gustavofrazao

Manole Capital Management

6th Annual Gen Z Survey: Brokerages

August 2024

Introduction:

Manole Capital Management is a boutique asset management firm based in Tampa, Florida, that exclusively concentrates on the emerging FINTECH industry. Manole Capital defines FINTECH as “anything utilizing technology to improve an established process.”

Manole Capital has asked its interns to research the Gen-Z demographic for the last seven years. Manole Capital’s goal with this research is to better understand Gen-Z perspectives and knowledge of financial services. We inquire about current opinions, perspectives, and trends in four key financial services: digital currencies, brokerage, banking, and the payments industry. This prior research can be viewed by clicking here or visiting: www.manolecapital.com/research.

2024 Interns:

This year, our research was conducted by 12 interns, all from different colleges and universities across the United States. We want to thank Luis Jasso (California State University, Fullerton), Cameron McCann (Virginia Tech), Aleksander Jopek (New York University), Moda Kurma (Cornell University), Kerwin Xu (Cornell University), Shruti Pokharna (Cornell University), Cameron Keaton (University of Notre Dame), Sai Vetcha (University of North Carolina, Chapel Hill), Noah Akiona (Newman University), Anish Gundimeda (University of Southern California), Jigyasa Nabh (Northeastern University), Joshua Missaghi (Yeshiva University), and Arvin Anbarasu (University of Virginia).

Participants:

As part of our study, we surveyed and received insights from over 275 participants, with 94% in our targeted Gen-Z demographic. 24% of respondents identify as female and 76% identify as male. 80% of our responses were from the United States and 20% were international. We had strong participation from individuals in India and England. Our surveyed population came from over 85 different colleges and universities and included dozens of high school students. Thank you to all who participated.

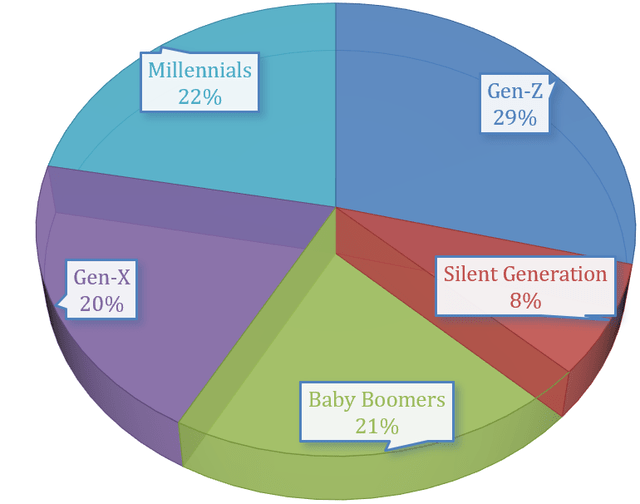

Generations:

Manole Capital chart

Baby Boomers were born from 1946 to 1964 Gen-X was born between 1965 and 1980 Millennials were born between 1981 and 1996 Gen-Z was born from 1997 to 2012

Having been brought up in a world that predates modern technology, Baby Boomers value personal relationships immensely and have strong interpersonal skills. Having lived through the dawn of the digital age, Baby Boomers were forced to learn new technologies quickly. Baby Boomers are often characterized as optimistic, idealistic, self-driven and have shown a tendency to be loyal. From a financial standpoint, studies show that Baby Boomers spend an average of 15 years with their bank or brokerage. After years of climbing the corporate ladder, many are currently exiting the workforce, enjoying retirement, and spending time with their family.

Gen-X is sometimes referred to as the “lost generation.” Many Gen-Xers had parents who worked around the clock, while others were raised by single or divorced parents. Because of this, Gen-X tends to place a greater emphasis on work-life balance. Often, Gen-X cohorts have more individualistic ideals and are often self-sufficient, skeptical, and resourceful.

Having been the first generation to master modern technology, Millennials are successful and driven. However, some have become too dependent on technology and thus, their interpersonal skills have suffered. As opposed to being raised by authoritative Baby Boomers, Millennials have been raised by Gen-X individuals, who tend to view parenthood as a partnership. Accordingly, Millennials were given more leeway and leniency, paving the way for some to display a degree of selfishness and greed.

