honglouwawa

The financial market’s landscape is as ever-changing as the seasons, and within this dynamic environment, insights from experts are like the North Star for navigating investment routes. On a day that seemed just like any other, CNBC’s broadcasting studio buzzed with anticipation as a seminal discussion on the S&P 500 potential earnings for 2025 was set to take place. The guest of the hour was Tom Lee, whose analytical prowess is backed by his role at FundStrat, a firm renowned for its in-depth research work.

With the calm and collected demeanor characteristic of someone who speaks numbers for a living, Lee conveyed his projections, stating that he anticipates the S&P 500 full-year earnings for 2025 could range between $260 and $280. This revelation, seemingly simple, carried the weight of numerous implications for investors, analysts, and the broader market ecosystem.

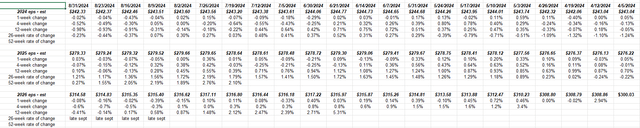

Following Lee’s insights was an even deeper dive into the realms of numbers and forecasts. A trend analysis unfurled, shedding light on the S&P 500 EPS journey from early April of 2024 through 2026. The trend for the year 2025 stood out, not merely for its gradual ascent but for the stark contrast it posed against the more gloomy adjustments of its temporal neighbors, 2024 and 2026. This gradual, yet persistent, rise in estimates is a beacon not to be overlooked in the tumultuous seas of market speculation.

This beacon shines all the brighter when considering the broader landscape of technological advancements and their implications on market dynamics. The weekend promised the release of additional forecasts on the technology sector’s forward earnings estimates. Despite a lackluster performance in the stock market, where numbers have remained stagnant, the forward-looking estimates tell a story of slow, yet persistent, improvement. This narrative underscores the underlying strength and potential resilience in the tech sector, suggesting that there may be more than meets the eye when it comes to evaluating investment opportunities.

Conclusion – A Market of Marvels and Musings

The blend of anticipation, analysis, and the sheer unpredictability of markets always weaves a compelling narrative. In the backdrop of these discussions lies the broader economic canvas, highlighted by a 3% GDP increase, which itself is a testament to robust consumer spending. Yet, this seemingly positive indicator is juxtaposed with concerns about the bond market’s reception and the Federal Reserve’s focus on a diminishing job market amidst election-year anxieties.

With the imminent release of the August jobs report, speculation is rife regarding the potential for “net, new jobs added,” a figure anticipated to align with historical trends, yet shadowed by the recent impact of natural calamities like Hurricane Beryl. As the data unfurls, so too will the layers of analysis and strategy adjustments by investors and analysts alike.

Stepping back from the granularity of numbers and projections, the overarching tale is one of relentless pursuit – the pursuit of understanding, of strategic advantage, and ultimately, of growth. It is a tale punctuated by the highs and lows of market dynamics, the serendipity of forecasts meeting reality, and the unending quest for clarity amidst uncertainty. Through this saga, outlets like DeFi Daily News remain your steadfast companion, shedding light on the evolving narrative of finance and investment.

As we venture forward, let’s do so with a curiosity that’s bounded not by the fear of volatility but inspired by the potential of discovery and opportunity. The markets may be a maze, but within it lies the treasure of insight, waiting to be unearthed by those willing to embark on the journey.

Thank you for joining me on this exploration. Here’s to the adventures that lie ahead in the vast expanse of the financial markets. Until next time, keep navigating with insight and foresight.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.