rewrite this content using a minimum of 1000 words and keep HTML tags

Richard Drury

Market Review

Global stock markets finished the final quarter of 2024 on a down note, while US stocks significantly outpaced the rest of the world, in both the quarter and the year, boosted by strong returns from growth-oriented index heavyweights and continued enthusiasm for artificial intelligence (AI). As in 2023, the rising share prices of the so-called “Magnificent Seven”— NVIDIA (NVDA), Apple (AAPL), Amazon.com (AMZN), Meta Platforms (META), Microsoft (MSFT), Alphabet (GOOG), and Tesla (TSLA)—plus Broadcom (AVGO) played a pivotal role. These mega-cap US companies contributed nearly half of the MSCI All Country World Index’s impressive double-digit gain this year.

Donald Trump’s victory in the US presidential election gave US equities a bump during the quarter, as investors looked forward to some business-friendly policies, such as tax cuts and deregulation, while perhaps overlooking the consequences to US companies of some potentially less business-friendly ones. International equity markets took a more cautious view of the incoming administration, as did US bond investors, who sent bond prices lower, presumably anticipating further fiscal largesse. The ICE US Treasury Core Bond Index, which maintains exposure to Treasuries ranging from one- to thirty-year maturities, fell 4% after peaking in mid-September.

MSCI ACWI Index Performance (USD %)

Sector

4Q 2024

Trailing 12 Months

Communication Services

4.9

31.9

Consumer Discretionary

5.5

20.7

Consumer Staples

-7.0

4.7

Energy

-3.8

2.9

Financials

2.8

25.1

Health Care

-11.3

1.5

Industrials

-4.8

12.8

Information Technology

4.3

31.9

Materials

-15.0

-7.8

Real Estate

-8.8

3.1

Utilities

-8.6

12.7

Geography

4Q 2024

Trailing 12 Months

Canada

-1.6

12.7

Emerging Markets

-7.8

8.0

Europe EMU

-8.9

3.4

Europe ex EMU

-10.5

1.4

Japan

-3.6

8.7

Middle East

14.3

38.8

Pacific ex Japan

-9.1

4.7

United States

2.8

25.1

MSCI ACWI Index

-0.9

18.0

Click to enlarge

Source: FactSet, MSCI Inc. Data as of December 31, 2024.

Click to enlarge

European yields also rose, but to a lesser degree than those in the US, even with significant political upheaval, including loss of confidence votes for the ruling coalitions in Germany and France. Asian bond markets shrugged off political uncertainty as well, as the impeachment of South Korean President Yoon Suk Yeol and election of Japanese Prime Minister Shigeru Ishiba had minimal effect on long-term bond yields.

With subdued inflation providing room for action, the Federal Reserve cut interest rates in both November and December. However, Chairman Jerome Powell’s language after the December meeting hinted at a potential pause in the current rate-cut cycle as inflation stubbornly remains above the Fed’s target. This cautious tone spooked bond markets, driving yields higher as investors recalibrated expectations for future monetary policy.

The Bank of England cut its bank rate in November, and in December, the European Central Bank followed suit, cutting its key lending rate for the fourth time in the year as domestic inflation edged down. In contrast, the Bank of Japan kept rates unchanged. China continued to grapple with worsening deflationary pressures, as ongoing fiscal and monetary stimulus efforts struggled to counteract the drag from the ailing real estate sector.

Meanwhile, commodities such as oil and gold showed little change in the quarter, while industrial metals such as copper fell as doubts persisted about a Chinese manufacturing recovery and concerns grew over the potential impact of heightened trade frictions with the US.

Major currencies in both developed and emerging markets (EMs) broadly weakened against the dollar. The election also sparked a rally in speculative cryptocurrencies, with Bitcoin surpassing $100,000. This surge was fueled by optimism over a potentially favorable regulatory environment and Trump’s campaign promise to establish a government stockpile of digital currency.

By sector, Information Technology and other Magnificent Seven host sectors such as Communication Services and Consumer Discretionary led gains this quarter, continuing the trends seen in the first half of the year. Financials also advanced, benefiting from the steepening yield curve. In contrast, Health Care shares were pressured by the nomination of Robert F. Kennedy, Jr. to head the US Department of Health and Human Services, which introduced regulatory uncertainty. Materials also underperformed as persistent concerns over China’s subdued demand for key commodities such as iron ore—which dropped over 15% in price over the year—continued to weigh on the sector.

For the year, all sectors delivered positive returns except Materials. While sectors such as Health Care and Consumer Staples achieved modest gains, they were overshadowed by exceptional returns in IT, Consumer Discretionary, and Communication Services.