Why Study Gen-Z?

Recent research from the United Nations and Jefferies indicates that there are over 2 billion Gen-Zer’s worldwide, representing over 30% of the global population. Asia has the largest concentration of Gen-Zer’s, being home to 58% of this demographic. Africa is 2nd at 23%, Latin America/Caribbean is 3rd at 9%, Europe is 4th at 6%, and North America being 5th at 4%. 90% of Gen-Zer’s are currently in emerging markets, with India being the single largest country with exposure. For perspective, the United States is the 6th largest Gen-Z population with 68.6 million.

In the last few decades, Baby Boomers have dominated the workforce in the US, but recently gave way to Millennials. This title will shortly switch from Millennials to Gen-Z; by 2025, Gen-Z should make up 27% of the workforce. In the US alone, Gen-Z’s 2023 income amounted to $360 billion, and by 2030, their global income is expected to reach $33 trillion, representing more than a quarter of the world’s total income. Gen-Z represents the future of our economy, and thus, we ought to give weightage and importance to their views.

In terms of wealth, this group is slated to inherit a significant amount of money from their Baby Boomer, Millennial, and Gen-X relatives. The transfer of wealth from Baby Boomers, Generation X, and Millennials to Gen-Z is projected to exceed $68 trillion over the next few decades. Understanding how Gen-Z views financial services should provide valuable insight into banking, brokerage, and spending trends that will impact various facets of our global economy. We hope this analysis provides a keen understanding of Gen-Z perspectives and behaviors.

Optimism?

We started our survey by asking, “Are you positive or negative about the US economy?”

We anticipated that Gen-Z would be generally optimistic about the US economy, and believed the responses would skew significantly positive (in the 75% to 80% range). However, our results did not reflect this type of encouraging outlook. While 60% of our respondents were positive on the US economy, there were 40% that skewed negative.

In the below sections, you will find each question that the Brokerage team asked of its respondents, as well as our opinions and big-picture takeaways from our survey results.

Question #1:

We started our survey with a very simple question. Do you have a brokerage account?

We have been doing these Gen-Z surveys for the last six years and the results are beginning to show some dramatic changes. Back in 2018, Manole Capital’s Gen-Z survey found that only 17% of Gen-Z had a brokerage account.

In this year’s survey, 56% reported having a brokerage account, 17% of respondents currently do not have a brokerage account but are interested in opening one and surprisingly, 27% of our respondents are NOT interested in opening a brokerage account right now.

Over the last six years, Gen-Z has clearly embraced investing – with account interest up by 3.5x! However, the results seem to be plateauing. For example, our 2021 survey found that 64% of Gen-Z had a brokerage account and another 23% were interested in opening one. Combining account owners and those interested, our results are modestly lower than three years ago.

In our opinion, we believe there are a few factors that could explain the decrease of Gen-Z brokerage accounts versus a few years ago. For some, it might not be a lack of interest, but a lack of resources and capital. Skyrocketing college tuition costs and persistently high inflation pressures could be responsible for the lack of brokerage account growth. Another potential reason why people may be less inclined to open a brokerage account is that they are afraid to take risks. Plus, some might prefer keeping their money at their bank, where cash is now earning a healthy return of 4% to 5%. Our takeaway is more “glass half full”, and we believe that Gen-Z is interested in the stock market and continues to open up brokerage accounts (17% in 2018 versus 56% in 2024). Over the next few questions, we will try to uncover where Gen-Z is investing, what they are investing in and what they want to get from their brokerage firm.

Question #2:

In this question, we sought to pinpoint where Gen-Z had their brokerage accounts. The results were interesting…

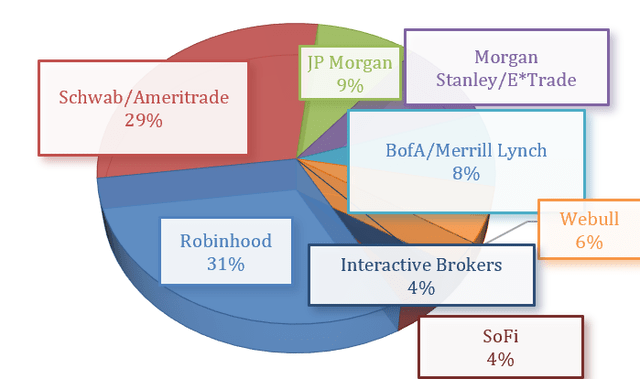

Manole Capital chart

Our survey work is depicted in this pie chart below, which shows that Robinhood is in 1st place, with 31% market share of Gen-Z. In 2nd place and relinquishing its title is Charles Schwab/TD Ameritrade, which now sits at 29%.

