shotbydave

Welcome to the August 2024 cobalt miners news.

The past month saw cobalt prices lower, hitting an 8-year low.

Cobalt Price News

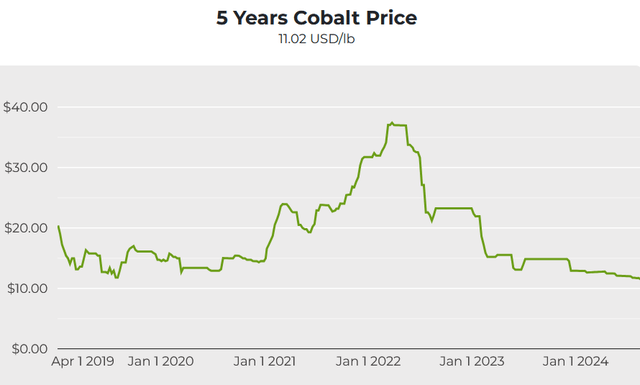

As of August 23, the cobalt spot price was at US$11.02/lb, down from US$11.77/lb last month. The LME cobalt price is US$24,065/tonne. LME Cobalt inventory is 115 tonnes, same as 115 tonnes from last month. More details on cobalt pricing (in particular the more relevant cobalt sulphate) can be found here.

Cobalt spot prices – 5-year chart – USD 11.02 (source)

Mining.com

Cobalt Demand v Supply Forecasts

You can view the latest Trend Investing cobalt demand v supply article here.

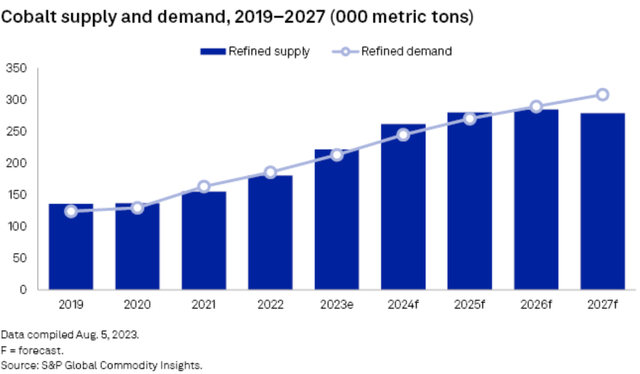

S&P Global Intelligence cobalt demand v supply forecast as of Aug. 2023 (deficit in 2027) (source)

S&P Global

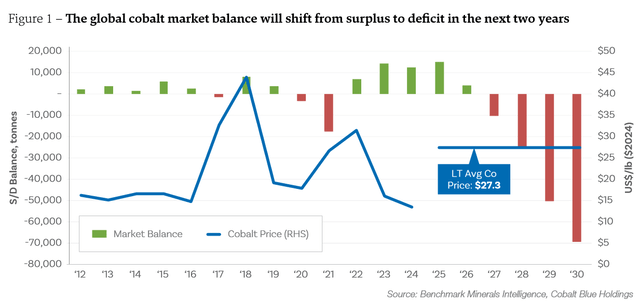

The global cobalt market balance is forecast to shift from surplus to deficit in the next two years (as of June 2024) (source)

Cobalt Blue, BMI

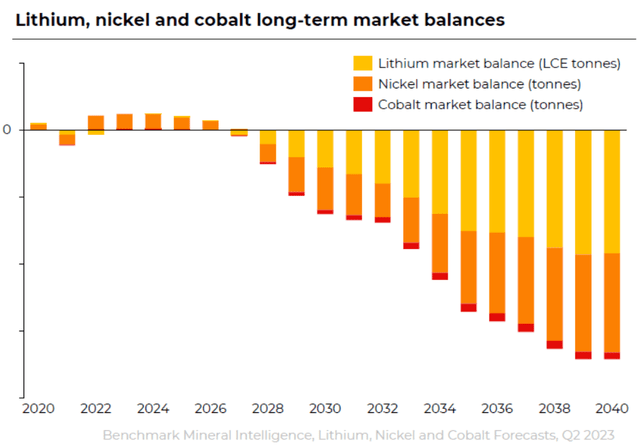

Benchmark Mineral Intelligence forecasts deficits for lithium, nickel & cobalt to increase from 2027 onwards (source)