Companies held in the portfolio at the end of the year appear in bold type; only the first reference to a particular holding appears in bold. The portfolio is actively managed therefore holdings shown may not be current. Portfolio holdings should not be considered recommendations to buy or sell any security. It should not be assumed that investment in the security identified has been or will be profitable.

Click to enlarge

The US market dominated the fourth quarter, gaining 3%, while all other major regions declined. Among major EMs, only Taiwan delivered gains, due to double-digit returns from chipmaker TSMC. For the year, the US market surged 25%, lifted by IT stocks. NVIDIA’s extraordinary performance alone contributed over a sixth of the MSCI All Country World Index’s annual return.

In terms of style, quarterly trends mirrored those of the first half of 2024, with the MSCI ACWI Growth Index outperforming the core index; for the year, the growth index surpassed the core index by more than 600 basis points (bps). Expensive stocks also did better over the quarter and the year, as investors prioritized growth over valuation. In the US, share prices of high-quality companies—characterized by lower leverage and more consistent profitability— underperformed in the fourth quarter but were nearly in-line with the broader index for the full year. Outside the US, however, share prices of higher-quality companies struggled. The MSCI ACWI ex-USA Quality index, which selects stocks of companies based on their rank of return on equity, earnings growth, and leverage, underperformed the core index by over 600 bps for the year.

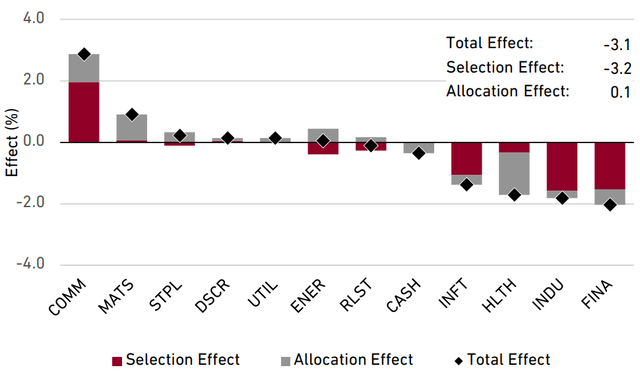

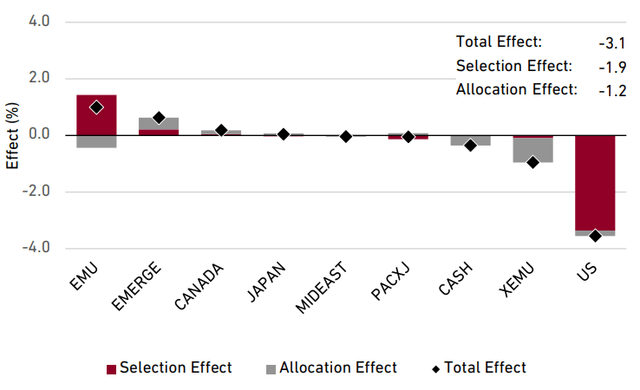

Performance and Attribution

The Global Equity composite fell 0.86% gross of fees in the fourth quarter, in line with the 0.89% decline of the MSCI ACWI Index. For the full year, the composite rose 14.9%, lagging the benchmark’s 18% gain.

During the quarter, we benefited from strong stocks within the Communication Services and Consumer Discretionary sectors. Netflix (NFLX) was our top relative contributor; the company provided a favorable outlook for subscriber growth in 2025 and made progress in two key areas, live TV and advertising. The streaming service broadcast its first sporting events, including two National Football League games on Christmas, and said that the ad-supported plan it launched two years ago amassed 70 million subscribers, more than investors expected. In Consumer Discretionary, Amazon.com (AMZN) reported strong third-quarter results. Revenue increased by double digits, led by growth in advertising and AI products, while the company’s operating margins also hit an all-time high of 11%. The key reasons for the higher margins were that its international e-commerce operations turned profitable, and there was faster growth in its high-margin cloud-computing business.

Those sector gains were mostly offset by our overweight to Health Care stocks. President-elect Donald Trump’s selection of RFK, Jr. to head the Department of Health and Human Services sent biopharma stocks reeling, due to the nominee’s criticisms of vaccines and the pharmaceutical industry. Health-insurance companies, initially a haven during the industry selloff, joined in the decline as public vitriol toward the US insurance system erupted in the aftermath of the killing of the chief executive of UnitedHealthcare, a division of UnitedHealth Group (UNH), and investors began to ponder the prospect of regulatory changes.

By region, positive stock-selection effects were entirely offset by negative allocation effects. Our overweight in Europe was particularly costly. The European economy continued to muddle along, weighed down by tepid demand. Additionally, technology companies, which tended to outperform around the world, represent a lower weight in Europe.

