Art Wager

Chart Industries (NYSE:GTLS) made an acquisition in a way that had Wall Street running for the exits about a year or so ago. An article covered the fact that the stock had lost about half of its value in one day with more losses to come, likely because Mr. Market hated all that debt. Articles since then, including the last one, have noted how management has executed as planned.

Earnings Doubts

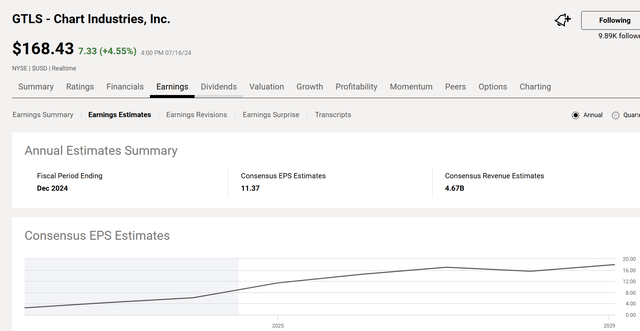

But a quick look at the website’s earnings estimates average demonstrated that no one believed management’s estimates for the current fiscal year. This is in addition to the debt issue.

Quant System Summary Of Earnings Estimates For The Current Fiscal Year (Seeking Alpha Website July 16, 2024)

This earnings doubt is likely due to the debt load and a general feeling that management wants no one to worry about the leverage. However, a company with long lead times probably knows what it will earn unless a major project it supplies products to has a delay. Even then, the company does not lose the sale, that sale simply moves to a later quarter.

But sometimes the market just gets an attitude that’s hard to shake. Logic appears to go out the window.

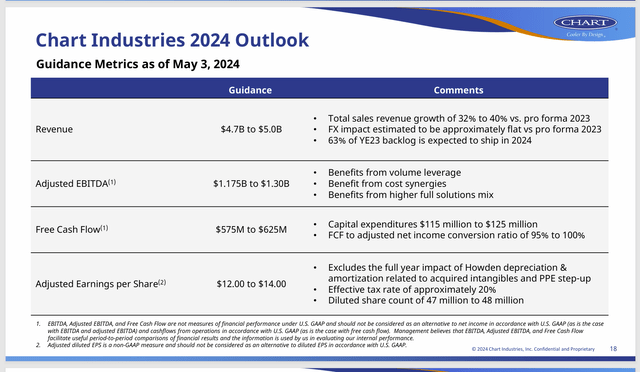

Chart Industries Management Guidance For The Fiscal Year (Chart Industries Corporate Presentation First Quarter Earnings Conference Call Made 2024)

As shown here, clearly there’s still a difference between management guidance and the general market stance on earnings for the current fiscal year. That’s despite the fact that much of the business has long lead times, and therefore management has an unusually visible view to earnings for the fiscal year. At this point, even small orders are unlikely to change earnings much.

Note that management is excluding some noncash adjustments from their earnings. But they have done that all along.

Probably the biggest issue is that adjusted earnings are guided to more than double from the previous year, and Mr. Market just cannot believe that.

Institutional Response

All this week, the market has been adding this stock to buy lists in one form or another. Here’s an example:

“Chart Industries pops as Raymond James adds to favorites list.”

This article was from the Seeking Alpha Website. But the five-day activity shows a bunch of these happening.

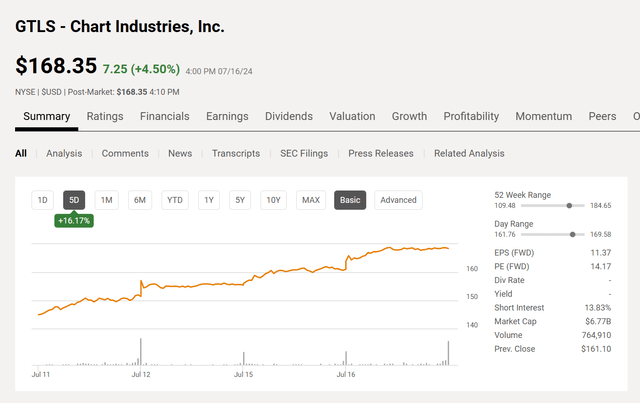

Chart Industries Stock Price History And Key Valuation Measures (Seeking Alpha Website July 16, 2024)

The net result of all of these adds is a stock price jump of roughly $40 per share in about a week (give or take) since the whole “adding to the buy list” throughout the market began.

Smaller investors, who knew that management was executing as planned or even had faith that management would execute as planned despite all the leverage in the beginning, could have purchased shares below $100 some months ago.

The interesting thing is that because the market hated the debt, the market decimated the stock price. Now that the debt ratio is coming down with a big jump in EBITDA (because adjusted earnings will more than double), Mr. Market is now deciding that things are not so bad after all.

The thing to keep in mind is that management projects it will grow earnings at an up to 40% pace for the foreseeable future. That could well mean that this stock recovers the old price earnings ratio in the 30s. As much as the stock has climbed in the last few days, a high-priced stock like this with relatively few shares outstanding (“you ain’t seen nothing yet”) can really get going. This is why this is one of the most volatile stocks I follow.

Trades On Order Intake

In more normal times, this stock tends to trade on order intake because earnings are so well known in advance.