BMI

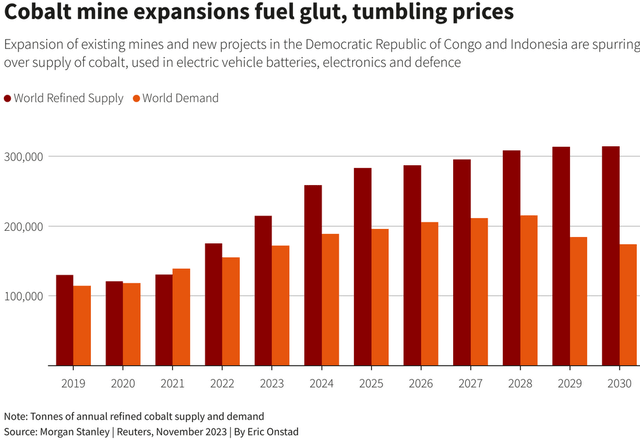

Morgan Stanley forecasts cobalt surpluses to grow this decade (as of Nov. 2023) (source)

Morgan Stanley

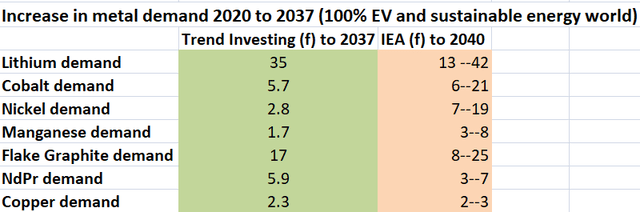

Trend Investing v IEA 2021 demand forecast for EV metals (Trend Investing) (IEA)

Trend Investing & the IEA

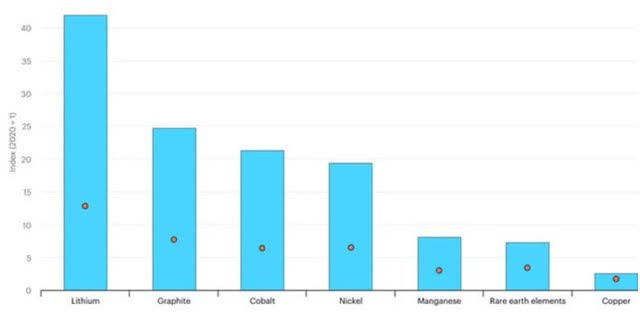

2021 IEA forecast growth in demand for selected minerals from clean energy technologies by scenario, 2040 relative to 2020 – Increases Of Lithium 13x to 42x, Graphite 8x to 25x, Cobalt 6x to 21x, Nickel 7x to 19x, Manganese 3x to 8x, Rare Earths 3x to 7x, And Copper 2x to 3x

IEA

Cobalt Market News

On July 22 Investing News Network reported:

S&P Global: US outpaced by most other countries in mine development times…The document reveals that it takes nearly 29 years on average for a US mine to progress from discovery to production, compared to 27 years in Canada and 20 years in Australia. Only Zambia takes longer at an average of 34 years…Without domestic supply, the US remains vulnerable to supply chain disruptions and geopolitical tensions. With that in mind, the Biden administration has recognized the need to secure domestic sources of important commodities and has taken steps to address lengthy mine approval timelines. For example, the Infrastructure Investment and Jobs Act includes provisions that prioritize energy and critical minerals research, and also allocates funds for mineral extraction.

On July 30 Fastmarkets reported: “Supply surge pushes Chinese cobalt metal prices to eight-year low.”

On August 22 Reuters reported:

Cobalt supply tsunami hits the market of last resort…The appearance of so much metal at the dormant market of last resort is a sign of chronic global supply glut…This time around the supply boom is being driven by a structural combination of capacity expansion in the Congo and fast-rising output from Indonesia.

On August 22 Fastmarkets reported: “China’s July cobalt metal export and intermediate import numbers raise market concerns about continued oversupply.”

On August 22 The Guardian reported:

US military announces $20m grant to build cobalt refinery in Canada. Pentagon investment would make North America’s first cobalt sulfate refinery as US looks to diversify supply chain. The US military has made its largest investment in Canada’s mining sector in decades…Electra Battery Materials says when the operation, located between the town of Cobalt and Temiskaming Shores, is up and running, it will be North America’s only cobalt sulfate refinery, capable of producing battery-grade materials…

Cobalt Company News

CMOC Group Limited [HKSE:3993] [SHE:603993] (OTCPK:CMCLF) (formerly China Molybdenum)

No significant news for the month.