Trailing 12 Months Performance Attribution

Sector

Global Equity Composite vs. MSCI ACWI Index

Geography

Global Equity Composite vs. MSCI ACWI Index

Source: Harding Loevner Global Equity composite, FactSet, MSCI Inc. Data as of December 31, 2024. The total effect shown here may differ from the variance of the composite performance and benchmark performance shown on the first page of this report due to the way in which FactSet calculates performance attribution. This information is supplemental to the composite GIPS Presentation.

Click to enlarge

For the full year, the composite’s underperformance was primarily due to poor stock choices in the US. NVIDIA, which we sold in the first quarter and repurchased in the fourth quarter, caused over half the strategy’s underperformance. We were hurt by our underweight as NVIDIA’s stock price soared during the first half of the year on the insatiable demand for the company’s graphics processing units (GPUs), which enable generative AI computing. However, strong holdings in the European Monetary Union helped our performance, especially Schneider Electric (OTCPK:SBGSF). The French company has been another beneficiary of the money being spent on AI data centers, as its electrical and cooling equipment are complementary products to NVIDIA’s GPUs, which are power intensive and produce a lot of heat.

From a sector perspective, we had poorly performing stocks this year in Financials and Industrials. Brazilian stock-exchange B3 underperformed as the country’s high interest rates reduced trading volume in equities, which account for 34% of the company’s revenues. Hong Kong–based insurer AIA Group (AIA) was hurt by negative investor sentiment surrounding China and Hong Kong. In Industrials, Atkore (ATKR), a leading manufacturer of electrical conduit, had to revise its outlook during the year as demand slowed, leading to increased rivalry, which hurt pricing and profitability.

Perspective and Outlook

The result of the recent US presidential election may not have been as surprising to investors as it was in 2016, but it could have profound implications for markets and the global economy.

The S&P 500 Index rallied sharply after former President Donald Trump won re-election in November, while international markets, particularly EMs, remained generally calm. It was a sharp contrast to the market reaction on election night in 2016, when major Wall Street indices initially slumped as the results came in; S&P 500 futures contracts also plunged more than 5% that night, triggering an automatic trading halt, while the Mexican peso, a bellwether for Latin American markets, initially tumbled 12% against the US dollar, before recovering somewhat the next day.

The main difference between then and now is that the market appears to be less concerned this time about the prospect of an escalating trade war. That’s because, over the past eight years— spanning both the Trump and Biden administrations—the global business community has already had to cope with many rounds of tariffs and sanctions, along with other disruptive industrial policies, and investors have had to cope with the effects those policies have had on companies’ performance and outlook. The broader public, in the US and other countries, has also become more familiar with protectionist ideas and has increasingly embraced them.

Although the impression this leaves is that the economy and society have adjusted to the conditions of a “de-globalizing” world, investors shouldn’t expect Trump’s second term to be more of the same. Not only is the macroeconomic environment inherently unpredictable (the core reason we build portfolios from the bottom up), but also the terrain in which President-elect Trump is going to operate is different than during his first term.

An example of how the conditions are different this time is the evolving rationale for trade protectionism. Eight years ago, the argument embraced by the Trump administration was primarily rooted in a simplistic grievance about the imbalance of trade between the US and the rest of the world, with China the leading target. However, protectionist ideas have since found more vocal support in political and investing circles, where the arguments have become more sophisticated, reflecting valid concerns about national security, the resilience of supply chains, and the perceived importance of one’s country winning the competition for technological superiority. The pandemic-era shortages, the conflict in Ukraine, and the potential vulnerabilities around the Taiwan Strait have only added to the momentum behind establishing a less globalized, more self-reliant world order. Now that Republicans control both houses of Congress, the Trump administration also may find more legislative support for further protectionist measures.

Another difference is that companies have already made the easy adjustments to their supply chains. They’ve routed shipments through countries such as Vietnam and Mexico, as well as establishing manufacturing facilities in new locations. Business leaders haven’t necessarily enjoyed these new complex arrangements, which seem to be more about ameliorating risks than reducing production costs, but they’ve accepted them. As a result, global trade has held up over the past eight years, with the World Trade Organization raising its outlook twice in 2024 and predicting that global trade volumes will rise 3% in 2025. However, if trade is further restrained, or governments crack down on these workarounds, businesses may have to make harder and costlier adjustments to their supply chains, and those could take longer to implement. The resulting trade dislocations would likely reignite inflation.

