GeorgiNutsov/E+ via Getty Images

Cannabis rescheduling approaches

July 22 marks another step forward in the highly important process of rescheduling cannabis from DEA Schedule 1 to Schedule 3. As we get closer to rescheduling, it’s time to look at how and when cannabis investors can be ready for this momentous event. In this article, we will nail down the timeline, review what it means, and look at one company well-prepared to benefit from it.

July 22 is the end of the public comment period for the proposed rescheduling rule. After a review by an administrative law judge, the final rule will be published in the Federal register, possibly as soon as August 22. Thirty days after that, the final rule goes into effect, which means that rescheduling could occur as soon as September 22.

This regulatory timeline is by no means certain. A full administrative hearing, if it occurs, would delay the process, and no doubt there will be lawsuits filed by anti-cannabis groups to stay or negate the new rule. Such roadblocks are by no means certain, however. A full hearing is not mandatory, and litigation does not require a stay — the new rule often remains in effect while it is being litigated. The timeline for re-rating cannabis stocks higher is also uncertain. My best guess is around August 22 when the new rule is promulgated or around September 22 when it goes in effect. There were two occasions in the past 12 months when stock prices jumped:

August 29, 2023: When the Biden administration announced that they had initiated the process of rescheduling. April 29, 2024: The proposed rule was submitted for a public comment period.

The table below uses AdvisorShares Pure US Cannabis ETF (MSOS) as an industry proxy. After each announcement, stock prices rose substantially, with the lion’s share of the gains in the first day. The message is clear: To participate in a news-driven cannabis rally, you should be fully invested beforehand; if you wait for the event, you can miss most of it. Similar cannabis stock behavior also occurred at developments in earlier years as well.

MSOS

Rally start date

08/29/23

04/29/24

Price before announcement

4.85

9.02

Price at peak

9.13

11.26

Trading days to peak

8

1

Gain first day

40.4%

24.8%

Gain to peak

88.2%

24.8%

Click to enlarge

The powers behind rescheduling

There is one very powerful reason why rescheduling is likely to move forward with utmost speed: The 2024 national election. The Democratic Party, and specifically the Biden administration, recognize that pro-cannabis legislation is a strongly favorable issue for them. Surveys repeatedly show that a large majority of Americans favor legalization. This sets up a stark comparison with the Republican Party, which has repeatedly tried to block access to cannabis. Just this year, we have had headlines like:

President Biden is responsible for getting the rescheduling this far, by using his power as chief executive. While it seems to be a setback that Biden has decided not to pursue re-election, he is still President until January. He and the incumbent administration will do all they can to get it across the finish line before the election to benefit from the political advantage.

Recap of why rescheduling is important to the cannabis industry

As a Schedule I substance, companies are not allowed to deduct most business expenses on tax returns. Consequently, they pay income taxes at very high rates. This punitive tax treatment would go away with a move to Schedule III, and free up many millions of dollars. For example, last year Verano paid $145 million in taxes on $938 million in sales. In a recent interview, Verano founder George Archos stated:

But when you actually think about what rescheduling can mean for us, you are right, 280E going away is probably the biggest near-term catalyst for our business, to the tune of over $80 million would drop to the bottom line if 280E didn’t exist in our world.*

(*280E is the part of the IRS Code that mandates punitive tax rates on cannabis companies.)

Mr. Archos is being somewhat hyperbolic here. Yes, canceling 280E may mean $80 million less in taxes paid, but much of that potential gain will be lost to competitive pricing pressures. Still, the major reduction in tax liability will strengthen Verano and all other US cannabis companies in numerous ways. To begin with, lower prices will increase sales volume.

Rescheduling will bring positive changes to virtually every company doing business in the US. But we all have limited funds and must still make decisions on whom to trust with our money. My overarching strategy is to invest in the best, most successful companies. The rationale is that companies that have shown the most success in cannabis so far will be the ones to most successfully adapt and take advantage of new developments in the industry. In other words, invest in superior management, not companies that are average or worse in this very tough industry. Rescheduling is the start of a new race, so to speak, and I want to be in the car with the best driver and best engine.

So how do we determine which companies have superior management? Fortunately, legal cannabis has been around long enough that companies finally have a substantial history. By looking at financials across companies, we can see which management have been successful (and most likely to continue their success). Spoiler alert: Green Thumb Industries (OTCQX:GTBIF) is at the top of the pack.

Comparing cannabis companies

Most of the following charts and tables below show data for five large multistate operators [MSOs] that can be considered peers: Green Thumb Industries, Curaleaf Holdings (OTCPK:CURLF), Verano Holdings (OTCQX:VRNOF), Cresco Labs (OTCQX:CRLBF) and Trulieve Cannabis (OTCQX:TCNNF).