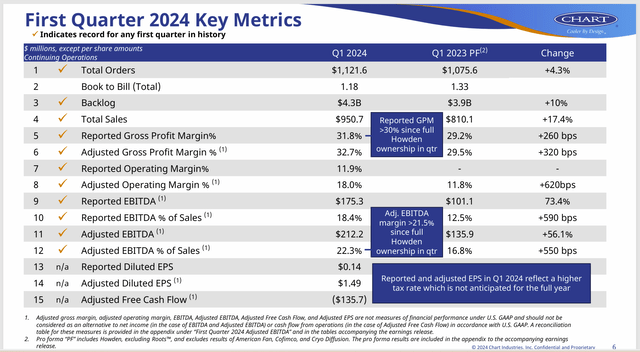

Chart Industries First Quarter Business Key Statistical Summary (Chart Industries First Quarter 2024, Earnings Conference Call Slides May 2024)

As shown above, it’s clear that the order intake is healthy and exceeds what’s going out. Investors can just bet that all those analysts throughout the market have been asking about orders the whole quarter. They likely got the same answer too (no change).

But the stock price clearly indicated that something bad would happen. Therefore, as management continued to execute, Mr. Market had to face the reality that disaster was not around the corner and the leverage issue would go away.

Now the first quarter is usually the weakest quarter with the least meaningful earnings. Indeed, management clearly expects each quarterly earnings to be larger than the earnings in the previous quarter for this fiscal year, with the same process and relative weightings to happen next year.

Keep in mind that quarterly earnings and the relative weights can vary as the product line has different margins. Therefore, an average margin for one quarter may not mean much.

Debt Ratio

This has been the big market concern ever since this acquisition of Howden occurred. It’s not just the debt, but the preferred stock as well. Long-time readers may well know that management often hedges to minimize the effects of the convertible items out there. But that has rarely been the issue. The issue is “The Debt,” period.

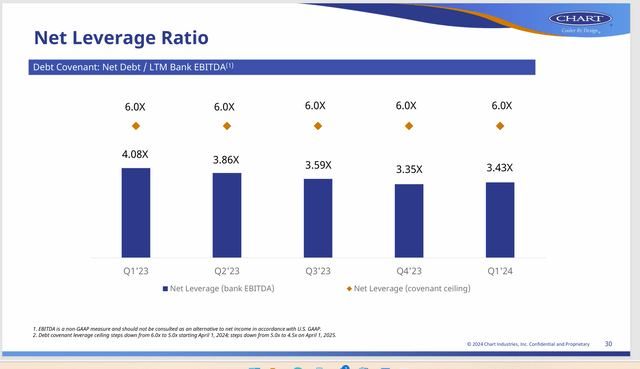

Chart Industries Debt Ratio Trend (Chart Industries First Quarter 2024, Earnings Conference Call Slides May 2024)

The largest consideration for that trend is the fact that EBITDA should at least double. That has a huge effect on the debt ratio. Far smaller considerations are when management can convert the preferred and some convertible debt as well.

Past articles covered that at least some of the convertible debt moved to a current liability. That likely means that debt converts sooner rather than later. But anything in this area pales to the effect of the sizable EBITDA jump.

Mr. Market has shown in the past that he does not care how that ratio comes down. He just wants it down, and getting it lower by yesterday is just fine with him.

This quarter is likely to represent the first meaningful start to a trend of a rapidly improving business this whole fiscal year. It would appear that the management strategy of combining the sales effort while retaining the Howden team is paying dividends quickly.

Summary

Howden is the largest acquisition by far for Chart Industries, even though the company has a very long history of successful acquisition integration. Mr. Market clearly had his doubts about this acquisition. But this week, it’s also clear that those doubts are coming to an end. Depending upon how the rest of the year goes, this very volatile stock could be very volatile upwards as a result. No guarantees of course.

The stock remains a strong buy even though the market has had its doubts through the whole acquisition and assimilation process. So far, management has performed exactly as promised (though I don’t ever want to go through anything like that big stock price downdraft ever again).

This is clearly a case where the market did not believe management despite a very long history of accomplishments with acquisitions. Now the market is rethinking its position (slowly). Investors who missed the bottom likely can consider this stock for further appreciation because the odds favor this stock returning to its old price-earnings ratio once the market realizes that this business is not slowing down anytime soon.

Chart is also a huge cash generator. This is a good thing because it means it can self-finance its own rapid growth. Therefore, the threat of earnings dilution from the growth is reduced here. Chart will continue to acquire companies in lieu of research and development for new products. Management has a very good strategy. Therefore, there’s no reason to change that strategy now.

Risks

Probably the biggest risk to fast growth is a loss of quality control. Here that risk is sharply reduced by retaining the acquired management while combining sales efforts. It’s also reduced by keeping the manufacturing facilities small (and not combining them). That keeps logistics simple and makes quality control far easier. It also means that a Chart facility is often close to customers worldwide. That establishes a relationship that’s often as important as quality control and other issues.

Clearly, the leverage issue was not what the market thought it was. This is due to the long lead times that give the company a very visible view to future earnings. Probably the largest execution issue is the benefits obtained by combining the sales efforts in an effort to become a “one-stop shop” Chart is actually made up of many small companies rather than one large one, with each company specializing in its area. Not many can match something like that.

Conclusion

After analyzing Chart Industries’ recent performance, it’s evident that the market’s initial skepticism regarding the company’s acquisition strategy and debt levels may have been premature. With management successfully executing as planned and a significant jump in projected earnings, the stock has experienced a notable resurgence, attracting positive attention from institutional investors and analysts.

The market’s perception of Chart Industries has shifted, reflecting a newfound confidence in the company’s ability to deliver on its promises and drive future growth. As the business continues to show strength in order intake and a reduction in debt ratios, investors are increasingly optimistic about the stock’s potential for further appreciation.

Despite the risks associated with rapid growth, including potential challenges with quality control, Chart Industries’ strategic approach to acquisitions and focus on cash generation position it well for continued success. With a strong track record of integrating acquisitions and a clear path to increasing earnings, the company’s long-term prospects appear promising.

For more insightful articles on trending news in the financial market, be sure to visit DeFi Daily News. Stay informed and stay ahead of the curve with the latest updates and analysis.