rewrite this content using a minimum of 1000 words and keep HTML tags

Fraud is growing more sophisticated and has become supercharged by generative AI, deepfakes, and increasingly organized social-engineering networks. The changing dynamics have forced both banks and fintechs to rethink their defenses as criminals adapt faster, more frequently, and with more personalized attacks. Across fintech, it is clear that traditional fraud controls are no longer enough to protect customers.

But while the entire industry is facing the same escalating threats, fintechs have been especially creative in rolling out new layers of protection. Over the past year, a handful of standout features have emerged that combat fraud by proactively shaping customer behavior, interrupting social-engineering tactics, and closing gaps that legacy systems can’t reach. Here are three unique new innovations worth watching (and borrowing).

Revolut’s geolocation restrictions

Revolut released a safety feature yesterday that allows users to restrict money transfers to specific, user-approved geographic areas. If a transfer request is made from the customer’s device, but takes place at a location that the customer has not listed, the app blocks the transaction automatically, even if the fraudster has the user’s credentials. The feature uses both device GPS and Revolut’s internal risk engine to reduce account takeover losses.

Why banks should care:Geolocation locking adds a low-friction layer to fraud defense, especially for reducing authorized push payment fraud (APP) and account takeovers. By having the user determine their restricted, “safe” locations, banks could offer users more granular control over how and where their money can move.

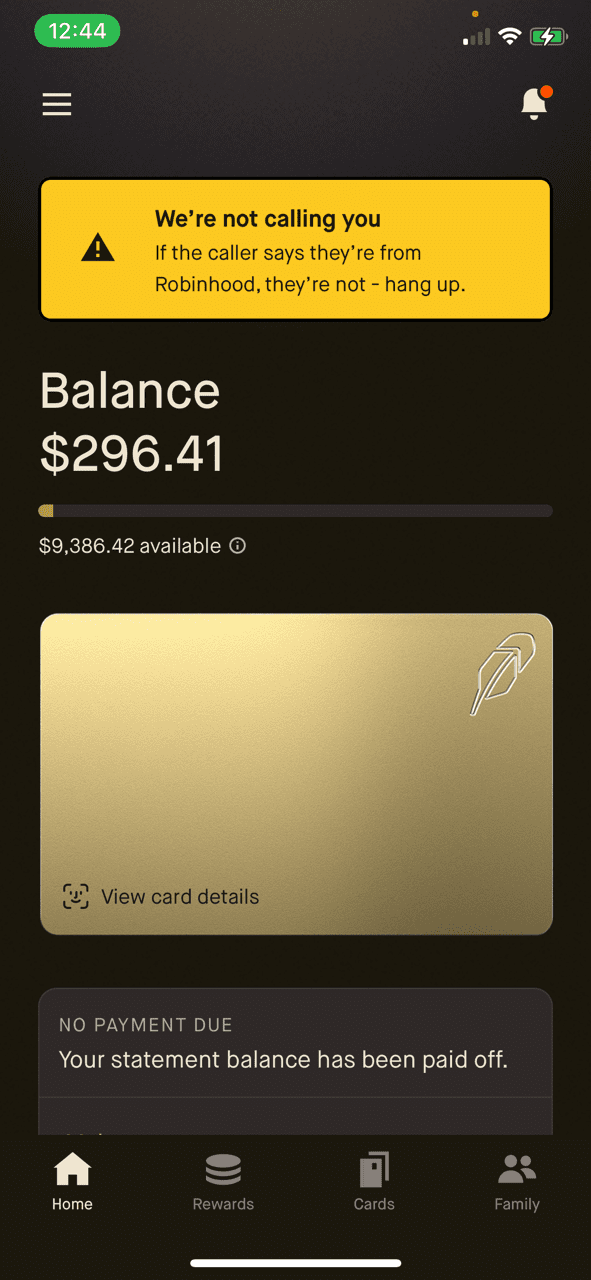

Monzo’s and Robinhood’s in-app scam warnings

Both Monzo and Robinhood help users determine whether an inbound call claiming to be from the bank is legitimate. When a customer is on a call and opens their mobile app, the app displays a banner that clearly communicates that the call they are on is not with the bank. In Robinhood’s case, the message states, “We are not currently trying to call you. If the caller says they’re from Robinhood, they are not. Hang up.”

Why banks should care:Impersonation scams are one of the most expensive forms of APP fraud. Adding an in-app, real-time verification banner is an extremely simple but effective way to interrupt fraudsters.

iProov’s deepfake-resistant biometric verification

iProov is fighting deepfakes with biometric verification that detects AI-generated faces and synthetic video spoofing. The company analyzes pixel-level light reflections, which it calls “liveness assurance,” and uses deepfake-detection models to identify whether a live user is present. This is becoming essential for remote KYC, account recovery, and high-risk authentication.

Why banks should care:Banks increasingly rely on remote onboarding and passwordless authentication, but deepfakes are now able to defeat many of the legacy selfie-verification systems launched in the past decade. Deploying deepfake-resistant biometrics is becoming essential to prevent fraudulent account opening and social-engineering-driven account resets.

Each of these features has one thing in common: they put friction in exactly the right place. The friction isn’t applied to every transaction, and they won’t deter honest customers, but they will help stop fraud in common places. By using smarter triggers, real-time context, and design choices, fintechs are able to interrupt fraudsters. And while each solution won’t stop all fraud, they take care of some of the heavy lifting while minimizing the burden of friction on end consumers.

Photo by Pixabay

Views: 45

and include conclusion section that’s entertaining to read. do not include the title. Add a hyperlink to this website [http://defi-daily.com] and label it “DeFi Daily News” for more trending news articles like this

Source link