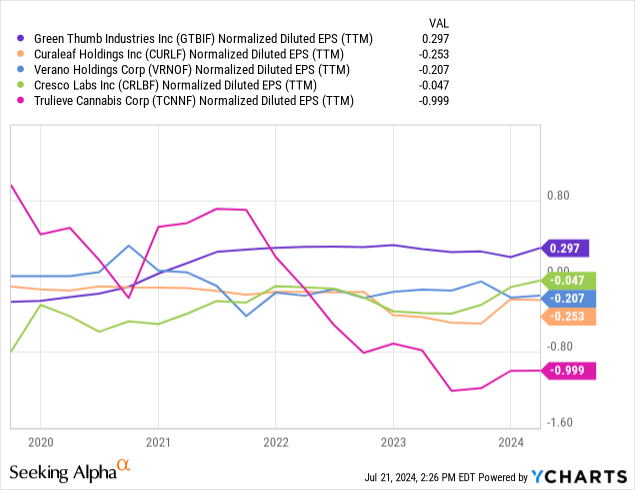

EPS Comparison

A company will not survive without profits. The table below shows the GAAP earnings per share for five larger companies: Green Thumb, Curaleaf, Verano, Cresco, and Trulieve Cannabis. Green Thumb is almost the only one with positive earnings over the last five years, and they have been remarkably consistent.

YCharts

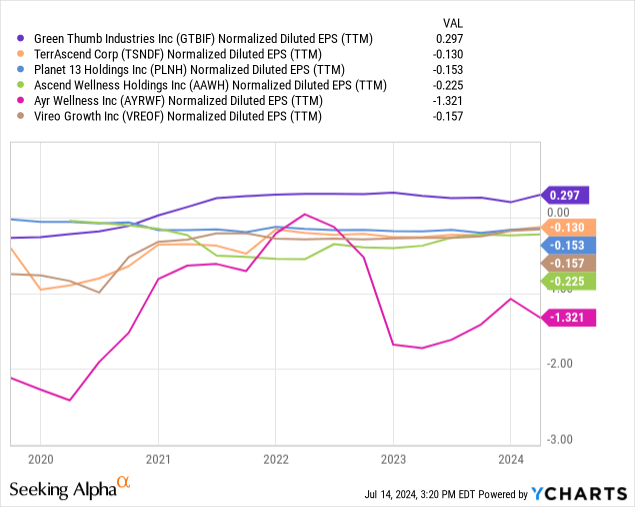

For readers curious about smaller competitors, here is EPS data for Green Thumb and four smaller cannabis companies: Terrascend (OTCQX:TSNDF), Planet 13 Holdings (OTCQX:PLNH), Ascend Corp. (OTCQX:AAWH), Ayr Wellness (OTCQX:AYRWF), Vireo Growth (OTCQX:VREOF). The superiority of Green Thumb is just as clear as in the previous chart.

YCharts

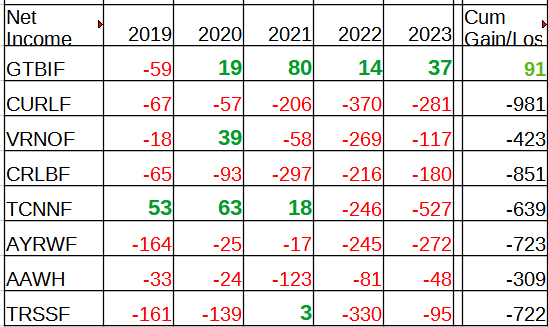

The data in table form shows that yes, it is possible to make a profit in cannabis, but only Green Thumb has cracked the code for doing it consistently. The numbers are for annual EPS, as opposed to TTM EPS in the charts above.

Seeking Alpha

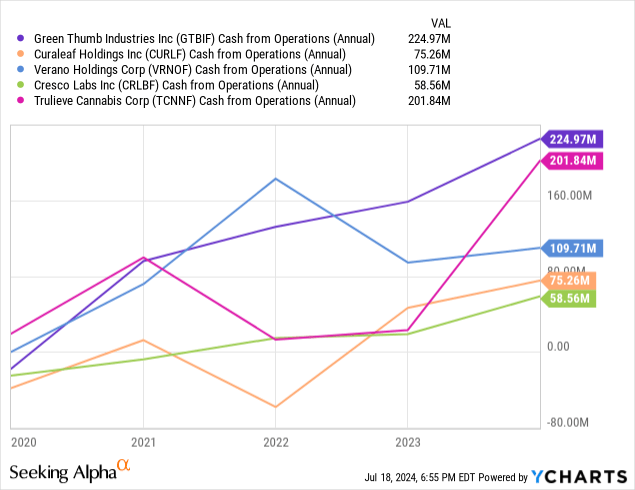

Cash flow

Operating cash flow is a metric that can be used in industries that have not yet reached GAAP EPS. Green Thumb stands out here as well. Not only does it generate the most cash from operations, but its consistency of growth stands out among the Big 5, along with Cresco.

