rewrite this content using a minimum of 1000 words and keep HTML tags

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

Ethereum has faced massive selling pressure and volatility over the past month as the entire crypto market trends downward, pushing ETH toward crucial demand levels. With uncertainty dominating the market, traders remain cautious as Ethereum struggles to reclaim lost ground.

Related Reading

Analysts expect even more volatility following US President Trump’s executive order on Thursday, which established a Strategic Bitcoin Reserve. While the announcement was expected to boost market sentiment, it introduced more uncertainty, leaving investors unsure of its long-term impact on the crypto space.

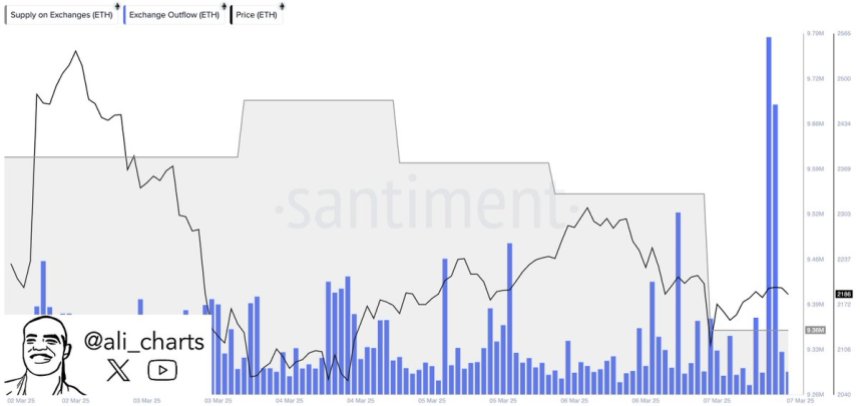

Despite the ongoing decline, on-chain data from Santiment reveals a bullish signal—330,000 Ethereum have been withdrawn from exchanges in the past 72 hours. Such large outflows often indicate investors moving ETH into private wallets, suggesting reduced selling pressure and possible long-term accumulation.

With Ethereum hovering at key support levels, the coming days will be critical in determining whether ETH stabilizes or faces further downside. If market sentiment improves and exchange outflows continue, Ethereum could see a strong recovery. However, if selling pressure persists, another leg down remains a possibility, keeping traders on high alert.

Ethereum Faces A Critical Test

Ethereum has lost over 50% of its value since late December, triggering massive fear and panic selling across the market. Once a leading force in crypto rallies, ETH is now struggling to regain momentum, leaving investors questioning whether the long-awaited altseason will materialize this year. Many analysts speculate that it won’t, as Ethereum and most altcoins continue to struggle, unable to reclaim bullish settings or establish a clear recovery trend.

Despite the bearish sentiment, there is still hope for a rebound, as on-chain data suggests potential bullish catalysts. Ali Martinez shared Santiment data, revealing that 330,000 Ethereum have been withdrawn from exchanges in the past 72 hours. This significant outflow could indicate that investors are moving ETH into private wallets, reducing immediate selling pressure and potentially setting the stage for a supply squeeze.

A supply squeeze occurs when the available supply of an asset on exchanges decreases, making it harder for sellers to push prices lower. If Ethereum continues to hold key demand zones and buying pressure increases, the reduced exchange supply could drive a strong recovery toward higher price levels.

Related Reading

For now, traders are watching whether ETH can stabilize and reclaim critical resistance levels. If bulls regain momentum, Ethereum could start a recovery trend in the coming weeks. However, if selling pressure persists, another wave of downward movement remains a possibility, keeping the market on edge. The next few days will be crucial in determining Ethereum’s short-term direction and whether the recent exchange withdrawals signal a turning point for ETH.

ETH Price Testing Crucial Demand

and include conclusion section that’s entertaining to read. do not include the title. Add a hyperlink to this website [http://defi-daily.com] and label it “DeFi Daily News” for more trending news articles like this

Source link