Should the competition between the US and China intensify, these countries may enter the so-called “Thucydides trap.” Thucydides, an ancient Greek historian known for his study of the Peloponnesian War between Athens and Sparta in 431–404 BC, suggested that when a rising power threatens to displace an established power, the result is usually war. In 2017, Graham Allison, a political scientist at Harvard, popularized the application of this concept to modern US-China relations, and at the time, the trap appeared to be more of a warning for a situation that could still be avoided. Looking ahead, tensions between the two countries do seem more likely to escalate over the coming years, even if they may not reach the point of war. This will have broad implications for global investing. The tensions could reverberate, as other countries—even those that wish to remain neutral—could be drawn into the conflict and forced to choose sides. Those countries may have to remember the lesson from the Melian Dialogue: “The strong do what they can, and the weak suffer what they must.” Melos was a neutral island-state that was annihilated in the Peloponnesian War—a sobering reminder for “innocent bystanders” witnessing two superpowers fight for imperium.

Perhaps the most important takeaway from the past eight years is that the most significant, and disruptive, events to occur during that time were those that most people didn’t see coming: a global pandemic, Russia’s invasion of Ukraine, and the ability of computer algorithms to create new content based on user prompts as well as the explosive growth in chip demand that these AI capabilities have ignited. In fact, we recently looked back on our letter from the fourth quarter of 2016, in which we debated the possible effects of Trump’s first term, and while all our predictions proved valid— innovation and US economic growth carried on, global trade didn’t unravel, inflation surged—they fell very short in capturing all that would transpire in the subsequent eight years, a reminder that the course of history is neither predictable nor straightforward.

Even just the last few weeks have been a testament to this, as the Health Care sector unexpectedly became a lightning rod. Compared to topics such as trade and China, health care was not near the top of investors’ list of concerns when Trump won in November. However, with his pick of RFK, Jr. to lead the Department of Health and Human Services, followed by the fatal shooting of the CEO of UnitedHealthcare, the Health Care sector ended the fourth quarter as one of the worst performers. The regulatory risks for pharmaceutical companies and health insurers have now jumped to the front of investors’ minds.

So, while we find many of the well-articulated narratives by armchair strategists intellectually stimulating, we resist the temptation to make so-called “Trump trades,” for there are no Trump stocks versus Biden stocks (where would Health Care fall?). Each industry and business may encounter its own twists and turns. That was true over the past eight years: Who would have guessed that stocks in the oil-and-gas industry, which seems to be favored by President Trump, would do poorly during his first term, while stocks in the renewable-energy industry, favored by Democrats, would be decimated in a rising equity market during the Biden years?

This is the context in which we are going to be evaluating our companies, and it is why, in our view, the world is too complicated for a top-down approach to investing; political and economic forecasts are not reliable. One must drill down to the company level to understand the degree to which each business—based on factors such as its financial strength, competitive positioning, and the growth prospects of its industry—is capable of maneuvering around the possible challenges ahead and adjusting to a new environment.

Therefore, we are sticking with the same process and principles we always have: monitoring the fundamentals of each business and its industry structure, maintaining a diversified portfolio, and making investment decisions according to whether the valuation of a business reflects its durable competitive advantage and the potential risks and opportunities. We scan the horizon for threats, but rather than impose top-down decisions, we incorporate these assessments into our bottom-up analysis, and balance that against expected returns. If we foresee the possibility of a change to a company’s competitive structure or growth potential, which could decouple its prospects from what is embedded in the stock price, that’s what will cause us to take action.

Portfolio Highlights

Our investments in the semiconductor industry demonstrate how we have brought various risk considerations, based on our fundamental research, into our decision-making.

One example is ASML, a Dutch supplier of advanced photolithography equipment used by the semiconductor industry to make chips. Following the stock’s strong run over the past two years, the price became difficult to justify based on the company’s fundamentals, and so we sold our shares in August. One of our chief concerns was related to geopolitical risk. China accounts for 47% of ASML’s sales, but export restrictions imposed by the US have prevented ASML from selling its most advanced machinery to Chinese customers. The possibility of further restrictions was plainly visible, yet the stock price seemed to discount a blue-sky scenario. In October, weeks after we exited, ASML reported bookings, an indicator of future revenue, that were well below investors’ expectations. The stock plummeted, and the whole industry came under investor scrutiny.

We’ll probably never know how much of the booking shortfall reflected overly rosy expectations by investors at their moment of peak optimism, and how much was the result of trade restrictions. However, not long after our sale, the US government did introduce additional restrictions on the export of advanced semiconductor chips and equipment to China, and there have been more restrictions announced since then.

After ASML’s disappointing outlook led industry valuations to compress, we added a strong company back to the portfolio—NVIDIA.