YCharts

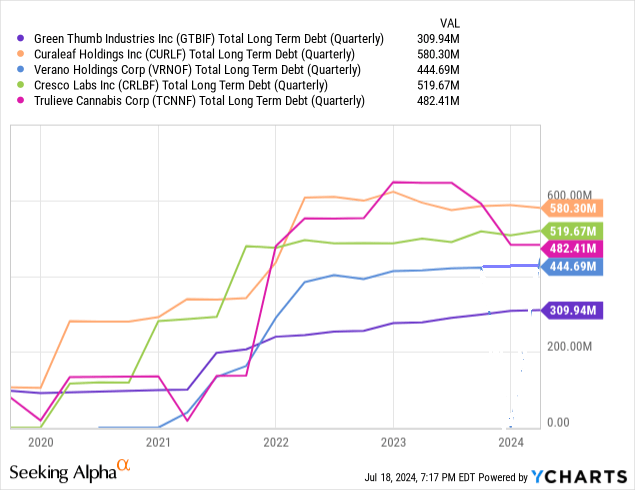

Funding: Long-term debt and shares outstanding

In a fast-growing emerging industry like cannabis, investors pay close attention to how growth is funded. Specifically, is it funded by debt, equity, or cash flows. In the table below, we see that Green Thumb used to be in line with other larger companies, but debt for the others has ballooned upwards. They now have significantly less long-term debt than the others, even those with a smaller market cap, i.e., Cresco and Verano.

YCharts

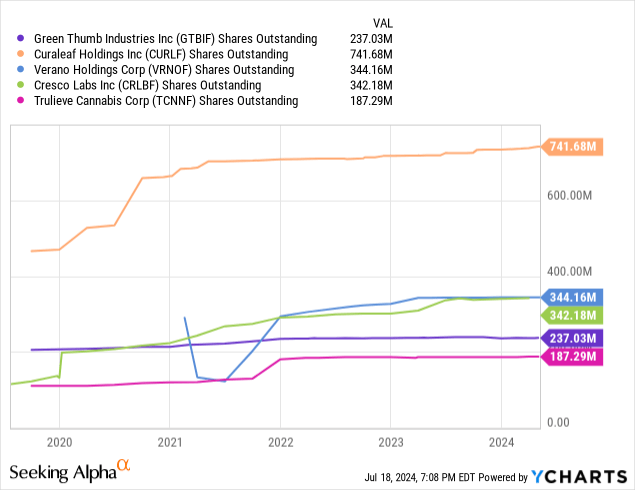

Green Thumb has also kept shares outstanding under control, as shown in the following chart. In fact, Green Thumb is already half-way through a $100 million share buyback, which is a strong statement of confidence in their financial position – buybacks are rare in the industry.

YCharts

The three charts above point indicate Green Thumb is able to fund its business from operational cash flow rather than borrowing money or diluting shareholders to a much greater degree than other big companies (and other, smaller cannabis companies). This is a more mature position to be in, particularly when the path to cash flows to pay off debt or reduce reliance on share issuance is quite opaque for much of the industry.

Risks

One of the biggest risks to this thesis is a delay or cessation in the rescheduling process, which would be a setback for all companies. Donald Trump is not a friend of cannabis. However, if the process is complete by election day as planned, it would be very difficult to reverse. On the company level, there are also the usual risks of investing in small emerging growth companies. A change in leadership at Green Thumb, or changes in business strategy, could hamper their performance. Fortunately, Green Thumb has had stable leadership which has, so far, managed the challenges of their industry well. They are the best in the current environment, where most business flows through MSOs — an environment likely to hold for the foreseeable future.

Investment case for Green Thumb

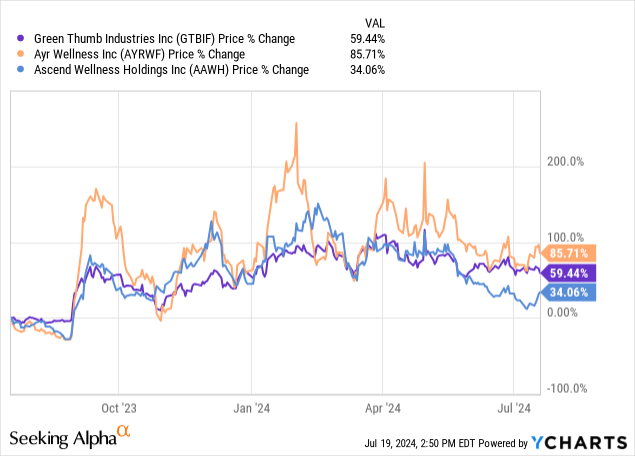

Rescheduling is an important milestone for the advancement of legal cannabis in America, marking a big step forward in the slow but inevitable progress of the industry. I fully expect a significant re-rating of cannabis stocks around the time when rescheduling is approved, before election day in November. The more volatile stocks, like Ayr Wellness and Ascend Wellness, may go up more than relatively stable stocks like Green Thumb. Some of the relative volatility is illustrated in the following chart.

YCharts

I am certainly taking

Source link