piranka

Software truly seems to be more of a need than a want in today’s civilization. Developments in Artificial Intelligence, Augmented Reality, Blockchain, and Internet of Things are at all-time highs. Businesses and individuals alike are becoming more reliant on digital solutions to enhance how we live, work, and connect with others. SPDR S&P Software & Services ETF (NYSEARCA: XSW) provides investors with wide exposure to this industry, from the big-name tech companies to dozens of small-cap growth companies.

XSW invests in stocks of companies operating across information technology, software and services, IT services, IT consulting, application software, and systems software sectors. The ETF offers a unique and strategic way to invest in a diverse range of companies involved in the broad landscape of the ever-changing software world.

Seeking Alpha

Seeking Alpha

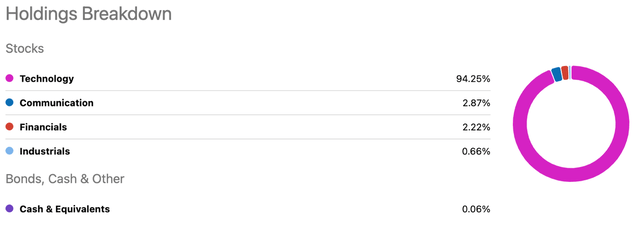

To no surprise, XSW is 94% comprised of companies from the technology sector. Now, what may be a surprise is the above list of the top 10 holdings for the ETF. They aren’t your typical household names dominating the media and topics of discussion. It’s also rare in any ETF to have your largest holding come in at just 1.14% of the entire portfolio. This is because of the ETF’s less common equal-weighting approach. It makes XSW a unique investment opportunity, but not necessarily a better one, in fact, the exact opposite.

The software industry is extremely top-heavy and concentrated with a few massive companies dominating the daily news. ETF’s providing exposure to the industry have the chance to address these challenges. XSW does so by broadening its mandate to include services firms and equal-weighting its portfolio to reduce concentration in the top industry companies. Ultimately, the fund delivers on its mandate to invest in both software and services and emphasizes the latter. Its equal-weighting style, which is rebalanced quarterly, produces tilts toward smaller, growth-oriented companies.

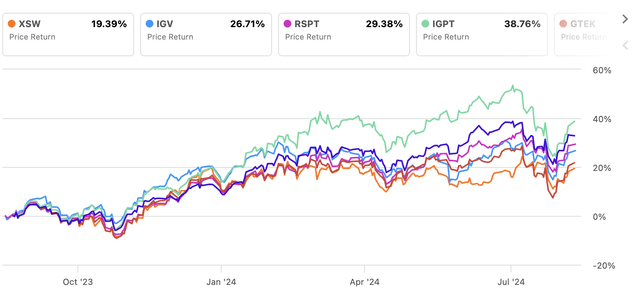

Unfortunately for XSW, this approach seems to be more restraining than anything. While it may sound nice to have an ETF that proportionately includes the smaller companies, it’s not as fun to see lesser gains than similar funds reaping the benefits from the biggest players.

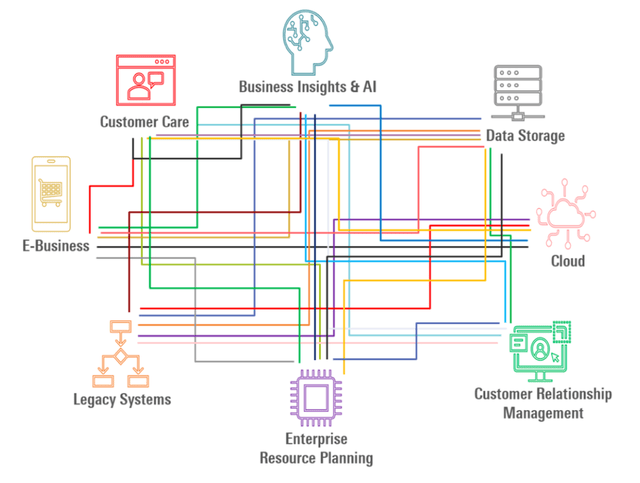

Tech Target

Businesses are increasingly looking for software solutions that can help them streamline their processes, reduce costs, and improve efficiency. Cloud-based software solutions have become increasingly popular due to their flexibility, scalability, and cost-effectiveness. This uncapped innovation is a huge advantage for the industry and allows for easier scalability for small companies, which XSW has a plethora of.