A distant 3rd, 4th, and 5th place were JPMorgan Chase, Morgan Stanley/E*TRADE, and Bank of America’s Merrill Lynch. The rest of the pack were Webull, SoFi, and Interactive Brokers, which combined for just 14%.

This year, it is clear that Robinhood has made the largest jump forward, while Schwab had the largest decline. Back in 2022, the last time this Gen-Z brokerage survey was conducted, Schwab dominated, with 38% (down 9% in ’24) of respondents reporting them as their preferred brokerage platform. Robinhood was in 2nd place, with 28% (up 3% in ‘24), Bank of America’s Merrill Lynch placed 3rd at 14%, followed closely by Morgan Stanley/E*TRADE at 11%. So, Robinhood is gaining market share, while more established players like Schwab, Merrill Lynch and Morgan Stanley/E*TRADE are all declining.

In Robinhood’s May 2024 Monthly Metrics Press Release, it stated that investment accounts grew by 120,000 and are now at 24.1 million. While this is healthy growth in new accounts, the average account at Robinhood is only $4,000. In comparison to Schwab, new accounts grew by 314,000, with the total accounts being 35.5 million and the average account is $234,000, Gen-Z simply does not have the amount of money that seems to be at the more traditional and larger brokerage firms.

Based on our results from this question, we can analyze why Robinhood is currently the most popular brokerage for Gen-Z. Interestingly, Robinhood has stated that they have “picked up new customers since the last group of TD Ameritrade users moved to Charles Schwab”.

According to a May 2024 article in MarketWatch (attached here), some Schwab customers are unhappy with its mobile application and user interface. As our next question discusses, ease of use is an important factor for Gen-Z when selecting their preferred brokerage platform. We believe that Gen-Z clearly favors Robinhood for its easy-to-use mobile interface.

Question #3:

Our next question attempts to understand what is influencing Gen-Z to select their preferred brokerage firm. We asked, “What factors influenced your brokerage choice?”

The most important factors this year were:

ease of use no fees/commissions recommendations from others

The survey in 2022 asked the question in a somewhat different way. They asked what the most important factor was when choosing a brokerage, not all factors that influenced their choice. The data from 2022 shows that although 43% of people chose “free trading” as the most important quality, only 1% of respondents chose “ease of use” as the most important quality. With most brokerages now offering free trading, it has become a less crucial factor for Gen-Z. In turn, ease of use has become the most important characteristic for Gen-Z when choosing a brokerage. With brokerages today constantly updating their intuitive mobile apps, it will be interesting to see what factors will influence these choices in the future.

Another crucial quality that Gen-Z is looking for in a brokerage platform is how recommended it is by their peers. This year, we asked respondents if “recommendation from others” influenced them to choose a brokerage, and nearly 21% responded in the affirmative. With Gen-Z being the youngest cohort that can invest, it is intuitive that they will be picking a brokerage platform that many people say is the best, with factors of how easy the app is to use and if trading is free. Therefore, it makes sense that they will be more likely to open a brokerage account with a firm that has a good reputation and/or recommended by their parents, older siblings or friends. The members of Gen-Z who do not find recommendations from others important may be in the older portion of the cohort who are already established and experienced investors.

Two traits that do not seem to be important to Gen-Z are banking and robo-advisor services. It is notable that as we move into a generation where more and more services are accessible from one firm, banking services are still not an important feature within a brokerage app. Another 2024 intern team is focused on the trends experienced by Gen-Z in the banking industry. Please look at their note to better understand what Gen-Z looks for in banking products. In early July 2024, Robinhood acquired Pluto Capital, which will offer investment research powered by artificial intelligence to Robinhood users. With advancements in AI and machine

Source link