There were two main reasons we sold NVIDIA last February (after holding the stock for more than five years). First, its biggest customers—data-center behemoths Amazon, Alphabet, Meta Platforms, and Microsoft—have been designing their own custom semiconductor chips, called application-specific integrated circuits (ASICs), that could eventually erode NVIDIA’s dominance. Second, it was unclear to us whether the adoption of AI by large enterprises will be as fast and meaningful as the optimistic views suggested.

After continuing to monitor developments over the course of 2024, we determined that it will take longer than we initially thought for emerging competitors to sufficiently narrow the technological gap with NVIDIA’s GPU chips to threaten the company’s pricing power. While ASICs such as Amazon’s Trainium2 and Google’s TPU are impressive, NVIDIA has been able to maintain its lead by developing next-generation products that extend beyond chips. Its new Blackwell server rack system, which comprises multiple GPUs, central processing units (CPUs), and advanced memory chips, as well as networking equipment, weighs approximately 3,000 pounds and is a sophisticated engineering platform.

Furthermore, NVIDIA’s development software, CUDA, remains a significant barrier to competition that shows no signs of cracking soon. CUDA enables users, whether expert or novice, to take full advantage of NVIDIA’s GPUs to maximize the performance of the applications they develop. CUDA only works with NVIDIA’s GPUs, and its large library of development tools and user support community help the company’s chips remain the preferred hardware. In her recent research, analyst Moon Surana, CFA, learned that even NVIDIA’s competitors admit that while they can come up with alternative chips, it is far more difficult for them to replicate the CUDA ecosystem.

On the question of the continuous advancement of AI and its adoption in the real world, more evidence has become available during the past six months to suggest there is strong industry-wide momentum. OpenAI, xAI, Anthropic, and Perplexity.ai have each raised billions of dollars of capital for potential infrastructure spending, while Alphabet, Amazon, and Meta have increased their already massive capital-expenditure plans. New large language models have also launched, including GPT-4o, Llama 3.3, Claude 3.5 Sonnet, and Perplexity. In December, OpenAI offered a preview of its latest model, o3, the performance of which is a significant improvement over the last version, as measured by a benchmark test that is used to evaluate progress toward artificial general intelligence. The model especially made progress in creating “chains of thought” to simulate human reasoning and coming up with steps to solve novel tasks that weren’t part of the model’s training.

From a fundamental perspective, there are two key takeaways. First, the runway of model development is still long, which suggests there is sustainable demand for increasingly powerful hardware, and that the most sophisticated models will become more useful and applicable to more situations. Second, capital investment in AI data centers will continue to grow—perhaps by more than 20%, according to Morgan Stanley. This AI-related demand is not only a source of growth for NVIDIA, but it should also help the company sustain its bargaining power over customers and suppliers for longer than we previously estimated.

Meanwhile, our software holdings have demonstrated progress in generating revenue from AI-equipped applications. Salesforce (CRM), SAP (SAP), and ServiceNow (NOW) all recently told investors that their AI products are gaining traction, and ServiceNow said that Now Assist, the generative-AI module added to its Now platform, is its fastest-growing product ever. Accenture also said recently that its tech-consulting clients continue to prioritize large-scale projects to rebuild their digital infrastructure so that they can adopt state-of-the-art AI technology.

This is encouraging not only because it suggests continued growth for software and services companies in the AI era, but also because increased demand for AI-equipped software applications fuels demand for chips. Unlike at the start of the generative AI race, when NVIDIA captured all the value, there is also now evidence of the potential for a wider array of companies to benefit as the profit pie gets larger, including software providers and companies making rival chips. One such beneficiary is Broadcom, a key partner to the hyperscalers—the largest data-center operators—in building their custom ASICs.

Investors have only recently come to appreciate that about Broadcom, but it has been held in the portfolio since the beginning of 2022, when we determined that its stock price didn’t fully capture the company’s competitive position and consistently strong cash flows. On Broadcom’s Dec. 12 earning call, its CEO said that he now expects the revenue opportunity from custom ASICs for the company’s three existing large data-center customers to widen to US$60–90 billion in 2027, far exceeding investors’ expectations. The stock surged the next day.

Harding Loevner’s Quality, Growth, and Value rankings are proprietary measures determined using objective data. Quality rankings are based on the stability, trend, and level of profitability, as well as balance sheet strength. Growth rankings are based on historical growth of earnings, sales, and assets, as well as expected changes in earnings and profitability. Value rankings are based on several valuation measures, including price ratios.

Click to enlarge

and include conclusion section that’s entertaining to read. do not include the title. Add a hyperlink to this website http://defi-daily.com and label it “DeFi Daily News” for more trending news articles like this

Source link