, I believe TXNM shareholders are getting a good deal in the buyout and will likely vote in favor. From the Blackstone perspective, I think they are getting a fair deal. It is less the case that they are overpaying and more so that other electric utilities are trading slightly below fair value.

TXNM has traded favorably all year and jumped from the low $50s to about $56 as the news of a buyout circulated.

S&P Global Market Intelligence

I see the low to mid $50s as where TXNM would trade in the event the buyout fails. This represents the arbitrage downside.

Why is the Spread So Large?

The roughly 11% gap between where TXNM is trading and shareholder proceeds in the event of completion consists of 2 components:

Time value of money (shareholders have to wait a bit over a year for completion) Uncertainty of closure

There are 3 main reasons to believe the deal may not close:

1) It has to be approved by a substantial number of regulators.

TXNM

2) A similar deal has failed in the past.

Per a Bloomberg Report

“The company had agreed to sell itself to Avangrid, a US unit of Spain’s Iberdrola SA, for $4.3 billion in 2020 but the deal was scrapped after New Mexico regulators rejected the takeover.”

Both BX and TXNM believe they can succeed where Avangrid failed, but it is of course not certain.

3) Regulators may not like the idea of private equity operating a utility.

Utilities are meant to be extraordinarily consistent over multiple decades.

You can hear the difference in personality in conference calls. The executives of the publicly traded utilities consistently come across as patient and reliable. In contrast, the executives of Blackstone come across as ambitious and cutthroat.

The aggressive style of Blackstone might help them extract maximal return in some instances, but it might not be consistent with regulators’ goals of having electricity consistently and cheaply provided to a large residential customer base for the next century.

Concerns of this nature are partially mitigated by the merger agreement, which keeps existing TXNM management in place for at least the next 2 years.

Overall, I think the merger has a medium to high chance of completion and that buying as an arbitrage play is valid. It has a reasonably small upside after giving respect to the time value of money, but the downside is also limited.

We have a small starter position in TXNM but will primarily be watching as it develops further. Share price changes and/or news on certainty of completion could turn it into a juicier opportunity.

Risk Level

Arbitrage plays have inherent risk in that failure of a merger tends to result in the stock price dropping back down to the unaffected level.

Failure of the merger is certainly a possibility here, but I still rate it as relatively low risk because the distance to unaffected price is not all that large. Additionally, the underlying utility company, TXNM, is solid and operating in high-demand growth markets. It is entirely possible that while waiting for the merger to close, TXNM’s intrinsic value will rise close to the buyout price anyway.

and include conclusion section that’s entertaining to read. do not include the title. Add a hyperlink to this website http://defi-daily.com and label it “DeFi Daily News” for more trending news articles like this

Source link