Glencore [HK:805] [LSE:GLEN] (OTCPK:GLCNF)

On July 30, Glencore announced:

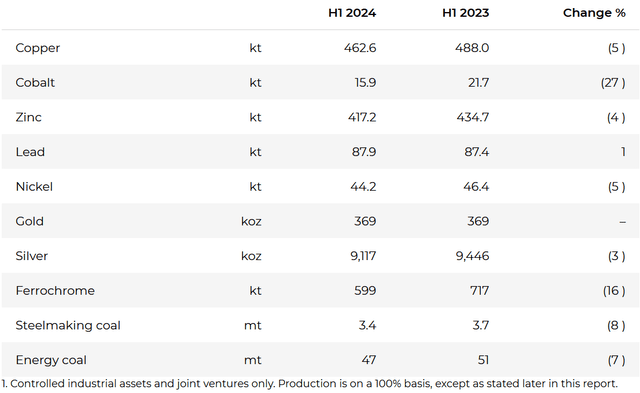

Half-Year Production Report 2024… Glencore Chief Executive Officer, Gary Nagle: “Across the portfolio, our full-year 2024 production guidance has been maintained…Key anticipated H2 over H1 higher production levels include African Copper: +c.30kt (recovery from H1 mill outage, access to higher grade ores and higher throughput rates at Mutanda), Antapaccay: +c.8kt (recovery from H1 geotechnical event), Kazzinc: +c.60kt (continued ramp-up at Zhairem) and Murrin Murrin: +c.3kt (reflecting the timing of its annual shutdown in April).

PS: As shown below H1, 2024 cobalt production was down 27% YoY at 15.9kt.

Production from own sources – Total1 (source)

Glencore

On August 7, Glencore announced: 2024 Half-Year Report. Glencore’s Chief Executive Officer, Gary Nagle, commented:

Against the backdrop of lower average prices for many of our key commodities during the period, particularly thermal coal, our overall Group Adjusted EBITDA of $6.3 billion was 33% below the comparable prior year period, however Funds from Operations were up 9%, due to the timing of income tax payments . We reported a Net loss attributable to equity holders of $233 million, after recognising $1.7 billion of significant items, including c.$1.0 billion of impairment charges.

“Reflecting healthy cash generation and after funding $2.9 billion of net capital expenditure and $1.0 billion of shareholder returns, Net debt, including Marketing-related lease liabilities, finished the first half at $3.6 billion, down $1.3 billion compared to $4.9 billion at the end of 2023.”

Zhejiang Huayou Cobalt [SHA:603799]

On August 16, Huayou Cobalt announced:

Huayou and Hyundai Glovis build a new pattern of Battery Recycling Industry Chain…Hyundai Motor Group’s vision of the right move for the right future coincides with the concept of Huayou Recycling, and strengthening communication and enhancing mutual trust will open up a broad space for lithium material recycling…the two sides will carry out in-depth strategic cooperation in the construction of special logistics system for waste power batteries, R&D, manufacturing and global market expansion of energy storage systems, power battery pretreatment and recycling of key materials.

On August 20 Huayou Cobalt announced: “Promoting low-carbon development in the industry, Huayou Indonesia participates in the 2nd LIKE Festival.”

Jinchuan Group International Resources [HK:2362]

On August 14, Jinchuan Group announced:

Operational update for the six months ended 30 June 2024 and positive profit alert…The Group produced 681 tonnes of cobalt content included in cobalt hydroxide in 2024 1H, representing a decrease of approximately 50% as compared to that of 1,364 tonnes in 2023 1H due to the lower ore feed grade and the continual decline in cobalt market prices in 2024 1H. The Group had adjusted its production plan to reduce the cobalt output and decided to temporarily cease the cobalt production in late May 2024 so as to devote more resources to the production of copper…the Group is expected to record a profit attributable to the Shareholders of not less than US$5 million for 2024 1H.

Chemaf (subsidiary of Shalina Resources) – to be taken over by Norin Mining Limited in Q4, 2024

No news for the month.

GEM Co Ltd [SHE:002340]

On August 17 GEM Co announced:

GEM and EVE collaborate to create a benchmark project for the commercial and industrial energy storage industry chain…on August 14, 2024, a grand signing ceremony was held for the 60.2MW/120.4MWh energy storage project between Jingmen GEM Co., Ltd. (hereinafter referred to as “GEM”), a subsidiary of GEM Co., Ltd., and Hubei EVE Digital Energy Technology Co., Ltd. (hereinafter referred to as “EVE”), a subsidiary of EVE Energy Co., Ltd…Once completed, the project will become the largest commercial and industrial energy storage project in Hubei Province…The project is located in the GEM (Jingmen) New Energy Materials Circular Economy Low-Carbon Industrial Park and will use lithium iron phosphate batteries produced at EVE’s Jingmen factory… the project is scheduled to be officially operational in the second half of 2024.

On August 19 GEM Co announced:

GEM and South Korea’s EcoPro BM forge 265,000-ton precursor supply agreement, marking a new milestone in strategic cooperation across the entire industry chain of secondary battery raw materials.. Both parties have agreed that from 2025 to 2028, EcoPro BM will additionally

Source link