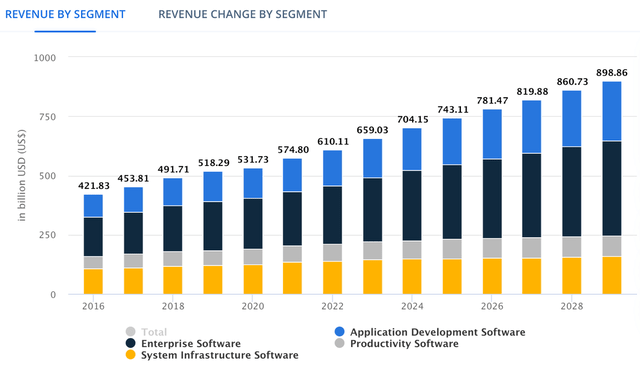

Another pro for the industry is how software can be distributed globally with relatively low marginal costs, allowing companies to tap into international markets without as much challenge as other sectors. The revenue by software segment has been increasing year-over-year for over a decade and all projections show nothing different into the next decade.

McKinsey

As positive as it all seems, there is still a downside to the software industry. Technological advancements happen faster than the consumer can keep up with, forcing software companies to constantly be making changes and updates to keep pace with competitors. Regulations, compliance issues and data breaches are all other problems companies within XSW must navigate as well.

But the biggest issue for this industry and specifically for XSW is market saturation. With thousands of small caps and start-ups there are many players in the game, and it can be highly competitive. The “big dogs” like Microsoft, Oracle, and Salesforce for example, can really take over the industry and make it very difficult for smaller businesses to make an impact. Although, XSW does hold some of the big leaders in this space, the ETF’s allocation to them is significantly smaller than its other software competitors.

Seeking Alpha

The chart above shows the 1-year performance for XSW relative to its peers. A big reason why we have XSW as a hold right now, and certainly not a buy is because of its underperformance to similar ETF’s. Even though the software and services industry has generous room for growth and need, it’s hard to justify a “buy” rating when there are other similar ETF’s seeing better gains. Others that focus more on strictly software or include holdings from other tech spaces are seeing better performance. Even RSPT, another equal weighted technology ETF, has climbed noticeably higher than XSW. The “services” side of XSW, along with its equal-weighted approach will hold it back from considerable gains. The ETF offers an interesting opportunity to the risk-averse investor, but the lack of “star power” is the biggest concern for now.

—

In conclusion, the software industry continues to be a pivotal part of our modern world, driving innovation and connectivity across various sectors. While SPDR S&P Software & Services ETF (XSW) offers investors exposure to a diverse range of companies in this industry, its unique equal-weighting approach may not always translate to optimal gains compared to its peers.

The software industry’s potential for growth is undeniable, with cloud-based solutions, global distribution, and consistent revenue streams painting a positive picture. However, challenges such as rapid technological advancements, regulatory compliance, and market saturation pose significant hurdles for companies within XSW.

While XSW’s emphasis on smaller, growth-oriented companies provides a unique investment opportunity, it may limit its ability to compete with ETFs focusing on larger industry players. As investors navigate the dynamic landscape of the software industry, weighing the pros and cons of XSW against alternative investment options becomes essential for informed decision-making.

For more trending news articles related to software and financial technology, visit DeFi Daily News. Stay informed and stay ahead in this ever-evolving industry!

Source link